Get ready for the flood of “we are going to make it” (WGMI) and “we are so back” posts.

I’m happy to see it.

Crypto Twitter needs it. But the reality of it all is that those reading those posts likely never left. New retail traders and users tend not to show up until after we get the sweet intoxicating smell of new all-time highs.

And it’s unlikely to happen in 2023.

It’s a statement that isn’t likely to ruffle any feathers. Many are not expecting new all-time highs this year.

Sure, an ETF approval that hits us unexpectedly before the January time period where many believe a decision is imminent could cause some unexpected outcomes, but that’s a lower probability and an outcome that is difficult to work around.

That’s why new all-time highs are unlikely this month.

But the fact we are discussing such things means our thesis from as early as March (nine months ago) is still playing out. Here was a post from April that hits on how price action reacts before a halving event – the current halving is expected in April of 2024.

We dipped below the 200-day moving average… It didn’t last long… And we haven’t really returned.

Sure, bears might get their last black swan event like March 2020. An event that provides a great entry, but by definition, black swans are not predictable. So why try to expect the unexpected? That’s what buying insurance is for. That’s what a put option is for.

Personally, I play the bull momentum. I do it without being paralyzed by fear that some rare 30% selloff might happen tomorrow, because I buy a small amount of insurance in the event that bears get one last day in the sun.

Let them get one last moment of happiness because it doesn’t pay to be a permabear. It pays to play the momentum.

So if this fear is you, then consider a put option. You don’t know what they are? That’s fine, J.J. is beginning to cover it exclusively. Expect a lot more videos on options in the coming months.

As far as what to expect in terms of price over the next few months? Let’s do an old-school Jlabs style of an Espresso market update.

Market Update

The weekend’s price action resulted in liquidation pools being wiped out to the upside.

The little bubbles in the chart below indicate where sizable futures positions are likely to sit and can be liquidated. The thought process here is that price is attracted to liquidity… You see lots of bubbles, that’s liquidity.

Price likes bubbles.

Ok, here was the chart this morning…

Here it is after the open.

Momentum sought out liquidity and has hence slowed down a bit.

Same story for ETH/USD. Word from the Jlabs Digital trade desk was that liquidity was sitting at $2,253… Here was a chart they sent out yesterday.

It’s since been wiped out.

A lot of this move began with somebody on BitMEX loading up on a $150 million long position back on December 1. A position that size is pretty rare for 2023, so it was something to note heading into the weekend.

It’s worth keeping an eye on the BitMEX open interest for this very reason. Any pullback on this open interest could begin a liquidity hunt to the downside.

In the meantime…

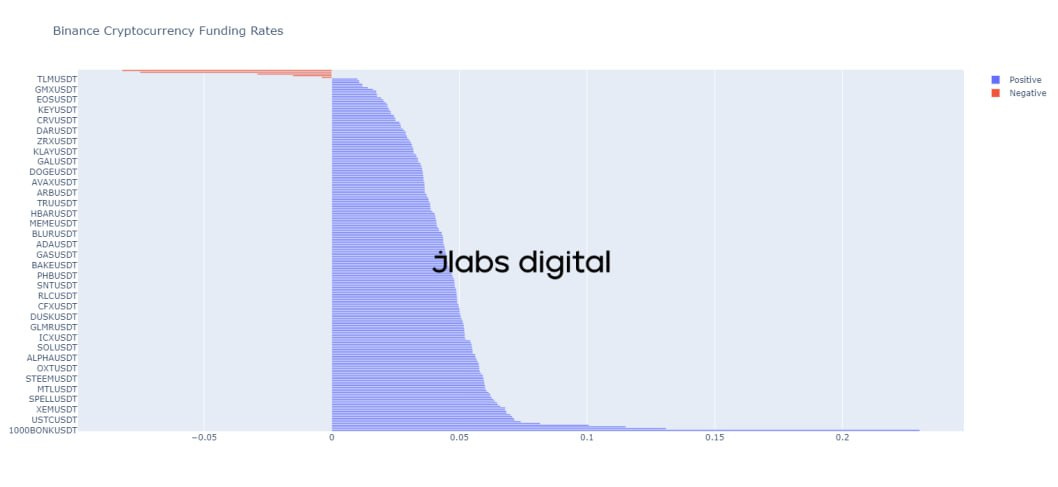

Funding rates have started to climb a bit here. For those that don’t know how funding rates work, take the rate and multiply to get a daily payout amount. Then multiply by 365 days. That represents the annualized percentage. The 0.05 figure below represents about 55% on an annualized basis. Normal is 0.01 or about 11% per year.

So this 55% figure might seem like a ton. But it’s not really extreme until we get north of 100%. It’s just worth noting because this is starting to heat up.

I say all this to really get into the possible short-term hunt into $40,000 region liquidity. Here was the chart from earlier. Those top two green pools look a bit enticing. Especially if the BitMEX long stays open.

If the trader stays open long, then eyes are on $48,000, which would be the top of this current trading range.

If we start approaching it…

Get ready for GMs, WGMI, and LFGs to top out the sentiment.

For the Oculus members that get market commentary from our trade desk, you’ll soon have more direct access to some of our models. Including CARI that was hinting at heightened volatility into the weekend.

Until next time…

Your Pulse on Crypto,

Ben Lilly

P.S. We are going back to the meaning of Espresso: a quick shot of data and charts. This means more frequent bursts of market updates with less long-winded dialogue. Now that the market is full of opportunity, we will be more active again.

If you enjoy our long winded theories and ideas, we will continue sharing them. Here was one that went out last week in xChanging Good. It was on “seasons” that exist in crypto and how to know when to go further out the risk curve. I’ll get into the chart below in future Espressos in the event you do have a listen.