Where the Next Inflation Swells Will Come From

Macro Update: The Three-Wave Inflation Theory, Part 2

Mavericks at Half Moon Bay, California, is one of the most notorious big-wave surfing spots.

Its huge waves have taken the lives of two surfers and nearly killed several others.

But besides the cold water and the presence of great whites, what really makes Mavericks so dangerous is what’s called the “two-wave hold-down.”

Imagine for a second: A surfer falls off the board after attempting to ride a 30- or 40-foot-high wave. They hit the water, which feels like a concrete wall, and then get sucked 10 or 20 feet under. The water sends them tumbling like a sock in the washing machine with no orientation of which way is up or down.

Even when they reorient, the surfer can’t reach the surface. Because normally after a wipeout from a big wave, the wave can hold down the surfer underwater for 10 seconds or more.

But Mavericks has a shorter wave interval, because the second wave behind the front wave breaks in such a short amount of time. So it’s impossible for the surfer to surface and get a breath of fresh air.

This two-wave hold-down normally pins the surfer underwater for 30 seconds or longer. This often leads to drowning.

In the markets, investors face a similar danger: trying to avoid getting caught by the next waves of inflation.

As we wrote about last week, we’re likely in the middle of a cycle of inflation that comes in three waves. After inflation’s recent dip, the global financial markets have entered the first lull in between the first and second waves. Today, we’ll look at what could trigger the next two waves of inflation.

Like the surfers at Mavericks, it’s important to be prepared for when those next waves will come, so you don’t get caught in the two-wave hold-down – and drown.

The Second Wave of Inflation

One of the reasons for the upcoming, second inflation swell is because of the excess liquidity that is still floating around.

Liquidity matters. If there’s still too many dollars sloshing around the economy, prices have no reason to come down.

That’s why the Federal Reserve (FED) has tried to reduce liquidity. It stopped printing money, and since June 15, it’s carried out quantitative tightening by removing $1.1 million dollars per minute from the system.

M1, a narrow measure of the money supply, fell from an all-time high of $7.3 trillion at the start of 2022 to $6.7 trillion in November for the U.S.

It is a good start. Unfortunately, there is still too much liquidity to bring down inflation.

Japan and China are still printing away and showing no signs of stopping anytime soon.

As we had mentioned in our update about Japan’s Yield Curve Control (YCC) back in October 2022, as long as the Bank of Japan (BoJ) continues with their efforts to peg and maintain the yield of 10-Year Japanese Government Bond (JGB), the printing press will be running nonstop for Japan.

Case in point: For the YCC tweak that surprised the world back in December 2022 when the Bank of Japan revised the range of YCC from +/- 25 bps to +/- 50 bps, the BoJ already spent 16.2 trillion Japanese Yen (JPY) or $123.26 billion USD to defend the new YCC range.

On January 13 and 17, the resolve and determination of the BoJ to defend YCC were tested again. The yield for JGB10Y broke through the top range band and spiked up to 0.568% on January 13 and 0.593% on January 17, shown in the chart below.

The BoJ had to spend another $4.6 trillion JPY or $35 billion USD to “normalize” the yield curve.

It’s on pace to do $300 billion USD of quantitative easing (QE) in January 2023 – just in one month. Alone.

Don’t expect the printing press at the BoJ to take a breather anytime soon.

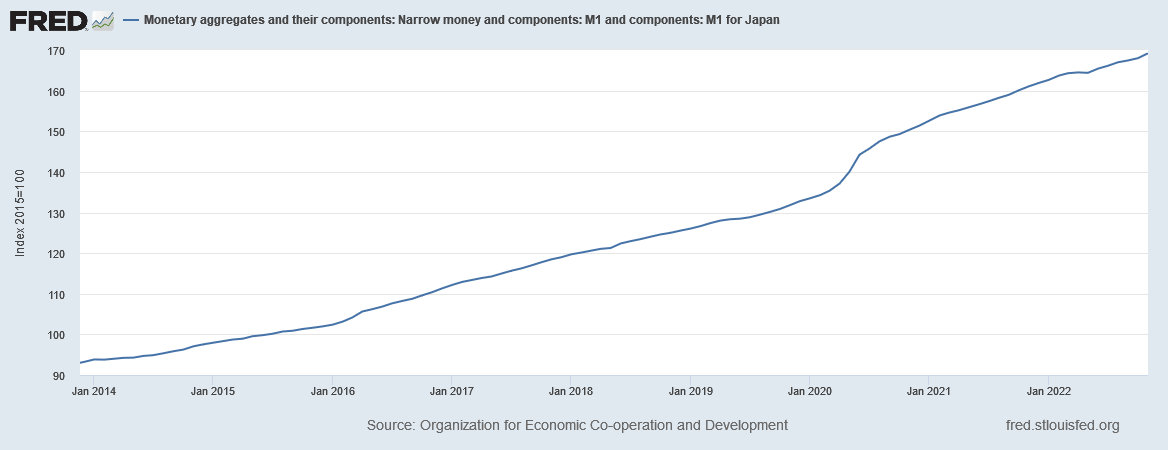

Here is Japan’s M1 supply as of November 2022.

China represents a different set of problems.

The Chinese government is under tremendous pressure to kickstart a floundering economy with fiscal stimulus.

Below is a chart of China’s GDP growth rate. The growth rate is expected to head back down to negative territory again.

Clearly, the Chinese economy coming out of COVID-19 pandemic is in a battered state already.

But what is really grabbing the attention of the Chinese government is the unemployment rate. As of the end of 2022, it stood at 5.5%.

While 5.5% might not seem to be that bad, this is quite a persistent problem for the Chinese government since 2018.

As shown in the chart below, the unemployment rate in China had been quite steadily holding at 4% until 2018. Since then, unemployment’s been steadily rising, showing no signs of falling back to the pre-2018 level.

And to add fuel to the fire, the most worrisome component in the unemployment equation for China is that one out of five of China’s urban youth is unemployed.

A high unemployment rate leads to a volatile society.

Solution? Print more Renminbi (RMB or CNY) to provide funding for more job creation projects and to stimulate spending.

Here is China’s M1 as of November 2022.

Translation: There will still be copious amounts of global money supply despite the tightening efforts from Western nations.

This ample liquidity will continue to be the fuel that feeds the inflation fire. The excessive liquidity has to park somewhere and look for yield.

That will lead us into the second potential factor for the second wave of inflation: Commodities.

The Coming Commodities Boom

Both excess liquidity and COVID-induced shortages will drive prices for commodities higher.

But there’s a third factor that could trigger a boom: nations and individuals are increasingly looking to diversify their assets away from the U.S. dollar.

When the Biden administration decided to freeze all Russian assets in the U.S. as well as all Russian assets denominated in dollars, it sent a message to the world: It is your money, but it is our currency. Hold it at your own risk.

The U.S. government basically weaponized the dollar.

Yes, the dollar is the safest, most liquid, and most stable currency.

But the caveat here is the U.S. can seize and freeze all dollar-denominated assets if the friendship goes sour.

This does not sit well with other nations.

So they will start to look for alternatives to diversify their asset holdings.

Gold and silver markets are manipulated by paper contracts. Not a top choice.

Cryptocurrencies are too volatile and too young as an asset class. Not even going to be considered.

So we’ll begin to see countries move away from solely holding fiat and bonds and diversify into baskets of commodities and hard assets. For instance, Saudi Arabia has expressed intention of investing $170 billion into mining assets by 2030.

This demand will drive commodities higher.

Plus, remember how we said above that the Chinese government will pull double duties on the printing press soon to combat high unemployment rate and try to stimulate the economy. These projects will require raw materials.

And as China increases the input cost for everyone else, the product’s final retail price also increases.

That equals inflation.

We saw this after 2008-2009, when the Chinese Economic Stimulus Plan sent commodity prices soaring. Below is the chart of the Global Price Index of All Commodities from the International Monetary Fund (IMF).

Finally, the increased demand for commodities leads us to the final potential factor for the second wave of inflation: The possibility of food shortages.

As I mentioned in this update a few weeks ago, food shortages are one of the major concerns to keep a watchful eye on.

We will be providing a separate update in the next few weeks on how one could potentially arise.

But putting it all together, these factors most likely will force the FED to keep hiking interest rates to combat the second inflation tide.

Then we enter the second lull.

Trifecta

At the start of the second lull, the economy will probably be in a recession and the unemployment rate might be higher than desired. But faced with inflation potentially creeping back up again, the FED will have no choice but to continue the inflation fight.

That means rates keep going up. Quantitative tightening will still be in place to drain excess liquidity.

The market and investors start to sell off. It’ll be a redux of the bear market from the first lull.

Then, inflation starts to plateau and head back down again.

The potential impetus for the third wave of inflation is the FED pivot and the return of quantitative easing (QE).

The trigger for the FED to reverse its stance will most likely be some form of credit event, either sovereign or private.

Economic recession translates to weaker profit earnings for the private sector. Weaker corporate profit earnings also mean lower tax income for governments. On top of that, governments from all levels will have to provide increased budgets for subsidies or aid programs to its people as a result of the prolonged, weak economy.

Additional funding will be needed.

But the high interest rate and shrunk liquidity will make it more difficult for corporations or even countries to issue or refinance/roll-over debts for operation or keep the lights on in government buildings.

The threat of default continues to intensify. Finally, something craters. The FED steps in.

(We will provide a more detailed and in-depth look into the credit market and the potential of a FED pivot later in our other updates.)

The FED cannot hold off the deterioration of the economy any longer. Rate cuts and quantitative easing will be dusted off and brought out from the lock box.

The familiar sound of “BRRRRR…” will be echoing once more in the chamber of the U.S. Mint.

The market will be euphoric once again. All asset classes will see their value rise in a furious manner except for bonds.

And inflation will skyrocket once more. Faster and higher.

The additional inflation pressure might also stem from the on-going deglobalization effort. The globalization of the world's economy for the last 30 years has made things cheaper and more affordable, which contributed to lower costs of living.

The new shift in the global trade paradigm to deglobalization will add to inflation in both temporary and permanent manner.

The transition from globalization to deglobalization means we will see disruption of supplies. The reshoring efforts and changes in the logistics will take some time to work itself out. This is the short-term impact that will add on to inflation.

Deglobalization will make manufacturing more expensive and hike up the cost of goods. This is structural inflation that will be sticky and won’t be going away.

So for the third inflation tide, we might be looking at a world that has high inflation, bloated asset prices, high unemployment, slower economic growth, and potential civil unrest in different pockets of the globe.

Stagflation returns, and central banks around the world will be scrambling to resolve this economic crisis.

We then might be subjected to even more intense and draconian measures compared to the 1970s to combat inflation.

Will History Repeat Itself?

Back in the 1970s, it took 10 years for the inflation cycle to play out from the first peak to the third peak. It took five years from peak 1 to peak 2 and another five years from peak 2 to peak 3. Please see the chart below.

Also, there were three recessions as well as bull market cycles interwoven into this period.

But with the enormous amount of liquidity in the system today (way more than what was sloshing around back in the 1970s) and how much more connected the world’s economies are , the cycles will probably be compressed and play out at a much faster pace.

We might see all three waves in the span of three to five years.

However, if Powell is successful with his attempt to contain inflation and slows its pace before this cycle begins in earnest, perhaps we will not see this cycle at all.

Does Jerome Powell have the will and the fortitude to stay true to his words and bring inflation down to 2%? And if he doesn’t, how will the next two waves of inflation play out?

Only time will tell.

Yours truly,

TD

Merci! Russia and Ukraine are the breadbasket of the world. If the war escalates, no crops!!