I learned to surf many moons ago. But I was never taught by a professional.

Instead, my college buddies taught me. They told me to just pick up the board, paddle out, and the rest will come to me.

It came all right.

After an endless number of somersaults and choking on gallons of seawater, I finally got the hang of it. Granted, there was not much on style points. But I managed to catch the waves.

When I was in Bali earlier this year, I decided to rekindle the passion I had for surfing.

I decided to do it properly this time. I signed up for lessons from one of the surfing schools in Bali. At the end of the lesson, I asked the school owner how to go about buying a surf board in Bali.

The answer I got was quite surprising. The instructor told me that I should be buying a second-hand surfboard from Russians living in Bali.

With the SWIFT ban and economic sanctions, the Russians cannot use their credit cards nor get money out of their home country. So many of them are selling their personal belongings for living expenses. The surfing school owner told me he’s been picking up used surfboards at a bargain.

This type of predicament is more common than you might think among non-U.S. citizens.

For example, Lebanese students studying abroad are unable to access their funds back in Lebanon, although for a different reason: Capital controls.

Following up on last week’s examination of the U.S. Dollar Index (DXY), today we’ll explore a bit about this common tool that countries around the world use as a last-ditch effort to stabilize their economy. And we’ll touch on how the Lebanese may have found an unconventional workaround.

Throttling the Flow

Capital control is a policy that nations use to control the inflow and/or outflow of domestic or foreign currencies.

It can come in different forms, whether through taxes, tariffs, penalty fees, or legislation that prohibits certain activities, as well as a nation’s policies on import, export, and exchange rates.

Domestically, capital control allows nations to impose regulations such as dictating the amount of money its citizens can withdraw from their bank or what types of businesses or industries will have access to capital.

In a simpler context, think of capital control as similar to riding a motorcycle.

A rider controls the speed of a motorcycle by either turning the throttle to allow more air and gasoline into the engine (just as a nation allows more money to flow into or out of its economy), or by letting go of the throttle to decrease the amount of air and gasoline going into the engine so the motorbike can slow down (similar to a country restricting the flow of money into or out of its economy).

Capital control is quite a controversial subject. Academics and government officials disagree on how effective it is. Some feel that it’s a must for the stability and steady growth of an economy, while others believe it leads to too much intervention in a free market and restricts growth potential.

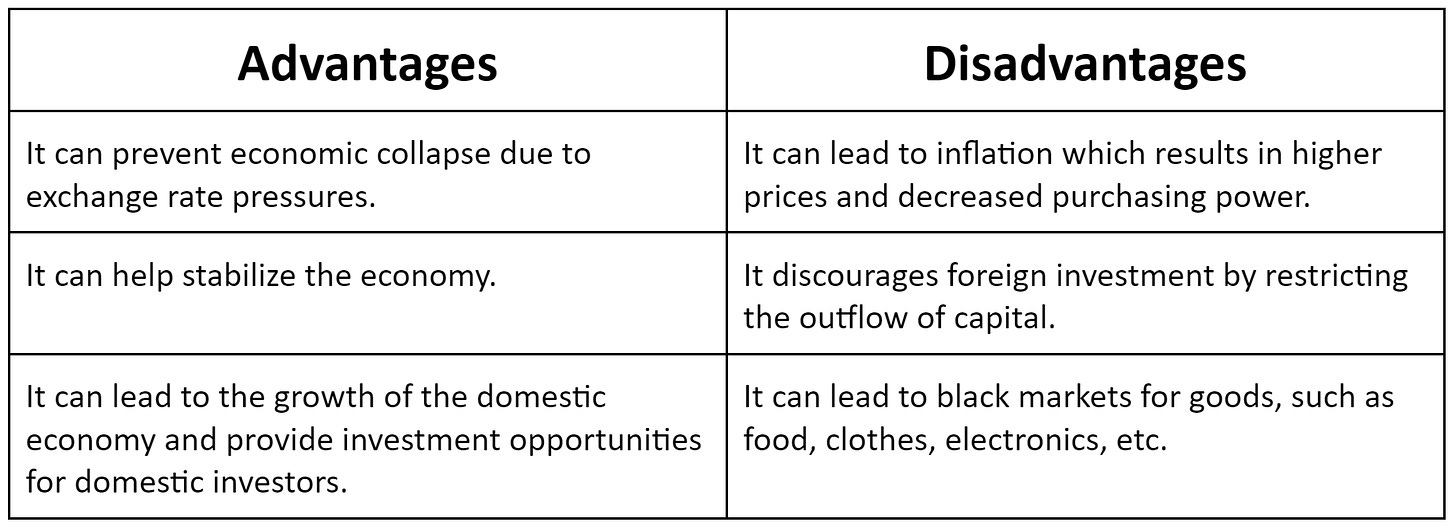

Below is a table that shows the advantages and disadvantages of capital control.

Capital controls are used more often than you think, and they’re not just limited to emerging economies.

For example, over the past few years, Canada and Australia experienced a meteoric rise in their real estate values because foreign investors were buying properties in cities such as Sydney and Vancouver at a rapid pace. But this hot money from other countries was disrupting the balance of the real estate market by sending home prices soaring.

So the Canadian and Australian governments imposed additional purchase taxes on foreign buyers to deter them from buying properties. The taxes are a capital control measure to reduce the flow of foreign money into Canada and Australia.

But the hot money kept flowing in. As a result, in April, Canada ended up imposing a ban on foreign buyers of its properties for two years. This can also be considered as capital control to bring down housing inflation.

On the other hand, the more common capital control examples that we normally hear about involve a government trying to restrict its citizens from withdrawing money from the bank as well as preventing capital from fleeing the country. And we will use Lebanon as an example.

It’s Your Money – But Only If We Say So

Lebanon has been in economic turmoil since 2019. It defaulted on its $31 billion Eurobonds back in March 2020, and that resulted in the Lebanese lira (LBP) collapsing more than 90% against the dollar on the black market.

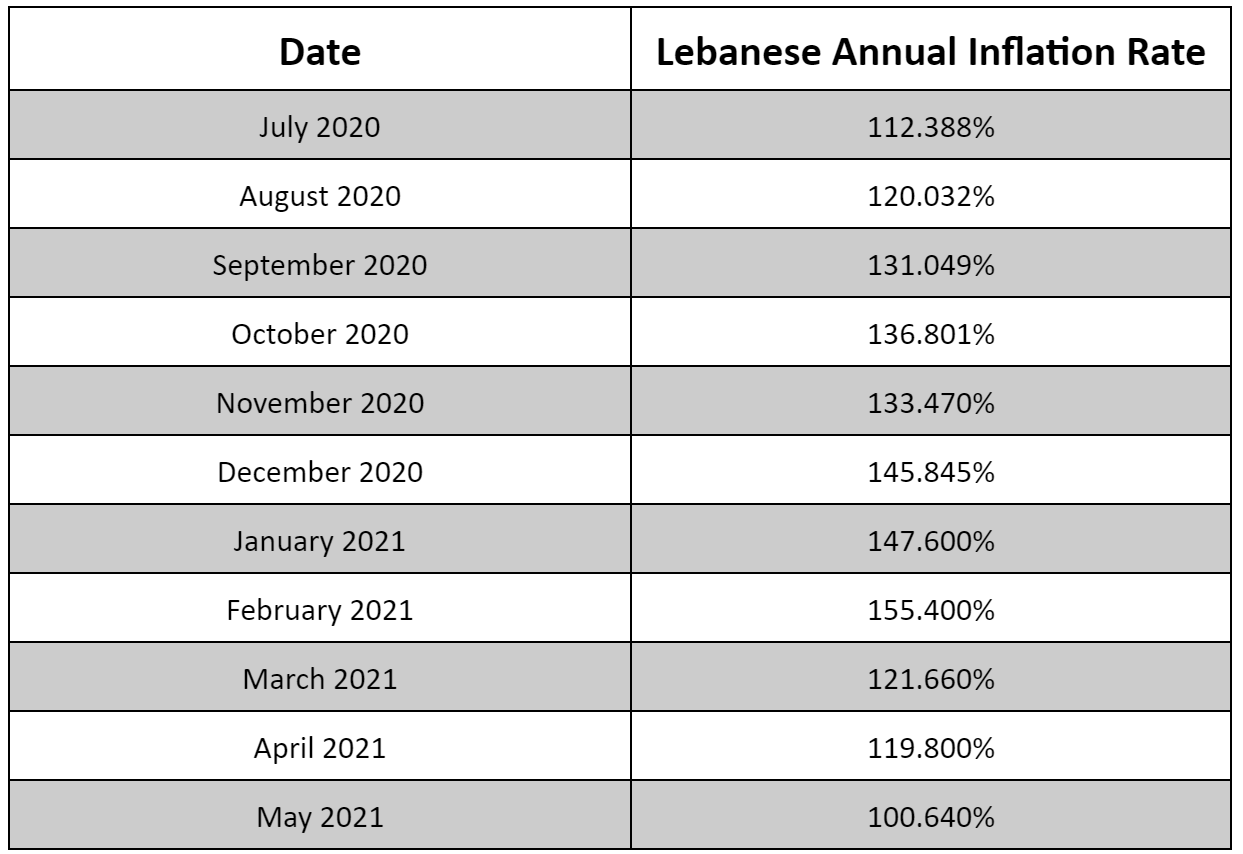

Then, inflation started to run amok in 2020. Now, it’s turned into hyperinflation.

And the hyperinflation is showing no signs of slowing down. As of April 2022, the inflation rate is at 206% year-over-year (YOY), marking the 22nd consecutive month of triple-digit inflation for the Lebanese.

Meanwhile, Lebanon’s national debt continues to rise. It was at 212% of its GDP in 2021. This makes Lebanon the country with the fourth-highest debt-to-GDP ratio, right behind Japan, Sudan, and Greece. Not exactly the Hall of Fame countries you want to be mentioned with.

Desperate for help, the economically battered country asked for economic aid (specifically, a four-year, $3 billion USD loan facility) from the International Monetary Fund (IMF). The IMF agreed, but not without asking Lebanon to agree to banking structure and law reforms, debt restructuring, and capital control measures.

But other forms of capital control started way back in 2019. As soon as the economy started to falter, the Lebanese government started to levy measures to stop domestic outflows of currency and foreign reserves out of Lebanon. It also prevented citizens from withdrawing more than $200 USD per month.

These measures were rolled out to prevent the economy from collapsing further.

The Lebanese people are going through some hardship for sure: Hyperinflation, the inability to access savings, social chaos, and no safety net to fall back on anymore. There is just no light at the end of the tunnel in sight.

What we are seeing in Lebanon currently might be a familiar scene to come should DXY continue to rise.

As we mentioned in last week’s update, a strong U.S. dollar coupled with a hawkish Federal Reserve (FED) will cause a strong riptide for foreign money to flow into U.S. Treasury bonds and the dollar itself. That’s because both offer a safe haven for investors and quick access to liquidity. Below is a chart of the performances of some of the larger emerging market economies’ currencies’ against USD (yellow line) this year.

Last month, we mentioned how the Sri Lankan rupee (LKR, light blue line) has fallen quite a bit. The Turkey lira (TRY, green line) at minus-53.69% and the Egyptian pound (EGP, purple line) at minus-36.37% are also quite concerning. This, however, is just a snapshot of the tip of the iceberg.

With the FED not relenting in its effort to tame inflation in the U.S., the rate hikes will continue and DXY will continue to climb.

This will spell trouble for a lot of emerging market economies – especially the ones with low foreign reserves. And more than likely, when DXY continues its rise, we will see more and more countries install capital controls to prevent their foreign reserves from dwindling and their economies from collapsing.

Slipping From the Iron Grip

The grim reality from Lebanon as a result of its capital controls is certainly concerning. At the same time, however, we are witnessing a new, alternative economy sprouting up in Lebanon that cryptocurrency zealots have been dreaming of.

The Lebanese citizens have turned to cryptos such as Bitcoin (BTC), Litecoin (LTC), and Tether (USDT) to create a doppelganger of the official economy. This allows them to gain access to their money and banking functions and conduct daily business activities, all while the erstwhile economy is restricted and ceases to function properly.

The decentralized aspects of blockchain and cryptocurrencies are what enabled the Lebanese to create this underground economy. The government and authorities have no reach and are unable to restrict or control the trustless system that blockchain and cryptocurrencies provide.

The video below provides a glimpse of how the Lebanese people are using cryptocurrencies as an alternative medium for a functional economy. You can click here to watch it.

This is music to the ears of cryptocurrency proponents because this is the exact vision that all the fanatics have: An economy that is based entirely on cryptocurrency with no central authority. And this is turning into a reality, unfolding right before the world’s eyes.

If Lebanon can pull this off, it will be bullish for blockchain and cryptocurrencies.

With the potential direction of DXY, we might get to see more dress rehearsals for cryptocurrencies coming up.

Yours truly,

TD

started with surfing and ended up with the Lebanese economy :))