Where is my Arbitrum airdrop??

I, like any other good degen out there, have been sybiling using Arbitrum organically in the hope of getting some sweet free tokens.

Every day I check my wallet and there’s no Arbitrum (ARBI) tokens. I can’t take this anymore man.

I’ve still got to pay for my Christmas gifts! Those pesky corporations got me with the “buy now, pay later” scheme. Was counting on the ARBI airdrop to handle the “pay later” part. What am I to do now?? Please devs send some ARBI soon!

Yes, I am exaggerating, but I would feel kinda cheated if I didn’t get an Arbitrum airdrop.

I know some of you would, too.

Others might be shaking their heads at my entitlement though. Crypto users have come to expect regular 4- to 5-figure airdrops, and plebs like me love them.

But are these airdrops justified in any way? Why do protocols do them, and what can they expect in return for giving out free tokens?

The usual reason is to reward early users. Or to further decentralize a protocol, which follows the ethos of crypto and can strengthen governance1.

However, we want to focus on what a protocol can get in return for an airdrop. Is there any clear, tangible benefit to them?

We argue that there are several benefits; today, we will touch on two major ones:

Marketing

Bootstrapping liquidity

Follow along as we explore the good, bad, and ugly of crypto airdrops through these two lenses.

The Best Marketing Is Free Stuff

Few things will get your protocol more “airtime” than giving users a juicy airdrop.

Even the hint of free tokens kicks off a speculative frenzy that sets airdrop hunters on the trail. Thirsty crypto peeps will discuss the possibility of an airdrop for weeks or even months. Droves of users will check out your project and interact with it in the hope of getting some free tokens.

If you’ve built a nice protocol, those users might stick around.

To illustrate this, let’s review one of the greatest rivalries in DeFi: Uniswap and SushiSwap.

By 2020, Uniswap was a mainstay in DeFi. Usage, trading volumes, and total value locked (TVL) exploded that summer not only for Uniswap but across the board for all of DeFi.

Then, on August 28, 2020, SushiSwap launched as a fork of Uniswap.

To bootstrap itself, the team promised liquidity providers heavy rewards in the form of SUSHI tokens if they moved their liquidity from Uniswap to SushiSwap. Lots of those liquidity providers made the switch. Traders followed, and Uniswap’s TVL and trading volumes declined.

Uniswap didn’t recover until it launched a token of its own on September 17, 2020.

Uniswap’s TVL stood at $915 million before the airdrop. One month later, it had risen more than three-fold to $2.9 billion. Trading volume more than doubled from $1.8 billion in September 2020 to $3.8 billion in March 2021.

A great example of what protocols lacking an airdrop are missing out on would be all the OpenSea killers.

RareGems, Portion, Foundation, and even well-capitalized exchanges like FTX and Coinbase tried to get in on the NFT craze. But they all went home empty-handed.

The only ones that had any semblance of success were LooksRare and X2Y2.

Both did an airdrop.

Based on data from Sea Launch, X2Y2 has daily volumes of around 1,000 ETH, LooksRare 500-1,000 ETH. This is lower than OpenSea’s daily volume of 7,000 ETH, but still significant.

All other Ethereum NFT marketplaces have negligible volume in comparison.

The thing is, it’s not as simple as just dropping a token at whatever rate you want. There needs to be some strategy regarding how you drop it.

What better way to understand this than a dive into tokens that provide limited value to the user?

Time for some meme economics.

Leader of the Pack

In the old days, protocols used to distribute tokens at launch via initial coin offerings (ICOs), which helped to decentralize a project. But since ICOs went the way of the dodo, these days when a token launches, only insiders hold the token.

That means that the protocol needs to generate demand from other investors or retail (i.e., they need heads to dump on). It’s that, or insiders will be left trading against one another.

Say you launch a token and fund a liquidity pool to create a market. If it’s just you and your buddies dumping into that pool, the token price will take the fast train to goblin town. There is no unsuspecting degen on the other side of that pool absorbing your token’s freefall in price.

Airdrops help generate this missing piece.

An example of this can be seen in dog meme tokens on Solana. They show us how airdropping a large percentage of tokens can make a market healthy.

In crypto, meme tokens command similar and even higher valuations than “legit” projects. Dog meme tokens fare particularly well for some reason. Dogecoin and Shiba Inu have the 8th- and 16th-highest market caps in crypto, respectively.

No wonder then that in every chain there’s a slew of “dog tokens,” each trying to become the DOGE of their own little kingdom.

Solana is no different. It has no fewer than 10 dog coins, from Woof to Solana Inu. There are even “cat coins” such as Kitty Coin Solana or CATO and other random meme tokens.

But no Solana meme token, dog or otherwise, was as successful as Samoyedcoin (SAMO).

At its peak, SAMO had a market cap of over $700 million. It’s now down to $12 million. But that’s still much better than the $900,000 market cap of WOOF, the second-biggest Solana meme token.

What made SAMO more successful than the rest of the Solana dog pack?

All these meme tokens had silly, dog-related names, big marketing campaigns, and funny logos.

What was SAMO’s secret recipe?

A massive airdrop.

The airdrop made up 14.4% of the initial supply. The thing is, the team later burnt 66.1% of all supply. That meant a whopping 42% of all circulating tokens were airdropped to users all around Solana.

This airdrop was orders of magnitude bigger than the airdrops that other Solana meme tokens did. SolDoge (SDOGE) airdropped 2% of the supply. Solabrador (SOLAB) a mere 0.16%.

What do their charts look like? And, more important, how do they stack up against SAMO?

SOLAB had a mini-pump at the start of last year and has been down-trending ever since.

SDOGE didn’t even manage that.

SolDoge’s very launch marked its all-time high. It dropped like a stone thereafter and has been languishing all year.

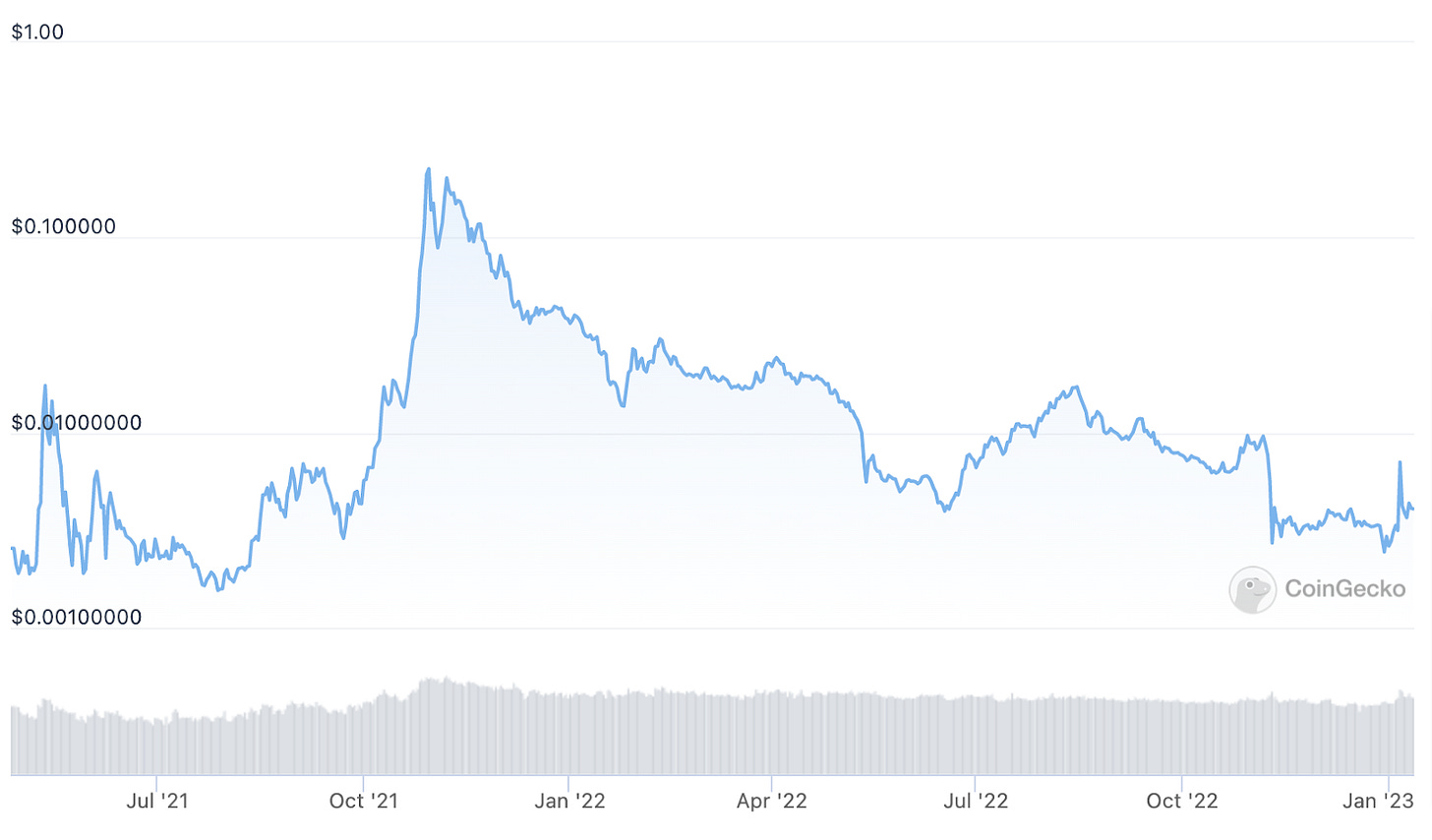

SAMO’s chart looks remarkably healthy in comparison.

SAMO launched in May 2021, and after a bout of volatility, it rallied through the end of the year. It topped in November 2021, like about every other risk asset out there, and has been on a downtrend since.

It did manage to rally a bit after June 2022, as did other crypto assets. Other Solana meme tokens didn’t join in that rally at all.

Even now, SAMO has a trading volume of over $300,000 a day. SBAR’s trading volume stands at $75.65, SDOGE’s at $35.62. The cost of about 6 Big Macs. That’s a dead market if I ever saw one.

By airdropping a large percentage of the supply, the SAMO team made sure that the market was not dominated by insiders. For a meme token that exists just for laughs, that is paramount.

And a new player in the Solana meme token arena seems to have learnt the lesson from SAMO.

I am talking about Bonk Inu (BONK), of course, the most recent flavor… I mean dog breed of the day in crypto.

A silly meme token with a website that has three buttons and a couple of images.

Guess what the token’s differentiating trait was (aside from the Bonk meme).

You guessed it, a juicy airdrop. From their website:

The Bonk contributors were tired of toxic “Alameda” tokenomics and wanted to make a fun memecoin where everyone gets a fair shot.

50% of all supply was airdropped among several groups, including the holders of the top 40 NFT collections on Solana (20%), NFT artists and collectors (10%), traders (15%), and Solana devs (5%).

BONK launched on December 10, 2021, and is now the hottest Solana meme coin with a market cap of $200 million and a fully diluted value (FDV) of $420 million. I’d add a price chart but it’s literally just a straight line up.

Not bad for a 1-month old dog coin.

We even saw something similar with Uniswap and SushiSwap. These two projects had a successful protocol backing their airdrops, so the ability to retain value in the token was easier.

The lesson seems clear: An initial airdrop helps bootstrap liquidity and leads to a healthier market from the get-go. It’s the best form of marketing a project can ask for.

It’s Arbitrum’s Turn

If there are any Arbitrum devs among the readers, it should be obvious to you now that you really should do an airdrop.

Not only to finance my Christmas buying spree. But also because your main competitor already did so. While their success can be debated, the chance to do better is squarely in your court.

You see, Arbitrum is not the only Ethereum L2 solution. Another one is Optimism.

Both launched roughly at the same time, and both are optimistic rollups. We won’t get into the tech here2; suffice to say they are both similar solutions for Ethereum scaling, and they are trying to court the same devs, users, and protocols.

For one reason or another, Arbitrum had the upper hand for much of 2021. It had more interesting dApps developing on it, more users, and more transactions per day.

This all changed over the summer, as Optimism launched an airdrop followed by liquidity incentives. Now, the gap between the two chains has shrunk.

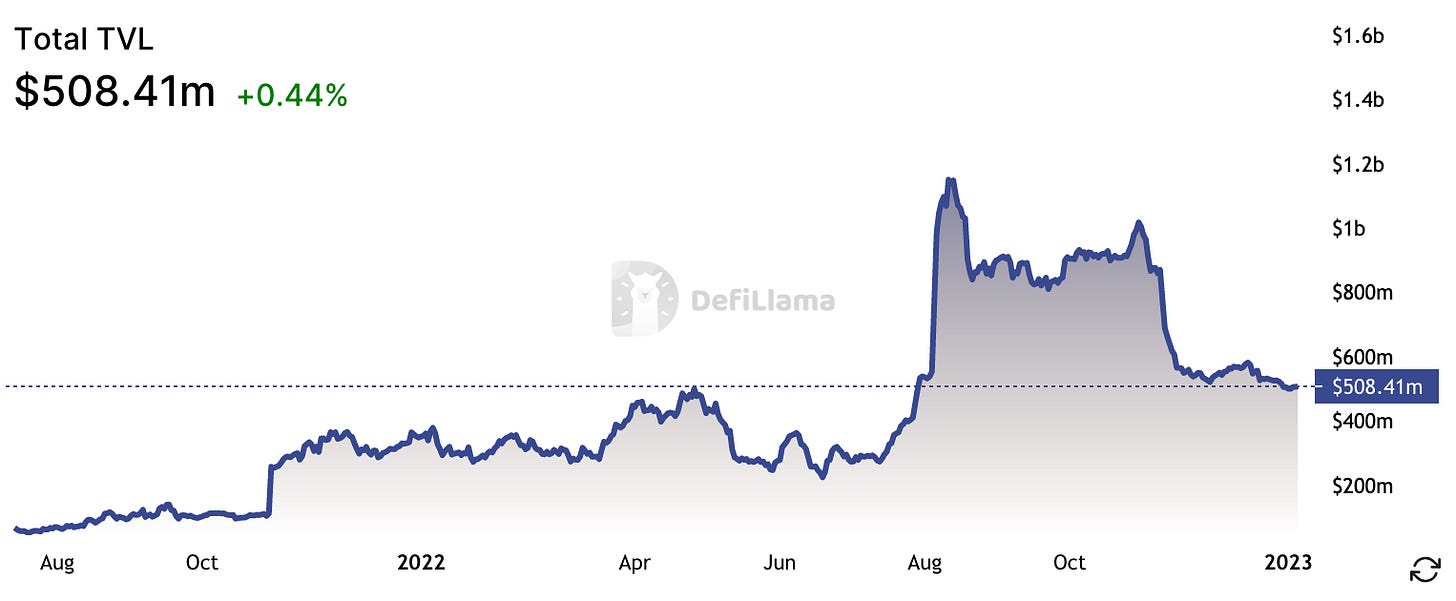

Optimism’s TVL stayed between $200-$400 million all through 2021 and until summer 2022.

After the airdrop and liquidity incentives, Optimism’s TVL jumped to $1 billion. It has come down to $500 million since, and is the seventh chain/roll-up by TVL.

Arbitrum’s TVL by contrast has been down-trending from its all-time high of $3 billion. It now sits at around $1 billion.

ARBI devs, if you want to make sure Optimism does not take the crown away from you, consider doing an airdrop with distributions that mimic some of the insights earlier. It’ll be interesting to see how the TVL figures react as this new asset is introduced to its economy.

Oh, and don’t forget the utility. Without a true purpose to the token, I’ll look to pay off those Christmas gifts by selling the token immediately upon receipt.

And because you’re probably asking yourself this question, yes, feel free to reach out to us to help you design that ARBI airdrop using the “contact us” form on this page.

Keep it fun,

Kodi

For a thorough analysis of the Uniswap airdrop and other DeFi airdrops that explores their role in decentralization, governance and rewarding users, do read this excellent piece.

If you want to learn more about it, check out Arbitrum’s and Optimism’s documentation.