The Next Phase Of The Macro Cycle

Market Update: FOMC update and crypto indecision

Last week, the FED released some notes on Silicon Valley Bank’s failure. The document listed four main reasons why the bank collapsed.

I’ll spare you the trouble of running through the document by saying none of these four reasons had anything to do with duration risk.

To be more specific, nothing was mentioned on how the FED hiking rates from 0% to 5% in a little over a year may have put the bank in a bad position.

Then comes Monday and we have First Republic going down for a similar reason. That’s some pretty strong irony there.

Fast forward to JPow’s recent press conference two days ago, and the FED continues its bold face lying.

During the recent press conference the FED stated the economy is getting stronger, it has very low unemployment, and a resilient banking sector.

We know they are lying,

They know they are lying,

We know they know we know they are lying,

But they are still lying

-Aleksandr Isayevich Solzhenitsyn-

Now, despite the unspoken game being played, the fact remains…

The market thinks the FED needs to ease up.

Otherwise, a recession looms.

The markets are quite literally screaming this right now. Oil is falling, economic growth projections are being lowered, and Treasury yields are inching lower.

At some point, the FED needs to step up and lay out a plan to avoid recession. In reality, the plan does not need to be all that great. The FED doesn’t even have to come clean. I think the lying game Aleksandr describes best in that quote above would allow things to progress.

And as I’ll show you in a moment, the conditions are set for this zombie- like march higher to unfold.

After hitting on why that’s the case, we can talk about where the crypto market stands today to help you navigate the weekend ahead.

Let’s get to it on this happy Friday…

The Risk Was Known

Duration risk is becoming a bank assassin.

In one way, it may seem like a surprise. But in truth, these rate changes have resulted in major movements in yield markets. The iShares 20+ YearTreasury Bond ETF (TLT), for instance, dropped as much as 40% since December 2021 - when rates were poised to rise.

Remember, this is a security that is deemed to be very low-risk. It’s a financial asset the Federal Reserve encourages holding… And it’s getting walloped like a shitcoin as rates rise.

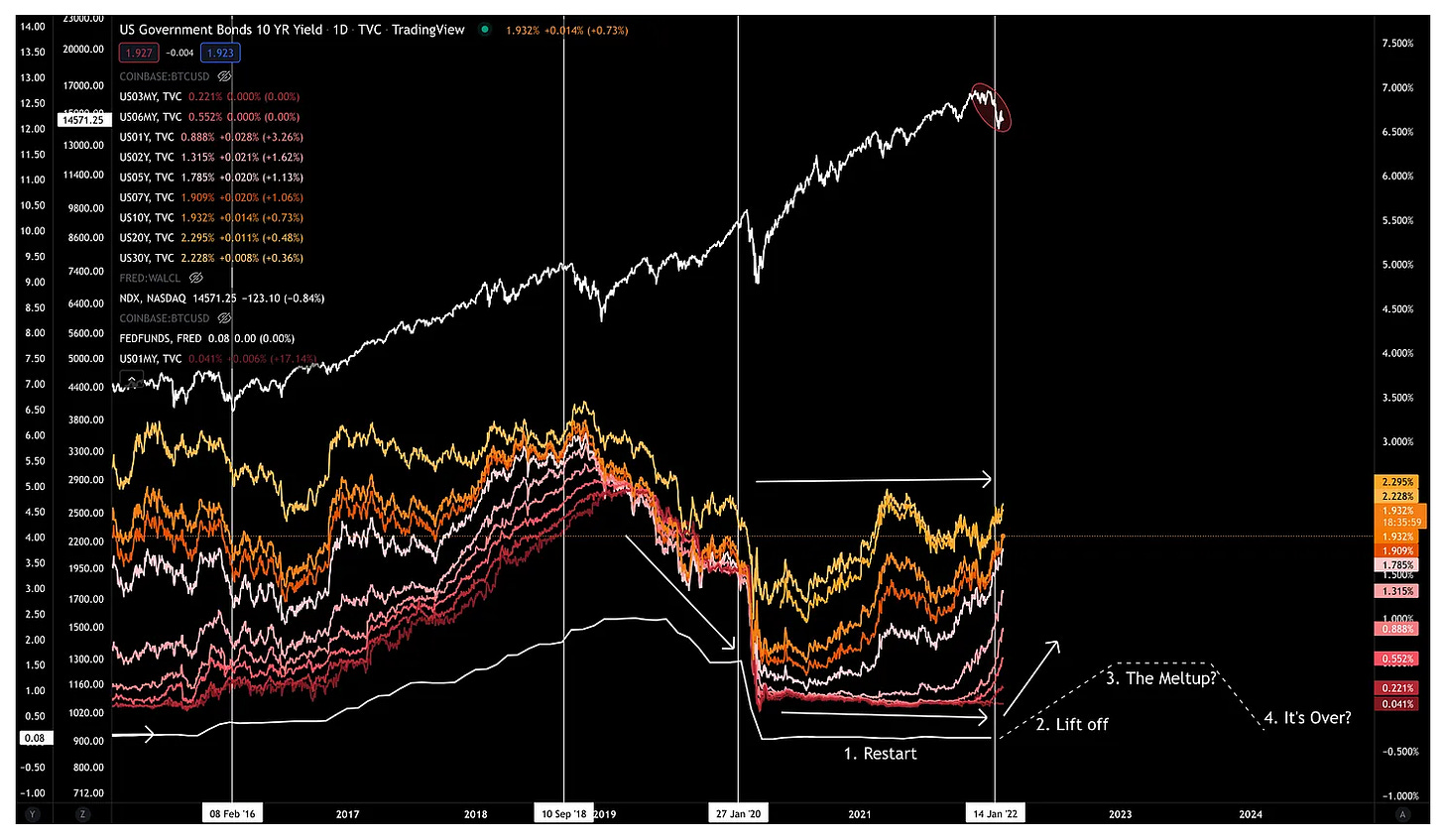

To really illustrate how the FED put banks between a rock and a hard place, below is a chart that shows yields for U.S. Treasuries since the FED began to really set in motion its plan for rate increases back in late 2021. As you can see, yields rose very quickly throughout 2022.

If a bank was not prepared for the speed of this move, it would eventually become a victim of the change. And since the FED did not give clues as to the speed of the hikes, banks are now getting blown up like participants of Squid Games.

The issue here is that bank capital is tied up in these bonds until the end of the bonds’ duration. Which means if your customers demand their bank deposits back , the bank needs to sell the bond back into the market to meet their demand.

This presents a problem. If you paid $99 for a bond that yields 1%, and rates are now rising toward 5%... that bond is no longer worth as much.The bank now needs to sell that bond at a discount and take a loss.

To make matters worse, it’s not like JPow and his FED hitmen didn’t know this was a risk. Back during the Jackson Hole symposium, these bankers had a literal panel discussion on how time-deposit issues always arise as market conditions tighten. This was not an unknown-unknown side effect.

And to see the FED not admitting it makes me worried. It alludes to the fact the pain they are inflicting on the market is intentional.

This pain is what the market is now thinking the FED will need to ease up on.

We can see this in the probabilities chart below. It’s a table of what the market thinks the FED will set rates at in the future. Notice how the highest probabilities – shown in blue squares – slide down and to the left.

It means the market thinks the FED will be cutting about 25 basis points (bps) each FOMC meeting starting in July or September of this year.

For those that are taking notes (aka me), we can look back on what this table looked like in the first few days of January of this year. What we see is the market was pretty accurate. So we shouldn’t dismiss this.

If anything, this is the market signaling what we’ve hit on over 15 months ago: that rates will plateau for the next five months after hitting a peak.

Entering Phase 3

Here is a chart from the February 2022 article in the link I just dropped showing rates tend to rise in what we call “Phase 2.” They then plateau. Usually this happens because of an “Oh shit” moment.

That moment happens to be the banking issues unfolding around us right now. That’s enough to warrant rates not rising anymore.

But the issue here is that rates never come down slowly like we see in the table above. Which is why I brought back the chart below.

Here was 2007’s attempt of dropping rates slowly. The equity markets ripped higher as conditions loosened in the latter part of phase 3. Then, the FED changed their plan by dropping rates to zero. Market prices then followed suit.

Then back in mid-2019, the FED also tried to slowly cut rates. The market responded by marching higher in late-2019. Then things changed, rates were chopped to zero, and the market nuked.

This pattern is important to note.

If we go back to those old Macro Cycles essays, we can see this playbook going back several cycles. And here we see it is unfolding today. And while we are now transitioning from Phase 2 to Phase 3… We need to keep an eye on the transition from Phase 3 to Phase 4.

The market and the FED think the FED can cut rates slowly. But history proves otherwise.

If the speed at which the FED raised rates was a surprise – as it was to me – then we should realize the rate of change here could accelerate faster than expected. Do we have five months of plateaued rates? If the FED starts to cut rates, do we really have 3-6 months of euphoric conditions like history suggests?

I’m trying to not overthink this one and instead let history be a guide.

For now, if history were to repeat itself, markets will be positioned to continue marching higher for 2023 as long as the FED can apply a few rolls of duct tape so we can continue to take part in their lies.

It also means crypto should be well-positioned for this next phase.

Will it begin this weekend? Let’s take a quick look at what the crypto market shows…

It’s Lame

In our last update, we highlighted how the market structure was set up for JPow to act as a catalyst for prices to sweep lower.

He fooled us… Well, in all likelihood it was probably just me. Us mid-curve analysts tend to overthink.

And while the sweep lower didn’t happen post-FOMC, it doesn’t mean it’s out of the question here.

We mentioned during the last market update that cumulative volume delta (CVD) for spot buyers was not looking great. Since then, it’s only gotten worse. It is now forming lower highs and lower lows over the last few days.

And since CVD for futures is really keeping price elevated right now, it won’t take much for prices to sweep lower.

If it happens, here’s what the liquidation map looks like. This map can help us better understand what levels prices might rise or fall to as they “hunt liquidity.”

For now, the market structure is still relatively indecisive.

There is not much change in open interest for futures. CVD spot is not great. And there isn’t great accumulation taking place in BTC nor ETH.

Here is an ETH divergence chart suggesting whales are not interested yet. We only see blue and green dots recently when we want to see red and orange.

And there hasn’t been any follow up from the New York time zone sessions. We wrote about how important trends happening in this timezone are. But we haven’t seen much from this segment since January 12, which started much of the price action in Q1. This might be a topic we come back to soon.

For now, this update is more about saying we need to see more before we can get too excited.

No need to read between the lines like we do with the FED.

Your Pulse on Crypto,

The Bens