All Hail the King

Macro Update: The Dollar’s Dominance Is Wreaking Havoc Abroad

The King.

Many are called. Few are deserving.

But while some may not be worthy of the title at first glance, if you dig deeper, you may find that there’s a reason they’ve been crowned.

For example, I love music. I take pride in myself for having quite a broad taste for many music genres.

That said, as a kid, I never quite understood the fanfare that people have with Elvis. I had always viewed him as a good-looking, teenage heartthrob with a renegade streak, much like most singers in boy bands today.

It was not until many years later, when I discovered songs like “Dixieland Rock” and “An American Trilogy,” that I was inspired to find out more about Elvis. The more I learned about him, the more I began to understand why Elvis had developed such a huge following and why he deserved his moniker “The King.”

On the flipside, there are instances where the coronation is impossible to argue against.

In a year where all investment asset classes have taken a beating, the U.S. Dollar (USD), considered to be the king that reigns over all other currencies, has soared.

Since the beginning of the year, the S&P 500 (SPX) is down 17.7% and Bitcoin (BTC) is down 65.6%. Meanwhile, the dollar, with its strength measured by the U.S. Dollar Index (DXY, often pronounced “Dixie”), is up 11.1% year-to-date and doesn't look to be stopping soon.

The King dominates.

Let’s peel back the layers on DXY to get a better understanding of what it is and how it works before we explain why the world’s economy succumbs to King Dollar’s influence.

The King and His Subjects

The Federal Reserve (FED) created DXY in 1973, two years after the dollar was de-pegged from gold, allowing it to free float against other foreign currencies.

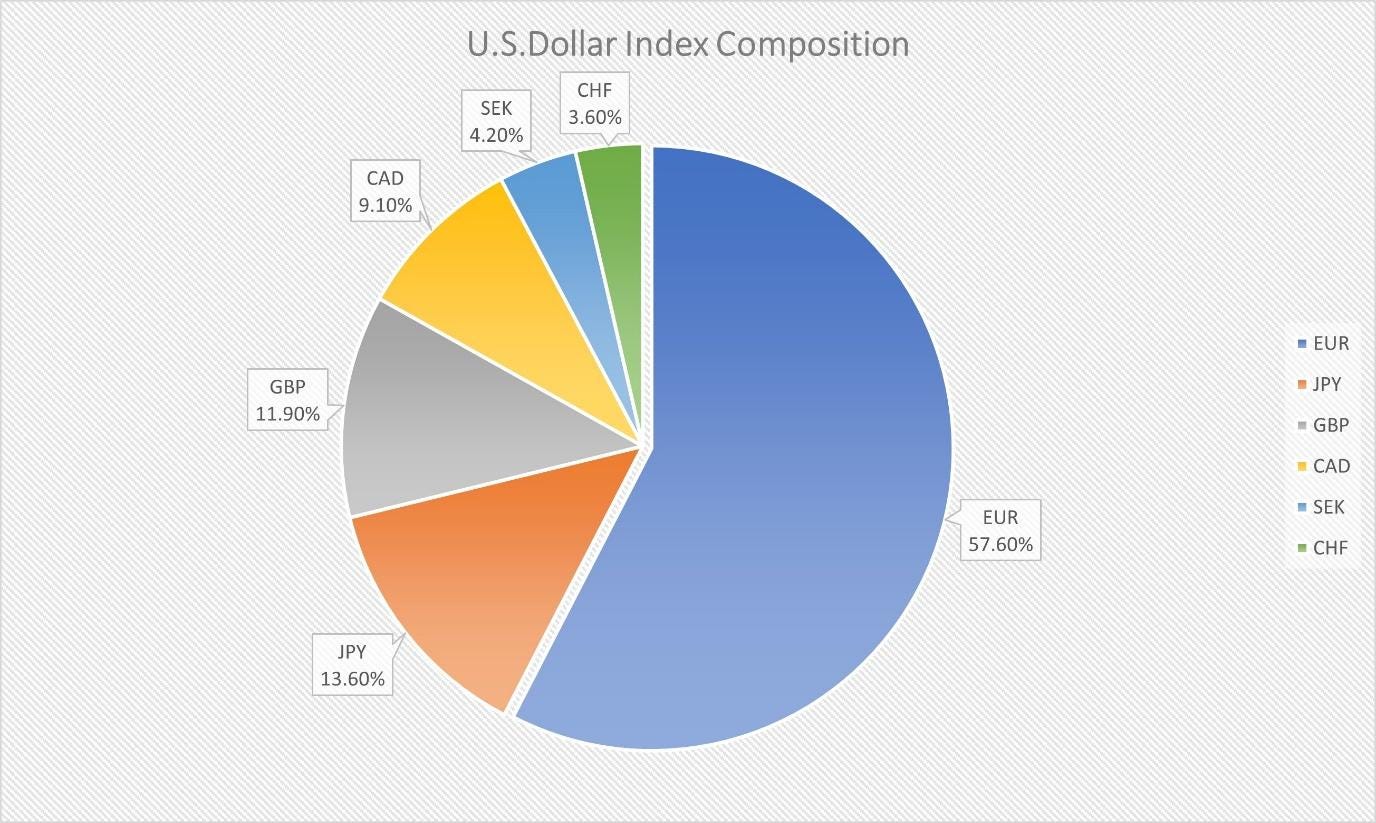

DXY is the measurement of the U.S. dollar’s strength against a basket of six other currencies: the Euro (EUR), the Japanese yen (JPY), the British pound (GBP), the Canadian dollar (CAD), the Swedish krona (SEK), and the Swiss franc (CHF).

The basket mix itself is quite interesting. Some pundits question if the current composite truly reflects the value of USD. They’ve even suggested replacing the Swedish krona and the Swiss franc with the Chinese yuan (CNY), the South Korean won (KRW), or other currencies from major U.S. trading partners to accurately depict the purchasing power of USD compared to these larger economies.

But CNY is not a free float currency. And other currencies from other major economies, such as the Indian rupee or the Brazilian real, are quite volatile relative to the USD – hence, they are not ideal candidates.

In a nutshell, the U.S. Dollar Index measures the strength of the USD versus other sovereign currencies.

And for select investors and governments, the unprecedented strength of DXY in 2022 has been unnerving, to say the least.

Flight to Safety

DXY has been on a tear this year. In the past 12 months, it’s shot up from 94 to as high as 114, an increase of roughly 21.3%.

At the time of writing, DXY dropped from above 110 to 106, possibly due to inflation coming in at 7.7% in October, which was lower than the expected 8%.

But overall, the dollar gaining strength is good news for the U.S., because now the exchange rate with other countries favors American consumers. Imported goods and commodities are cheaper, which should translate to lower expenses for U.S. households (although energy prices have the world swimming in the hot oil of high inflation).

So, exactly what caused DXY to strap onto a space rocket and go on a parabolic ride?

There are three areas where DXY has the most potent impact: Commerce, financial markets, and the economic stability of emerging market economies.

The capital flight to safe-haven assets is what is sending DXY to the moon.

And the FED is the wind beneath its wings.

By aggressively hiking rates, what the FED is doing is making USD and U.S. government debt – the de facto liquid, safe-haven assets for the rest of the world – even more attractive to investors.

In our update on MBS in September, we mentioned that a high interest rate would make U.S. Treasuries an attractive asset given the economic chaos from high inflation that the world is muddling through this year.

As an example, the six-month Treasury bill’s interest rate is 4.41%. And as an AAA-rated, investment grade asset backed by the U.S. government, it’s one of the safest places to park your capital.

Combine this with the surging dollar, and foreign investors can generate an annual cumulative return anywhere from 6-10%, if not higher, depending on their own currency’s performance against USD. In a high-inflation environment, this is a very attractive proposition.

The only caveat here is foreign investors have to sell their domestic currencies and buy USD before they can buy U.S. Treasuries. That triggers more demand for USD, creating a shortage of dollars while all other currencies are jettisoned.

As an example, the chart below shows the Chinese yuan (CNY, purple line), the Indian rupee (INR, blue line) and the Sri Lankan rupee (LKR, red line) all declining against a strengthening DXY.

This also spells trouble for risk-on assets such as equities and cryptocurrencies.

With “flight-to-safety mode” kicking in, investors seeking shelter are rotating capital from those asset classes into Treasuries and USD.

The correlation is quite pronounced. As DXY climbed higher, the S&P 500 (SPX, orange line) and Bitcoin (BTC, blue line) got hammered. As DXY corrected, SPX and BTC started to mount a comeback – except at the moment, the FTX fallout is hindering BTC.

Another negative impact of a strong dollar on equities markets has to do with corporations generating revenues overseas or exporting from the United States.

For multinational corporations, their earnings overseas will take a hit when they get converted back to USD. And exporters in the U.S. are also part of the collateral damage because the money they’re owed is most likely denominated in local currencies. A strong USD hurts their revenue once these figures are converted back to USD to pay for operations, cost of goods sold, and capital expenditure.

Our Gain, Your Headache

We cannot talk about the impact of DXY without mentioning USD’s status as the global reserve currency.

That’s why all commodities are denominated in USD.

If India wants to buy wheat from Canada, India will have to exchange its Indian rupee to USD first, then use the USD to buy wheat from Canada. Because wheat, just like other commodities, is priced in USD.

France wants to buy uranium from Kazakhstan for its nuclear power plants? Then, it will have to buy USD with euros and send it to Kazakhstan for uranium.

As a result, a strengthening USD represents higher costs for developing countries and emerging market countries that rely on imports for energy and food. This can result in riots and civil unrest, like what happened in Sri Lanka in March. As we showed you above, its currency has weakened drastically this year.

But even countries with rich natural resources have seen their currencies drop sharply against USD. Below, we have a chart for DXY versus the Indonesian rupiah (IDR, orange line) and the Brazilian real (BRL, blue line).

And courtesy of monetary and interest rate policies, some of the G7 economies’ currencies are sinking like a cruise ship anchor against USD as well. Below is a chart of DXY against the euro (EUR, orange line), the Japanese yen (JPY, blue line), and the British pound (GBP, red line).

EUR and GBP are showing more bounce against USD with their interest hikes, but JPY is still floundering because the Bank of Japan is still attempting yield curve control via quantitative easing.

As USD gets more expensive, more people seeking safe assets will shelter in it, and as more foreign currencies are sold, that pushes exchange rates against USD even lower. It is a negative feedback loop nightmare for foreign governments.

Long Live the King

It is obvious that DXY has a deep impact on financial markets. And a strong U.S. dollar certainly creates issues for many countries in different ways.

With the FED showing no signs of slowing down its rate hikes and other potential catalysts for higher inflation looming on the horizon, the smart money approach would conclude that DXY will continue to rise.

Will DXY see a meteoric ascent like it did back in the early 1980s, when it shot up over 160 in 1985? That remains to be seen.

This quick tour of the U.S. Dollar Index sets the stage for us to kick off another series of discussions that we will focus on later, with topics such as capital outflow control, a potential of emerging markets crisis or Asia Financial Crisis 2.0, and the debut of central bank digital currencies.

Until then, we will keep an eye on the macro for you.

Yours Truly,

TD

Beautiful.

Long Live the King 🤴