The Problem With Ethereum Yields

Plus: A Cheat Sheet for Market Bias; The SEC’s Sleight of Hand Tricked Crypto Again

We’re getting close to the halfway point of 2023.

Yes, time flies. But what I find amazing here is SBF, Celsius, BlockFi, Voyager… they each are still occupying headlines and headspace in the market.

We saw this after the big news dropped earlier this week that the SEC is suing Binance and Coinbase. It resulted in Twitter posts telling everybody to remove funds from exchanges. I even saw the decision matrix, which shows what happens if you keep funds on an exchange versus taking them off, populate my timeline again.

What this tells me is we all still suffer from PTSD – Post-Traumatic Scam Damage. The collapses of those centralized exchanges and lenders are still hurting traders to this day.

This too shall pass. But it will take more than just time. We’ll need many days of green candles and new yearly highs in prices to get over this PTSD.

And while the recent price action does not help, we should remember the bigger picture.

For one, Bitcoin’s halving is in Q2 2024.

We have also cleared the 200-day moving average. And while we are likely to retest – and possibly fail – this level in the coming weeks or months, that is another sign that these cycles are still continuing. (For more on this, read an old post here that dives into this cyclical trend. Or listen to this snippet from this week’s Alpha Bites podcast episode where I briefly touch on it.)

I bring up this “zoom out” perspective not to say dismiss the FUD. But instead to help you look at the recent events with a clearer lens. Yes, Gary barks a lot. But behind the scenes, the pieces are coming together to allow this space to flourish.

And now that it’s clear things are in fact changing on the regulatory front, what does that mean for those who are fearful of the market, sitting on the sidelines? They will get sold digital assets again, not by us… But by the legacy institutions that will eventually profit from this industry. You don’t have to like it, it’s just the truth.

When that happens, I look forward to seeing Super Cycle theories return to my timelines and for PTSD to be a memory, not a headline. So with that, let’s remain focused on the market, innovation in the industry, and what those pieces in the background are doing on the regulatory side.

That’s what we hit on here in the weekly release of The Blend. If you have a topic you want me to touch on, just ping me on Twitter @MrBenLilly. I’m trying to be more active, and your engagement will help me share our team’s ideas more frequently.

For now, let’s get to today’s issue… starting with why the SEC’s actions aren’t the most important story from this week…

Don’t Fall for Gensler’s Dog-and-Pony Show

Gary “Shades” Gensler has a knack for distracting Crypto Twitter right as something important happens.

The Coinbase and Binance lawsuits his agency filed earlier this week were no exception.

Check out this tweet from crypto lawyer Alexander Grieve on Monday, the day of the Binance lawsuit:

https://twitter.com/AlexanderGrieve/status/1665738935081787396

Gensler likes to cause half the crypto community to have a temper tantrum so they completely miss what they need to pay attention to.

The recent actions from the SEC are merely just barks for attention.

What you should be paying attention to instead is what dropped right before Armstrong and CZ stole the show (and what Grieve alluded to in his tweet): a new legal framework for digital assets for the U.S.

It’s a draft bill from two committees in the House of Representatives. That alone is pretty significant: It takes a lot of resources to coordinate such a bill across so many staffers.

What’s more is that these two committees (the Financial Services Committee and the Agriculture Committee) likely sound familiar to some of you. That’s because the SEC tends to visit the former while the CFTC visits the latter. Meaning this bill’s scope is cross-jurisdictional.

This gives us a hint that both regulators will be involved in crypto’s legal future.

The draft also wasn’t thrown together at the end of the year… which tends to happen when lawmakers don’t plan to spend time on it.

Now, as far as what the objective of the bill is, I’ll just be lazy and copy/paste what its authors wrote:

The House Committee on Financial Services and the House Committee on Agriculture … [are] establishing a functional framework that works for both market participants and consumers. This functional framework would provide digital asset firms with regulatory certainty and fill the gap that exists between the authorities of the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC).

But in the text, there are a lot of specifics laid out. It spends time describing what constitutes a network as being decentralized; what a decentralized vesting schedule and token distribution looks like; how voting rights can’t exceed a certain percentage by the founding team. And a lot more.

This draft bill could directly address the topic clogging up your timeline – the status of the tokens deemed to be securities by Mr. “Deal With It” Gensler.

It’s no coincidence. The time is coming for the rules to be hashed out. And based on this latest attempt, the pieces are starting to come together.

I personally look forward to this as legitimate non-meme token projects can now reduce legal fee expenses, disclose things as needed, doxx themselves, and spend more time focused on shipping a product to market.

It’s the sort of major moment that can define the industry as finally being able to breathe. And hopefully, I can then avoid the looks from my friends when their favorite crime show once again depicts some criminal using cryptocurrency.

We got it, Dick Wolf, enough with the negative connotations. Don’t tread on me.

This Indicator Says Bullish… For Now

My two-time bear cycle brother from another mother, Benjamin, and I dusted off some old metrics we worked on a few years ago.

ROSI is usually what he and I get messaged about the most. I called it the Knife Catcher when we first released it, as it looked to pinpoint the bottom of major selloffs. Its accuracy drew such a big following on Twitter that all I had to do was post a picture of a flower blooming to tell people the indicator was flashing.

Another old metric we came across was the Jarvis Labs Bull-Bear Indicator.

It’s definitely not as fun a name as ROSI or Knife Catcher… But it’s impressive in and of itself. The indicator takes various moving averages and rearranges them to create a simple answer to the question, “Are we in a bull or a bear market?”

It’s handy because the answer to that question can often create a bias when trading. For those that know the saying “the trend is your friend,” you likely know having a good bias can get you out of bad trades.

Well, with that bit of background, last week we went ahead and updated the index to see how it performed over the last couple years.

It basically told us to turn bullish in July 2020 when BTC was below $10,000, and then flip our bias back to bearish on April 21, 2021, at $53,000. Pretty solid.

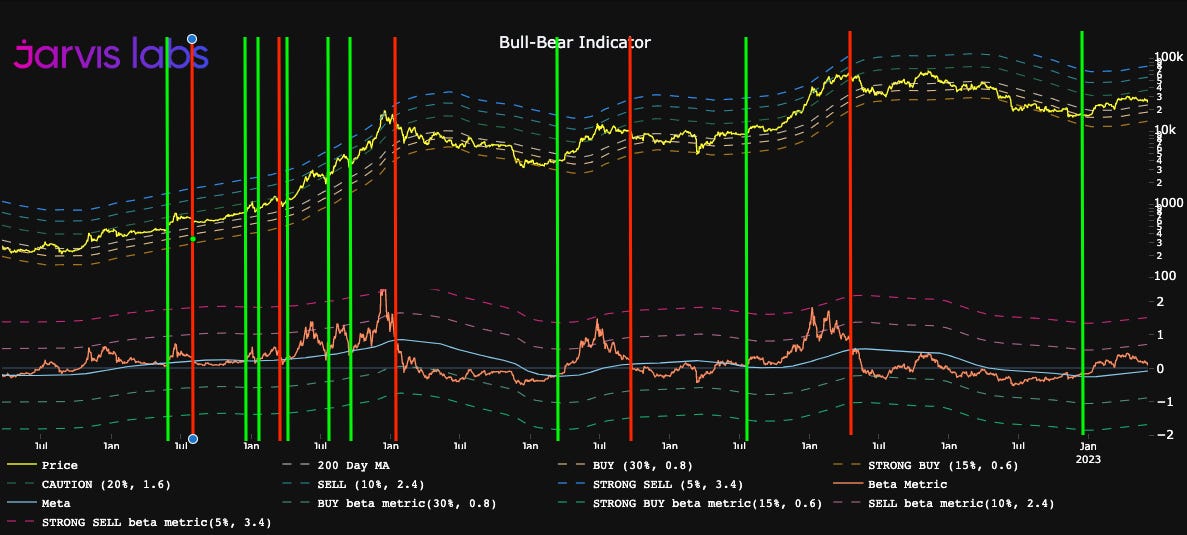

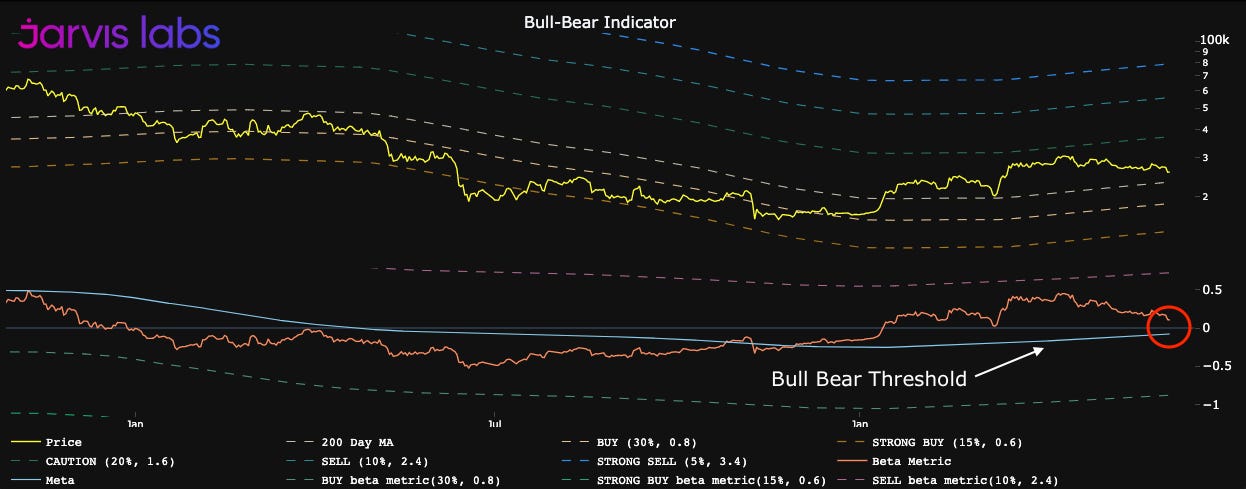

You can see it below. Basically, the solid yellow line is price. The solid orange line below is the index reading. When it’s above the solid blue line in the subplot, the reading is bullish. Below, bearish. The red circle is when the bias flipped to bearish. (Don’t get too caught up in the other lines for now.)

Again, that’s pretty good timing there. Granted, not sure how I would have felt when price went on to run up again in July. But hindsight is 20/20 here.

Moving on to 2022, the indicator flipped bullish for a few days prior to the FTX bomb… It then dipped back bearish for a short time and finally became definitively bullish in December (red circle below). It has since remained above this threshold.

For the curious among us, here is the chart going back to 2016. I dropped some lines to showcase areas of interest where the indicator flipped bullish (green lines) or bearish (red lines). I didn’t do some areas in 2016-2017 as the chart would get very busy. Hopefully, this helps show its effectiveness.

Now, if we take a look at the present day… you’ll see why we wanted to reintroduce this chart to you all now. The indicator looks ready to retest the threshold in the coming weeks.

We’ll likely come back to this chart soon.

Your Yield Isn’t What It Seems

The cost of capital is rising.

I’m not talking in terms of USD, but ETH.

The reason is simple. More and more use cases are coming to ETH.

Its most basic function allows users to stake ETH. They can also stake with other protocols that may provide additional yield for that collateral. Or a user can use the tokens as collateral for a stablecoin and earn yield in another manner. Or perhaps they want to drop it into a Uniswap pool and earn trading fees.

There are lots of possibilities.

As a result, any protocol or application looking to attract ETH to its platform will need to make it more attractive for users. How they do this, I’ll leave it up to them, as the point I want to make today is on the user’s side.

To illustrate my point, I wanted to look up how much ETH was staked to the Beacon Chain. The numbers I found ranged from 15.94% to 20.36%. That’s a difference of 5.3 million ETH or about $10 billion.

Clearly, there’s something more going on here. After digging around a bit, I figured out some of the reasons. Etherscan, for instance, lists a Beacon Chain deposit contract that shows more than 20% of ETH staked. Chad Hildobby from Dragonfly references this address.

Then there’s Ethereum.org… It references a different explorer showing 19.3 million ETH staked, which falls in between that range mentioned before.

And finally, Staking Rewards is coming in on the lower end… although I’m not sure how they factored it.

What this tells me is there is a more important figure that not many people know for certain other than those staking ETH themselves: APY, or annual percentage yield.

In other words, how much ETH are you making on your ETH?

It seems like a pretty basic question, but the answers I found were across the board. On Etherscan, I was calculating 2.89%. Ethereum.org listed 5%, and Staking Rewards showed 6.5%.

Then, there are liquid staking derivatives like stETH, cbETH, rETH, and many others. Chad 0xngmi and a few others do a good job of calculating their real yields, but they’re still tough to figure. Are the listed yields in USD terms or native tokens? Is the 30-day yield a moving average, a true yield, or extrapolated off the last 24 hours?

This is why I personally find it difficult to seek out yield. My expectations are never met when I give it a go.

Which leads me to the bigger issue at hand…

All these amazing new projects need to do a better job at tracking yield.

The anons over at the XC studio are beginning to cover these topics weekly on the Alpha Bites podcast.

Two weeks ago, Ray hit on Tokemak (you can listen to it here). Kodi The Kid has been covering projects like Lybra Finance since day one, and even ran through a series of projects such as unshETH, Prisma, Asymmetrix, and Swell on this week’s episode.

These projects are awesome. And they’re igniting my excitement about DeFi. But the question of what the yield actually is keeps coming back to the top of my mind.

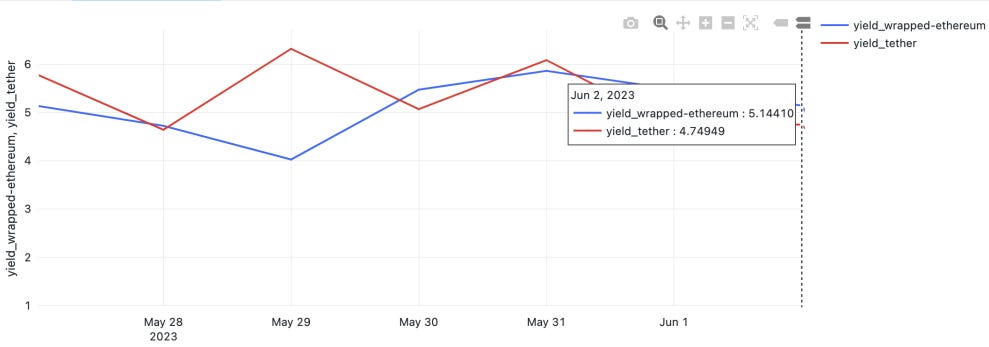

To show you what I mean… I asked Kodi to check the yield on an ETH/USDT Uniswap v2 pool.

For clarity, this is measuring the yield a liquidity provider would earn by depositing tokens into this swap pool. It’s not as stable as ETH staking yields, but it’s another productive use for ETH that we should look at when trying to maximize our yield.

He went ahead and kept it in ETH terms for this one.

He did the same in USDT terms… And then dropped this chart to compare the two forms of yield (blue line for yield in ETH, red line for USDT).

Well, look at that. 5.14%. That suggests we can earn more on our ETH being an LP than what Etherscan and Ethereum.org are saying I’ll earn by staking my ETH on Ethereum.

Sure, it’s two different forms of yield, but it’s yield nonetheless. And this is a pool I’d consider on the more trustworthy end of crypto. Further, this yield is low, historically speaking.

I know issues of impermanent loss and transferring the USDT earned into ETH come into the picture here, but if that’s your worry, then look at a pool like stETH to wETH. The issue again is, what does that yield mean? Where’s the data from? How’s the number calculated?

There is a renewed need for yield data, especially as ETH’s scarcity starts to climb. And if these yields are suggesting anything to me… I think we are approaching what looks to be a good amount of ETH staked. We will surely overshoot this figure until the market realizes it can get better yield elsewhere.

But for that to happen, we need better tooling. More on this front in the coming weeks.

Alright, that’s enough out of me today. I really hoped you enjoyed this issue of The Blend. Your favorite janitor and I are hopping on a call with our friends at Paradigm, and we’re looking forward to dropping some options alpha on you next week, so stay tuned.

And in case you missed it… Be sure to listen to our Alpha Bites podcast episode from earlier this week. JJ went ahead and started to divulge some of the early conversations we had with Paradigm.

In that episode, we also dropped a market update, covered some ETH LSD projects, and mentioned what we would say to Gary “Shades” Gensler if we were waiting in line at Starbucks for coffee.

Enjoy your weekend.

Your Pulse on Crypto,

Ben Lilly

Disclaimer: We are not financial advisors. The content on this website and our YouTube videos are for educational purposes only and merely cite our own personal opinions. In order to make the best financial decision that suits your own needs, you must conduct your own research and seek the advice of a licensed financial advisor if necessary. Know that all investments involve some form of risk and there is no guarantee that you will be successful in making, saving, or investing money; nor is there any guarantee that you won't experience any loss when investing. Always remember to make smart decisions and do your own research.

Are ROSI alerts still operational for Oculus? Haven't seen them in a long while.

Also, I've been under impression that you've been sharing much more alpha in this newsletter and twitter rather than in Oculus. Is there any reason for this change?

Why I cant see the Bull Bear Indicator on Tara?