This Token's Down 97%. And It's Looking Strong

The Blend: The Fed Crashes PayPal's Party; Measuring How Much This Market Sucks

There is a line I keep repeating…

Hard work pays off.

My philosophy is pretty simple. You work hard, be consistent, and you’ll win. And once the wins are realized, you reinforce the mantra with, “That’s why we work hard.”

But in all truth, crypto sucks right now. Am I right?

Volatility is at extreme lows, and it almost feels like nothing of substance is happening.

When it comes to projects making noise, it’s nothing long-lasting. It’s mostly market makers unloading tokens on unsuspecting buyers (looking at you, STMX, YGG, and perhaps soon LPT) and tiresome meme rug pulls like BALD which are simply headline fodder. It’s a bit tiresome.

And all this is unfolding as we have an entity like BlackRock at Bitcoin’s doorstep. It’s such a split world in some sense.

Yet, me and the other Ben (Benjamin, AKA the main brainiac between the two of us), stay stubborn to our core principle: Hard work pays off.

It’s a mantra we cling to in the depths of a bear market.

I bring this up because I want to give a shoutout to YOU for reading this. You’re spending the time staying up to date in the market and looking to take advantage of the next bull cycle. Your hard work will pay off.

And while I’m at it, I’d like to also give a shoutout to our team at Jlabs Digital (yup, new name and everything as we rebrand)…

This is a team that works hard.

It’s how we release so many batches of Espresso each week.

And in the background, there is an even larger group working on data storage, computation, execution, quant analysis, fundamental analysis, and visualization to bring you alpha we haven’t even shared yet. Some of the subscribers to our AI product are beginning to see bits of this already.

Our team is close, and I can’t express how excited they are for you to see what they have in store. I truly hope they get the recognition they deserve.

But it doesn’t end there. There is even a group building livestreaming capabilities for a metaverse. That’s right – YOU, our dedicated reader, will soon be able to meet the team in the digital realm. Why? Well, because we want to get to know YOU, the bear market survivor of 2023.

So in some sense, this issue goes out to you and also the Jlabs Digital team.

You, because of your belief in us and what we believe in. And to the Jlabs team for pushing the frontier of what is possible day in, day out…

Even when the market sucks like it does.

And that leads us to our first topic: Exactly how much does the market suck right now?

Keep This Chart Handy Ahead of Volatility’s Next Breakout

Earlier this week, the man with the mop, our resident janitor J.J., mentioned volatility was at record lows.

While J.J. is never somebody I would doubt, I just had to look at it with my own pupil-less eyes. As the white line in the chart below shows, volatility as measured by BitMEX’s 7-day volatility index has only been lower three times in the last six years (marked by the vertical red lines).

And in each of those instances, Bitcoin (orange line) made some massive moves (red boxes), with the rest of the market soon following suit.

What we also see is that once volatility is let out of the bottle, it stays out for a long time.

Of course, the question is, which way does the market go once that happens? For more on that, I recommend listening to this week’s Alpha Bites episode right here.

While you wait for the episode, I’ll make mention of one chart I want to keep an eye on for when volatility expands… It’s the Bitcoin dominance chart (BTC.d), which measures Bitcoin’s share of the entire crypto market cap.

Two weeks ago, we discussed on the Alpha Bites podcast how BTC.d looks poised to fill the gap created on the heels of the first XRP ruling from Judge Analisa Torres, which opened the door for most altcoins to potentially avoid being deemed securities.

It’s since gone ahead and nearly filled the gap.

If volatility explodes, I’m expecting BTC.d to keep chugging higher to a range of 52-55%.

If the market were to give us this type of move, then keep an eye on the ETH/BTC dominance chart. That’s because if we can get a Bitcoin Milkshake type of move, one where price rips higher and pulls liquidity from the rest of the market, then the next token to make a move will be the first step down the risk curve: ETH.

Keep that in the back of your mind as we continue poking Bitcoin with a stick asking for it to do something.

In the meantime, let’s take a quick look at how other layer-one smart app protocols have been faring since the start of the year.

The Zombie Chain That’s Coming Back to Life

When the market decides to take a step down that risk curve, it’ll do so by moving from Bitcoin into tokens with larger market caps.

Most of these are layer-one smart application projects, like Cardano, Polkadot, Cosmos, and the like.

I personally don’t care for all the narratives that Crypto Twitter likes to attach to these tokens… And with these projects, it’s very hard to assess network fundamentals like TVL, yields, borrowing rates, token distribution, GINI, application usage, and more.

That’s why I and a few others in the industry mostly use technicals when gauging what project’s native token is showing the most strength. And when I checked these metrics recently, I was rather surprised to see how terrible many of them looked.

In fact, going through the top 100 layer-one smart app protocols by market cap, I looked for which projects were above their 50-day, 100-day, and 200-day moving averages on the weekly chart.

There was only one.

Can you guess the project? I’ll give you two hints. The first is this token has dropped 97% from its peak. The second is its price chart below.

Answer: Solana (SOL).

Many wrote it off as dead… And rightfully so. The token died. I mean, it fell 97%.

Yet, here it is, coming back to life. The question then becomes, is this some zombie price action?

Well, to answer that question, I’d like to drop a bit of alpha on you.

Most people hate total value locked (TVL) as a metric. It measures how much value is locked up by a protocol or application through staking, liquidity provision, or other similar acts.

When DeFi Pulse first introduced TVL years ago, it was a way to show an application’s growth. I was a big fan of it early on.

But what many disliked about TVL was that it was bad at predicting price.

Well, anybody who says that is doing it wrong. It has been a long-held secret of ours that TVL is in fact a great price predictor. You just have to know how to use it…

For Solana, we can look back and see there were hints of this predictability happening (note: these analytics were not available back then).

The DefiLlama chart below shows the change of TVL on Solana since early 2021, in terms of SOL.

I highlighted four time periods marking when TVL took a big dip, three in 2021 (June 2, August 28, and October 22) and one in late March 2022.

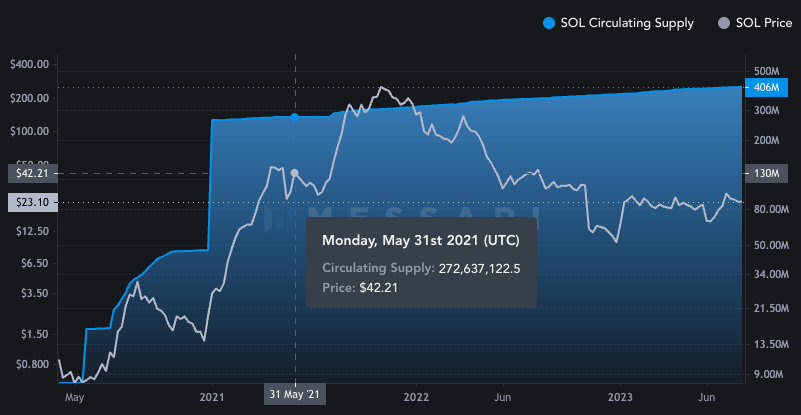

These dips all took place after a massive flood of SOL hit the market in late 2020. You can see that in the chart below, which shows SOL circulating supply just before the first major drop in TVL took place.

When Solana’s TVL went through those dips, this massive glut of new supply started to weigh on its price until TVL started to go up again.

Here are all those dates singled out on a price chart. Note how local tops in price happened shortly after TVL dropped.

Pretty helpful.

To explain why, I’ll lean on economic theory, which tells us that a change in token supply (or more specifically in this case, the liquidity of that supply), once met with an uptick in velocity, results in inflation — all else being equal.

Anyways, I’ll save that for another day…

Point is, TVL is helpful. It even helps in predicting when price will rise. Which is why we should keep an eye on the recent movements in TVL to see if we’ll get another uptick in SOL.

The last time its TVL went on a bit of a run was between June 10-14 of this year (roughly marked in the chart below), breaking six-month highs. Soon after, it began to trend lower until July 25.

Here’s the price chart with that June timeframe highlighted.

Who said economists can’t help explain things?

Now, I’m not saying Solana will be able to climb out of this pit it’s fallen into and become a force to be reckoned with anytime soon. I’d like to see its TVL rise above 20 million SOL and stay there, instead of falling right back down to its prior TVL like in this latest rally.

But if it does, consider SOL alive again and worth digging into some more.

Don’t Sweat the Fed’s Latest Move

The Federal Reserve went ahead and announced it’s sniffing around crypto.

It came on the heels of the PayPal news. The fintech payment company announced it’s introducing a stablecoin to its customers called PayPalUSD (PYUSD).

The coin is backed by cash deposits, Treasuries, and cash equivalents. It’s a play against Tether (USDT), which is raking in revenue from not passing along the interest it earns on its deposits to its users.

Well, as much of the hoopla died down, the Fed decided to release a statement.

Here’s the relevant part, emphasis mine:

[The Federal Reserve] will exercise its discretion under section 9(13) of the Federal Reserve Act to limit state member banks and their subsidiaries to engaging as principal in only those activities that are permissible for national banks — in each case, subject to the terms, conditions, and limitations placed on national banks with respect to the activity — unless those activities are permissible for state banks by federal statute or under 12 CFR part 362.

In Interpretive Letter 1174, the Office of the Comptroller of the Currency (OCC) specifically recognized the authority of national banks to use distributed ledger technology or similar technologies to conduct payments activities as principal, including by issuing, holding, or transacting in dollar tokens. However, the OCC conditioned the legal permissibility of these activities on a national bank demonstrating, to the satisfaction of its supervisors, that it has in place controls to conduct the activity in a safe and sound manner.

Whether the Fed has the legal basis to do this, I’m not entirely sure. But I imagine this will be a conversation that picks up momentum if we see it act on these self-prescribed powers. And I don’t see Crypto Twitter staying too quiet.

But what we should also remember is something we have been hitting on since March of this year: FedNow, which launched last month.

Back then, we discussed how FedNow will help banks hold more Treasuries on their balance sheets, and how a settlement system like FedNow helps meet customer obligations…

There was even a quick discussion on how the Fed will do all it can to ensure maximum uptake by U.S. banks.

Well, here we are. The Fed showed its hand, and now it looks to gain widespread adoption through rules it made up by itself in order to protect the U.S. dollar.

I say let ‘em have it.

For crypto to truly showcase itself, its main use case cannot and should not be the transaction of stablecoins. It should be to promote smart contract technology that resides on the network.

In doing so, the various decentralized blockchain networks will be viewed as beehives of pure, unadulterated, golden productivity.

Central banks around the globe are worried about the decline in productivity taking place in the developed economies of the world. Agustín Carstens, chief of the Bank for International Settlements, once used the analogy of a plane gliding in the air without power to describe the current status of developed economies.

Public blockchains and their native tokens can unlock a massive surge of productivity.

To showcase it, maybe we stop spending so much time talking about BALD people and dog tokens. If we don’t, then expect these new, self-appointed Fed powers to strengthen Chokepoint 2.0’s grip.

And if they do…

My question is whether the network state of crypto begins to look like a network of pirates, similar to how the first British settlers arriving in America appeared at the time.

Only time will tell.

Until next time…

Your Pulse on Crypto,

Ben Lilly

Great article mate. Thanks