No Man's Land

Backwardation and Waypoints

First its bad.

Then its worse.

And then before you know it, its testing your very beliefs.

This was likely the way many experienced the bitcoin and the cryptocurrency market last week.

First we got what everyone seems to be calling the Elon selloff, which was bad.

Then as we sat on a support level, in came China FUD. That was worse.

Then before you knew it, a baseball bat was was swung at the knee caps of altcoins.

Thoroughbred ETH saw a 60% haircut from its high. LINK did it one better and saw more than 70%. And then superstar ENJ… a drop of over 80% from its recent peak.

These are large cap altcoins that got obliterated.

It was worse than what we expected in our bad scenario.

And amidst the bloodshed tweet after tweet asked if the bottom was in. Was that the worst of it. And many others very similar.

But what’s important here is, did your thoughts and beliefs of cryptocurrencies being a legitimate asset hit an all-time low? Was there a pit in your stomach that got so unbearable you closed your computer or phone and said screw it, I’m done with this?

While about 40-50 clients (who were sitting on the sidelines) sent questions along these lines, my guess is many of you had very similar thoughts and experiences.

For me personally, I had those same thoughts and feelings rush through my head during my first major selloff. At the time it felt like I was the only one with bad luck in crypto…

Well I’m here to say if you haven’t been caught up in a sell off, then you haven’t been part of crypto for more than a couple days.

So don’t be so negative. Keep grinding.

Now, to help put that head back on straight and chin up let’s check out something a bit more optimistic.

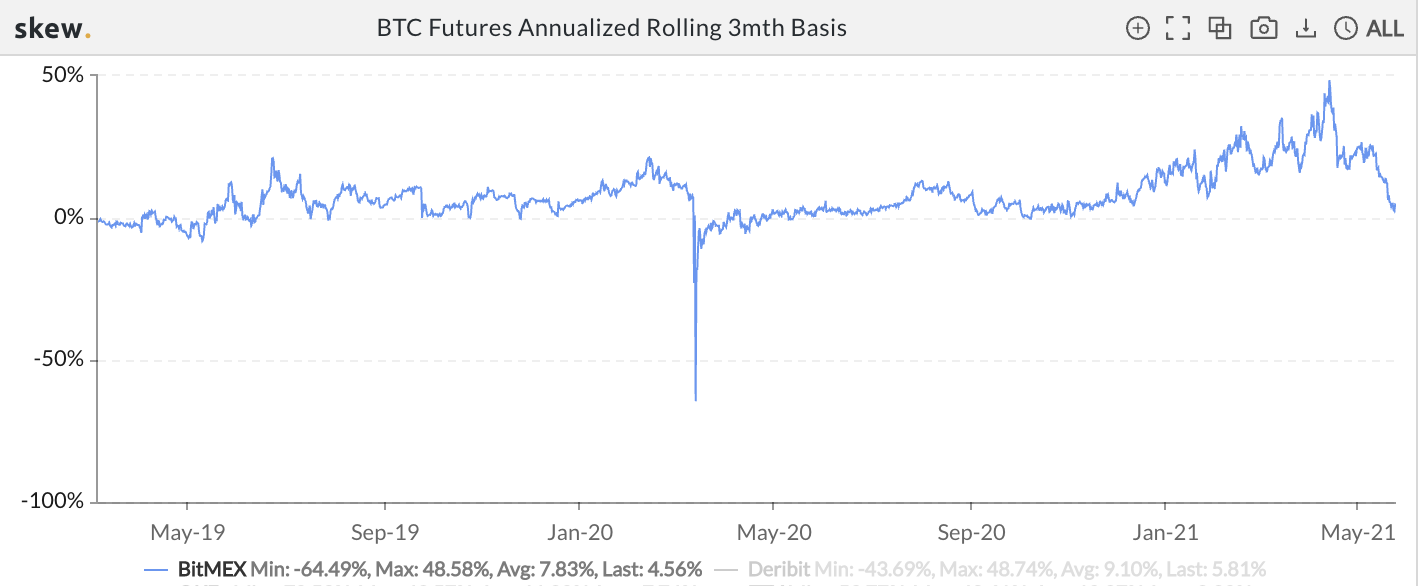

In the chart below we have bitcoin’s annualized rolling basis on Bitmex.

A rolling basis is calculated by taking the current spot price of bitcoin and comparing it to a futures contracts. Then annualizing it.

If a contract three months out is trading at a 2.5% premium to spot prices then it’ll show up on the 3 month basis chart below at around 10% annualized.

Looking at the chart below we can see the premium rarely goes below 1%, which is what happened briefly on May 23rd.

This is important to realize, so take a moment to see how many times it goes near 0%…

If we compare those times when the basis dropped below 1% on Bitmex to a price chart (note, using Bitmex since it has most history and even since US DoJ issues, still relevant) this is what we get.

This looks promising in terms of finding a bottom. It harkens back to why we use funding rates so much. Because just when people think crypto is coming to an end and its off to the woodshed, it bounces back.

It’s why we made our comment in Coindesk during the dip. That in times of backwardation, which is when the futures contract trades at a price less than spot, it can be viewed as a buying opportunity.

“What we find is backwardation tends to be more predictive of a reversal or buying opportunity, especially in a bull market.”

Now, while the bottom may or may not be in, we can say that it’s still a good time to enter in on spot, but not necessarily for going long in the futures market.

That’s because with futures market we want a better indication of which direction the market is going. With more risk requires more accuracy. And right now, we are look deciding whether or not a bottom is in…

To help us decide if the answer is yes, we want bullish transactions.

Unfortunately, we haven’t gotten them yet. Even with about 6 billion worth of USDC hitting the chain, the bearish transactions haven’t subsided.

And while the fractal we shared with you late last week has come and passed without the dip it predicted taking place, we still aren’t confident in saying whether or not we think a lower low will form.

Right now we’re flying in no man’s land.

There are several potential scenarios at play right now in our minds. I’ll lay them out here.

First…

A quick “V”-like dip can entice more shorts to enter the market. The newly added fuel in the form of USDC is used to buy up the dip, and we get a squeeze.

This is mainly due to funding rates.

Looking at the profile below. We see at lot of green bars. This means those who hold a short position are paying those who hold a long position. This isn’t common and tends to signal that a reversal might be incoming - for reasons similar to what we talked about prior with the 3 month basis hitting 0%.

Second scenario…

We get a slow carve out of a bottom that revisits the low. You can also think of this as a consolidation phase. There were over four months supply of bitcoin that flooded the market. Meaning it might take some time for the market to gain solid footing.

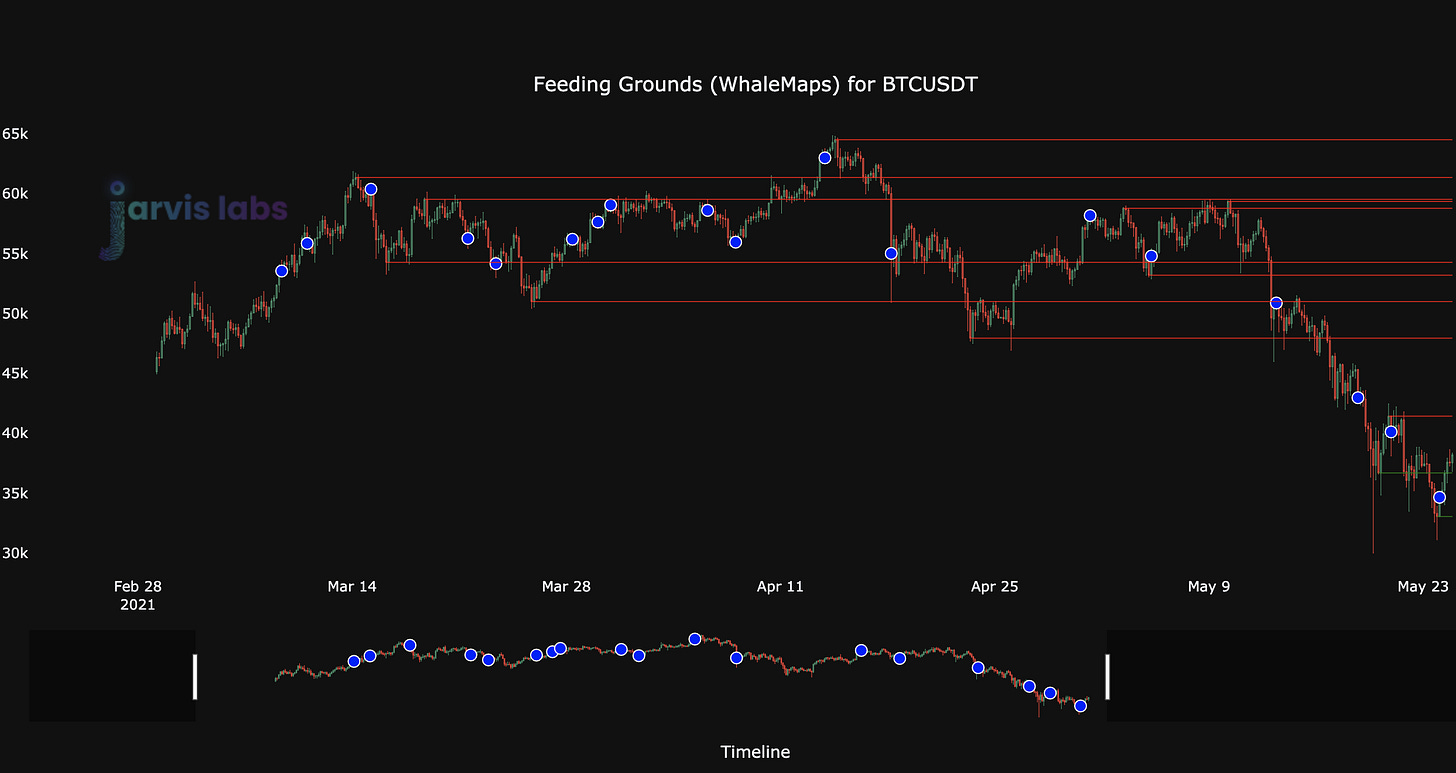

The carve out might have us hang out below our last area of interest in terms of on-chain transactions. Looking at the Feeding Grounds Whalemap chart below you can see the $42,000 and $40,000 price point are the next resistances while $33,000 is our new support.

Which is why I wouldn’t be surprised if this is the range we hang out in and carve out a bottom in the following few weeks.

In fact, it’s just the sort of thing that invites head and shoulder charts to be created.

With such uncertainty in the market (ie - head and shoulder discussions) price is able to almost quietly charge back above $50k without much noise.

But again, that might take some time.

In the meantime, there’s still uncertainty.

Bearish transactions continue. We have two price points of interest of $42,000/40,000 and $33,000. And with funding rates leaning in a direction that’s inviting a short squeeze if we get another strong dip, there’s some potential volatility ahead.

That’s why we’ve officially entered no man’s land.

We continue to wait for certainty.

Your Pulse on Crypto,

Ben Lilly

P.S. - We officially raised our subscription costs to Jarvis AI as well as consulting costs last week. This is to avoid diluting the alpha and also keep our commitments to our earliest subscribers. Any questions be sure to drop us a note on telegram.