Bobbing up and down in the water, you’re about to fall asleep on your surfboard...when all of a sudden…

You feel a small force begin to lift you up. The sound of churning water grows louder. Your body is being rushed toward the shore.

Finally.

A wave is here.

You spring into action, crouching on your board, finding your balance, judging the speed of the wave…

And then…

Plop.

Just as fast as it started, you’re back neck-deep into the water. Your board slowly surfaces a few seconds later.

The wave is already dead. It’s back to waiting.

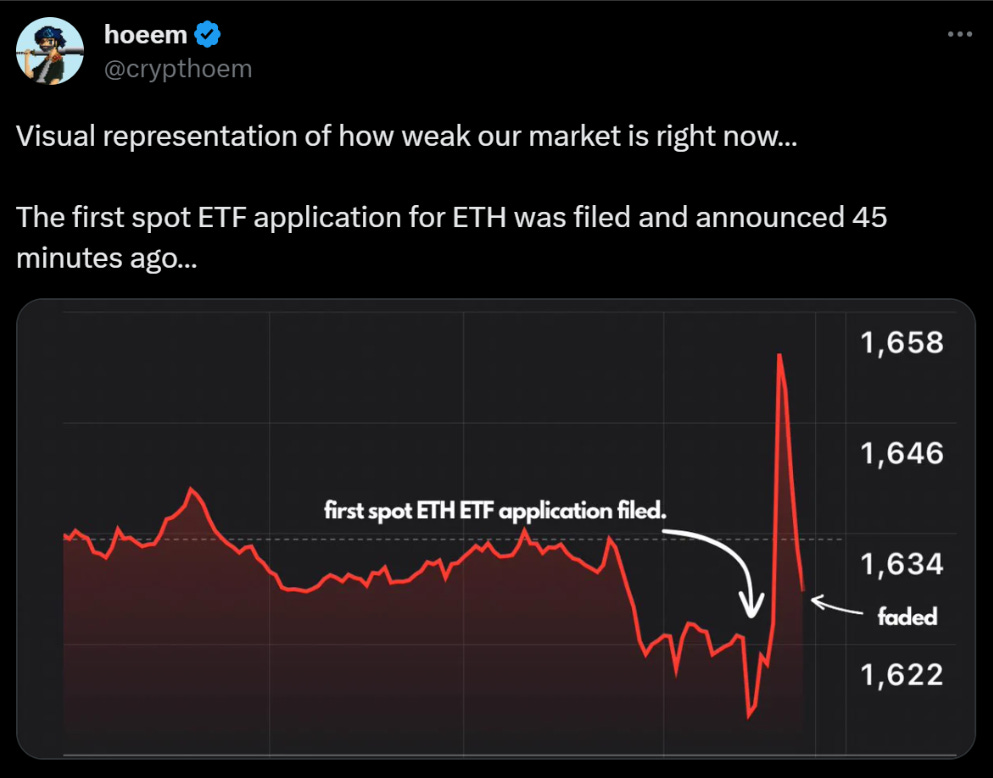

I’d wager this is how most of us feel in crypto right now. After the euphoric high of last week’s court victory against the SEC, it felt for a second like we were finally about to ride that wave into the next bull.

But then, that wave subsided, and we’re back to boredom again.

So how long exactly is this period going to last? And is it a good time to buy?

That question was front-and-center in the latest episode of Alpha Bites. And our own Benjamin (no, not me, the other Ben) tackled it using one of our proprietary metrics called the Jarvis Labs Bull-Bear Indicator.

It takes various moving averages and rearranges them to determine if we’re in a bull or bear market. And that knowledge is crucial for deciding if it’s time to ease in or out of trades.

Here’s what Benjamin had to say:

Are we still in a bearish trending regime? The thing is, ever since January this year, it was starting to trend on the bullish side of things. After the consolidation that we have had for the past couple of months and the drop we had in the past few weeks, now it is in bearish territory.

Now, what happens every time this goes into bearish territory [is] it rarely pops back up into bullish territory anytime soon. Like, it takes months. This was something I was quite scared about. I didn't want it to drop below that level, because when it does, it literally takes a few months before it can pop back up...

But the thing is, it's also doing exactly what it did in the 2019 cycle. After the August period, after the pump-and-dump that we saw, this metric dropped back into the bearish sector. And then only in April of 2020, it started turning back into bullish. So given that logic, and given that we are [expecting] the halving to happen somewhere in April or May next year, I think we are in sync with that cycle.

So for now, it means that we have to take a step back from buying the dip aggressively. We have to watch out for event-driven situations to affirm our bias. And I think there are going to be more opportunities to get in. I would not look forward to swing positions right now. That's my observation when it comes to this metric. But basically, it's, “Caution, everyone.”

We’ll definitely revisit this metric in the coming months, as we get closer to the halving...and a potential spot Bitcoin ETF.

But just because the market is boring doesn’t mean no one’s building. In fact, last week we got some big news regarding the largest decentralized stablecoin issuer, MakerDAO (MKR).

The protocol has been looking to launch its own native blockchain as part of its long-term plans. And its cofounder, Rune Christensen, said on Twitter that he’s proposing Maker build that second chain by forking Solana.

On the podcast, Kodi, our token design expert, shared his thoughts:

This came as a surprise to everyone, myself included. I think everyone was thinking that [Maker] would launch a sort of L2, an EVM-based [chain], maybe a Cosmos chain, but definitely not Solana.

And the reasons that Rune says why they have chosen Solana is that it's a highly optimized blockchain. And it's made to be like a monolithic blockchain, [so] everything sits on the same chain and it's as efficient as it should be. And it also scales with hardware.

And one of the really good things about Solana is that...it has parallelization, so basically you can run multiple “commands,” or transactions at the same time. And the second reason is it has proven great resilience, even after the FTX debacle.

…

I'm excited to [see] people [working] on Solana and on the [Solana Virtual Machine] in general, and also forking Solana and having it run as an option basically, and have the backend for a protocol sit on Solana or another chain. You could also do it on Cosmos. Sommelier is doing that. And then your frontend product is sitting on Ethereum. So I think we're going to be seeing more of that as well.

Stay tuned for this Monday’s Single Origin, in which Kodi takes a deeper dive into this trend and explains why Rune should consider another chain for Maker’s next move…

Meanwhile, Alpha Bites host Marconi Wight asked the XChanging Good team what innovation they’re hoping to see soon in crypto. And independent analyst Ray had an interesting idea on why he hopes to see that innovation come from the Bitcoin market:

I need more trustworthy Bitcoin custodians to intake Bitcoin and then offer collateral for that – whether it be stablecoins or U.S. dollars or other fiat – direct to consumers.

So if you look at on-chain data, you see the record amount of Bitcoin holders. That metric continues to rise. You see more and more people adding to their Bitcoin pots. Numerous companies are holding large Bitcoin treasuries... [and] Bitcoin miners are holding large Bitcoin treasuries. So I personally would like to be able to unlock some of the nailed-down cash that's in my Bitcoin position and use it in real-life stuff.

And as Bitcoin’s volatility begins to taper off over time, and we get more adoption of the asset as a store of value on the institutional side, then I think that you'll see more and more investors become holders.

So finding ways to just collateralize that and put it to use elsewhere would be a big step forward for Bitcoin. And it's something that would provide a lot of daily use to people that are holding that asset.

Along with Ray’s idea, the team also suggested some other potential innovations that could benefit crypto, such as zero-knowledge-enabled privacy and Web3 mobile apps. You can listen to that whole conversation, and the rest of the podcast, on YouTube right here, or on Apple Podcasts or Spotify.

Now, Ray touched on a key reason why Bitcoin has yet to gain widespread adoption among institutions: its volatility.

But Bitcoin’s wild price swings are no mystery. In fact, they’re easily explained by a fundamental component of economics: elasticity. And it was one of the topics in the Blend this week:

Elasticity is essentially how much something changes in response to a new event.

...

I like to view it as how much something can handle before it snaps.

In the world of crypto, we translate this to how much a change in demand results in a change in price. It’s quite literally one of the most highly misunderstood topics in the industry.

While at the same time, it's also the most common phrase uttered in the halls of Crypto Twitter: “The parabolic pump.” “The squeeze.” “Convexity.” For Econ nerds, it’s all about elasticity.

You can read the full insight here...and for any parents out there, I explained elasticity in a way I’m sure you’ll relate to.

Finally, on Monday I predicted what will be the world’s next global reserve currency: the “Debt Dollar.” It’ll come courtesy of the Federal Reserve. And we’re already using an early version of it:

Let me introduce you to a proof-of-concept version of the new dollar: USDC.

The token is essentially dollars and trades like dollars. In all actuality, it’s tokenized dollars… Right?

No. It’s basically government Treasuries. Debt. Same goes for USDT. Debt. Yet, we all are happy to hold it like dollars and use it to pay salaries and play in DeFi while earning less yield.

Nearly the entire amount of tokenized dollars on the Ethereum network is really just debt being traded around. And these traders are crypto natives who are wary of FedNow, U.S. monetary policy, and the debt bubble. The most skeptical crowd is already subscribed.

The proof-of-concept of what FedNow will become exists. You are using it. [The Bank Term Funding Program] already gave way to Treasuries being seen as risk-free. With another quick accounting adjustment, tokenized debt dollars will flow through the 24/7/365 settlement network with ease.

This will give the Treasury market endless pools of liquidity. All dollars turning into debt dollars.

If you want to learn why debt becomes the new “gold standard,” you can check out the full essay here.

As always, you can find links to all the content we published this week below – along with our Tweet of the Week.

That’s all from me this week. Enjoy the weekend.

Your Pulse on Crypto,

Ben Lilly

Espresso:

Alpha Bites:

Tweet of the Week: