Who Crashed the Market?

The story which nobody wants you to hear

(this was originally published on June 19, 2020. You can find it here: https://jarvis-labs.xyz/who-crashed-the-market-the-story-which-nobody-wants-you-to-hear/)

Be sure to subscribe to our newsletter, Espresso. We deliver daily on-chain crypto insights to start your day.

The Carnage Left Us a Clue

Media and analysts have it wrong, it was Pablo… Not Corona.

Pablo was responsible for the market dropping 57% earlier this month.

But instead of pointing the finger at Pablo, the media was blaming COVID-19, financial markets, a BitMex DDOS attack, a PlusToken scam and an array of other reasons.

The theories were endless.

The fact is, they don’t care about the truth. What they do care about is you clicking on their headlines in order to profit from their advertisers. Each click means more eyeballs on their website’s domain. That’s what they were after.

It’s why you won’t find the media diving into the blockchain searching for the truth. Which is unfortunate. Because if they did they would see the tracks left by one of the largest crypto Market Movers in the game right now. We nicknamed the wallet, Pablo… and it’s who dropped the market from $9,241 to sub $4,000 in a span of five days.

Over the course of five days, Pablo gave the market whiplash. On March 13th when the carnage was being assessed, he left traders in a state of paralysis… wondering was it safe to get back in? Was crypto just an experiment gone wrong? Was the $97 billion wiped from Bitcoin’s market cap just the beginning?

To find out the answers to all these questions and what Pablo was up to required getting your hands dirty. It’s not something we expect any popular news outlet to do.

Frankly, that’s fine by us because it’s what we specialize in. Uncovering clues and hidden trails that lead us to the truth. So join us today as we draw back the curtain on Pablo, our best friend Jarvis AI, and a hidden secret about where the market is headed.

But first…

We Track Around The Clock

Welcome, if this is your first time reading something from Jarvis Labs, think of us as your Sherlock Holmes traders. We gain an edge by holding the magnifying glass to the blockchain.

Our team of detectives track Market Mover ripples as they move across the chain. Through these ripples we anticipate their movement by crunching millions of real-time transactions through our Artificial Intelligence/Machine Learning algorithm 3 years in the making.

We call this AI/ML Bloodhound, Jarvis AI. To learn more about us, how we operate, or gain access to Jarvis, click here. Or continue reading to find out more about how Pablo crashed the market.

The Carnage was Premeditated

Pablo is no ordinary trader. When his wallet stirs, he’s better described as being THE market. This is why Jarvis was ringing the bell on March 4th as Pablo’s wallet began shuffling 15,000 Bitcoin.

Jarvis already knew what this meant. The market was about to take a hit. The chart below shows the time and date of when Pablo’s wallet began to leave traces on the blockchain. You can see the price was trading around $8750 while the mini pump after the move took the price to $9,150 followed by the rug pull.

The secret play started with the first move on Feb 18th, 6k BTC move out into the exchange hot wallets for selling (by propping up the price by injecting USDT and USDC simultaneously). A similar play on March 4th, as shown in the chart above.

It’s what started the cascade. The thing is, by March 12th Pablo started to settle his debts with his bookie. You might be wondering why Pablo has a bookie. Or better yet, what is a bookie in crypto? It’s a story best left for another day… For now, just know when Jarvis AI witnesses the bookie getting paid, the Market Mover is turning the office lights off to grab a beer.

Unfortunately for anyone loaded up on $20,000 per Bitcoin dreams, this drop was only Part One.

Part Two showed Pablo was making a masterpiece with Broadway choreography.

That’s because as soon as Pablo hit the bar, buy orders across crypto vanished. Poof, millions of dollars of liquidity lifted. This resulted in price moving like hot lead through butter. Which is what made it clear Pablo wasn’t at the bar… he was busy orchestrating a masterpiece.

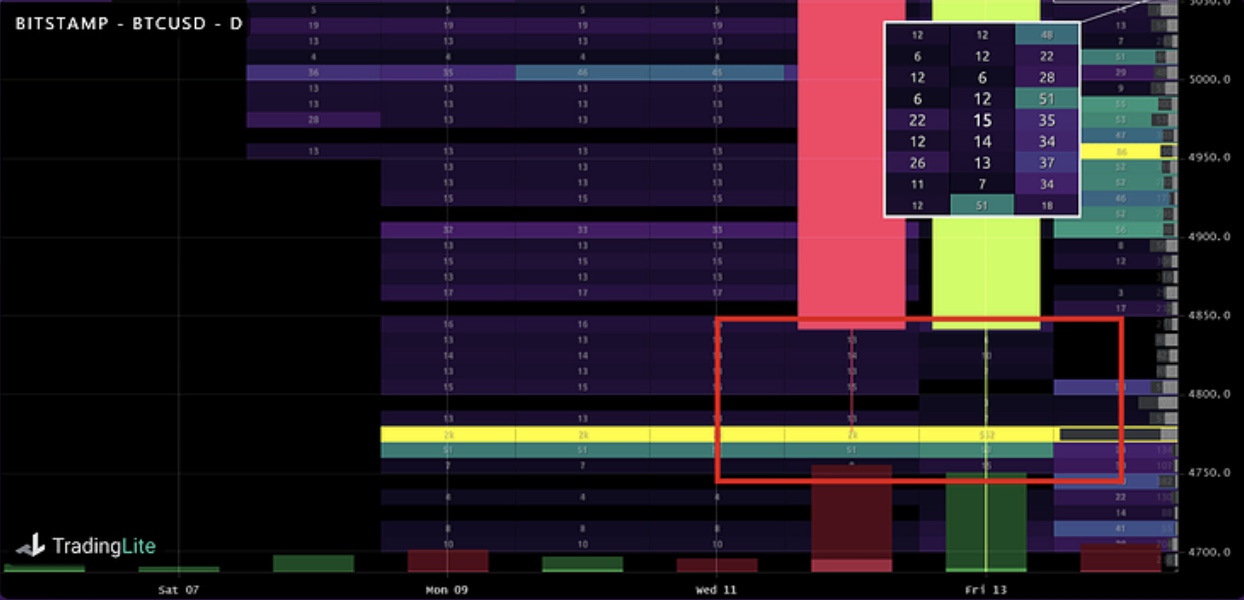

Here’s Pablo in action lifting his buy orders. The red circle highlights what we call buy walls. These are massive orders for buying bitcoin orders. The highlighted red box point to the orders being lifted.

His maneuver slashed prices in half. It was a massacre.

Every indicator was flashing oversold leaving technical traders slaughtered in the carnage. Popular trading platform Bitmex reported over $1 billion in trader losses from this.

The only breadcrumbs left on the scene were found at $4,770. A 2,000 BTC buy order was placed around the time Pablo squared up with the bookie. Here it is on Bitstamp’s exchange, just before Pablo started his opening act. The red box shows when the massive buy order was entered.

Pablo’s order was filled on March 13th. It was a 50% clearance for him. Pretty decent day at the office. But the thing is, his masterpiece is still playing out. We know this because Jarvis is still sounding the alarm.

So what’s Part Three of Pablo’s masterpiece? You’ll have to tune in next week to find out more. In the meantime, understand Pablo is about to take the crypto market by surprise. When he does, Jarvis will be watching, and ready ourselves to ride the impending shockwave.

Jarvis AI is a fully independent artificial intelligence system that tracks on-chain (USDT, BTC, USDC, ETH) transactions, exchange flows, market sentiment together with a bulk of other data and processes them into tradable signals.

To join us in our endless hunt, stop by our website, or check out our Telegram channel.

Contact our analyst Ben on Telegram for further details on how Jarvis AI can help you.

Until then, we’re on the sent…

Suspense cliffhanger about the bookie story..

I kicked myself for having not discovered you earlier....