Patient Parabolas

Accumulation patterns and a shopping list

Market movers exude patience.

This is not necessarily a trait that helped turn them into a market mover. Its a trait born out of necessity.

Having large sums of capital means you can’t merely open up an account on a Kraken, KuCoin, or Gemini and throw a $50 million bag of dollars into the order book.

You’ll get smoked. The liquidity and spreads are simply not there. Meaning you try to buy $50 million of bitcoin on a single exchange, you’ll get spotted after your third or fourth $250k order gets filled.

It’s why prime services are becoming more and more popular as more capital floods into the space. With larger sums of capital requires an arsenal of accumulation strategies.

These methods are different than what day traders use, and the mindset needed to pull it off is different as well.

In order to move large sums of capital the buyer requires patience to scale in during a window or price range. Let price run a bit, slowly come back to fill up a bit more, let it run a bit again, and fill it up some more…

Otherwise the buyer will cause price to run and ultimately he or she will lose out on their entry.

A subtle, methodical, and patient approach let’s them stay in range and accumulate for a longer stretch.

If you were to look on a chart, do you have an idea how this might look?

A series of higher lows.

We tend to hear that a lot as traders… Price forming higher lows. This can take place on any time scale.

But at the end of the day, when the market gets a bit too heated when a series of higher lows form, something unique begins to form.

It’s a parabolic curve. Its when you know you’re at the end of this accumulation stretch and several players are fighting over one another to get on the order book to fill their orders before it runs.

It’s the mother of all patterns in my opinion.

It tells you when those major buyers are beginning to get impatient. And for any futures trader, this is your signal to get in on the action.

When impatience is happening in the market, volatility begins to expand and the amount of time you need to put capital to work is at an absolute minimum.

From the vantage point of on-chain flows, this means capital is starting to pile in faster and faster. And when these parabolas form at the end of a long accumulation pattern, the price will have massive legs to it.

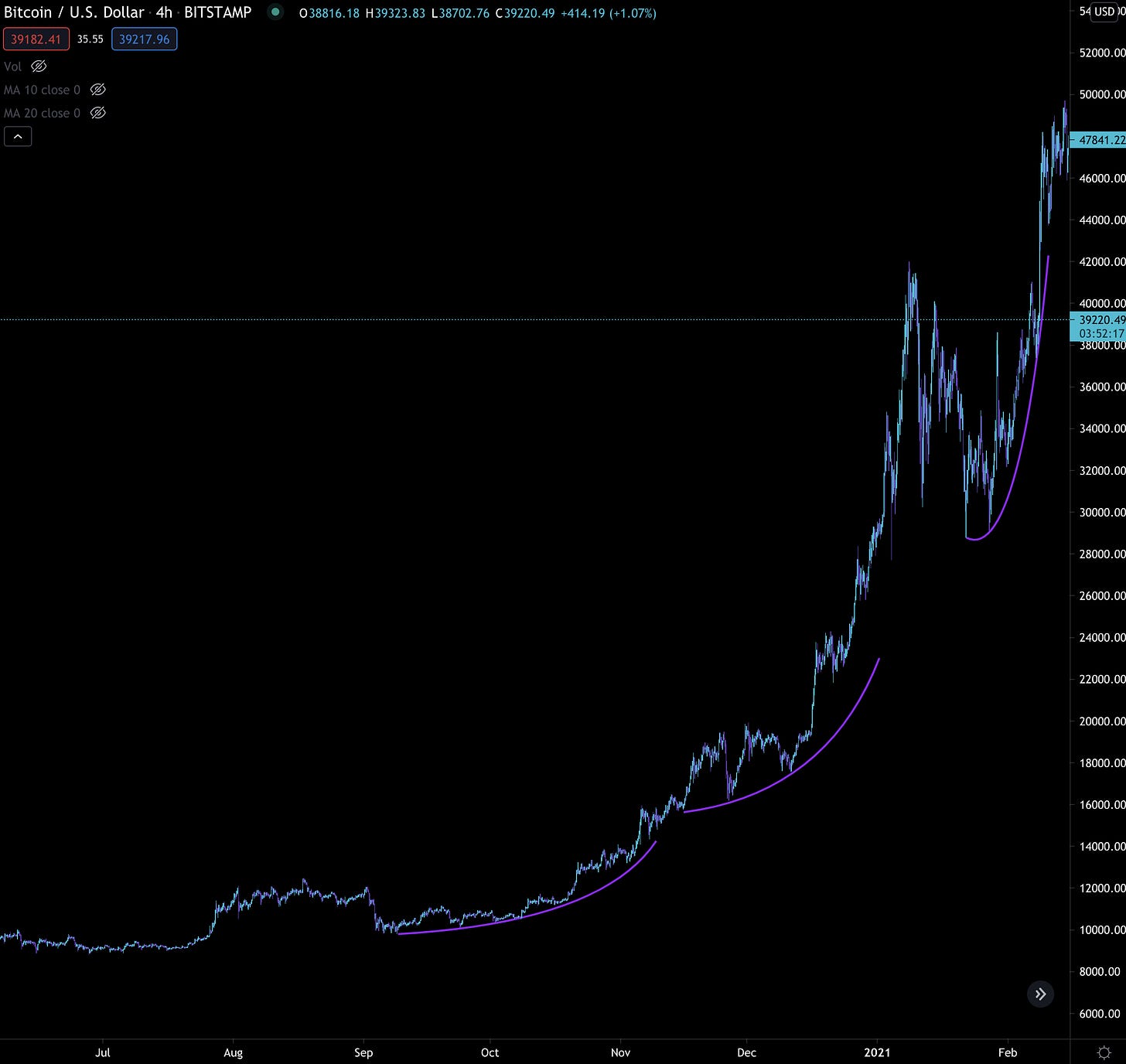

To give a visual for what it looks like, here’s the parabola from early 2019.

It’s a massive one that expanded over five months.

They can be found anywhere at various timeframes. In fact, here are several from September last year to February this year…

It’s something to watch out as our current price range materializes. I wouldn’t be surprised to see a rounded bottom or parabola form at the later stages.

That’s because of the data we hit on yesterday. Larger wallets are beginning to accumulate once again.

This will likely take some time to unfold properly. And a rounded bottom and / or subtle parabola forming would reflect such activity unfolding in the background.

But for that to play out will take some time.

And for most readers here, you’re probably more interested in what’s happening in the near term.

Well, we got some interesting news on this…

We got our first bullish pulse yesterday. Turns out bullish life does exist on-chain.

This was quickly followed with some nice price activity higher… Then soon after bearish movements showed up again.

It might seems discouraging, but this is good. Seems the range of $40-42k we suspected to act as resistance is starting to cement itself.

Now we’ll see when bullish signals start to emerge again. As this will give us a good idea what price will be defended.

From our article called, “No Man’s Land” we discussed the $40-42k range with on-chain resistances… and we also hit on $33k using that same on-chain support/resistance chart.

So that’s the area we suspecting gets defended.

And as appetizing as $33k looks, we’ll see if we get it. The market is starting to get a bit lopsided on shorts. We know this with the negative funding rates we showed you a few days ago, they have not subsided at all.

This can fuel a squeeze higher. And if it happens, there’s a good chance we still grind back down for more accumulation.

But here’s the thing. Once these funding rates reverse there is one thing to keep in mind. A change in funding rates from overly bearish to overly bullish will do a lot to this measure…

or better yet, this one.

As we hit on yesterday the conditions are better than they were for Grayscale to do what it does best. We’re already seeing how the drop impacted the discount for the better.

And from what we can decipher based upon what unfolded in the trackable on-chain part of the bitcoin market, this premium is likely to return.

Meaning the question might soon turn from, will the premium return to… How big can it get this time around?

In the meantime, let’s use patience as the current trading range unfolds.

With this patience, consider adding to some altcoins when the time presents itself. Here’s an internal metric we call the fair price scanner.

We’ll eventually pull back the curtain on what all goes into it, just know its a way to evaluate price relative to whale accumulation prices.

Here are more expensive coins..

The cheap…

Go find your favorite projects on the list and see where the stand. See if it makes sense to add to your bag or not.

But remember, no matter what, practice patience.

The market is still feeling itself out. But the undercurrents are starting to emerge that accumulation is taking place.

Time looks to be on our side… At least for now.

Your Pulse on Crypto,

Ben Lilly

Ben, you are a real enrichment! Many thanks and big respect to you sir

This newsletter Is So Great!! incredible 👍 Thanks