The Curve Crisis Could’ve Been Avoided

Filtered: July 31 – August 4

It’s easy to forget that DeFi is still young, and it has some hard lessons to learn as it continues to grow and mature.

But some lessons are more expensive than others. And this week’s came with a big price tag.

For those who’ve been living under a rock, Curve, the second-largest decentralized exchange, got hit by a hack on Sunday. Thanks to a bug in the programming language Vyper, hackers were able to make off with about $70 million from several Curve pools (the actual number varies since some white hat hackers recovered some of the funds and gave them back).

But the fallout from this exploit goes beyond just Curve. Hundreds of other contracts use the compromised versions of Vyper. And a number of other DeFi protocols accept CRV as collateral, which means liquidation cascades have become more likely as CRV’s price tanks.

The biggest risk, now somewhat mitigated, comes from Curve founder and CEO Michael Egorov himself, who has around $100 million in loans backed by 427.5 million CRV.

That’s about 47% of the entire CRV circulating supply – and you could argue it shows decentralized finance isn’t quite living up to its name.

Naturally, this was one of the big topics we discussed on this week’s episode of the Alpha Bites podcast. And our resident token design analyst, Kodi, had some thoughts on how we got to this point:

This is a fault of the lending protocols. They didn't consider the risk of someone using as much of the circulating supply when taking out loans. They should have set gaps for that Curve. They should have taken into consideration the liquidity that they might have when they have to liquidate the loan, which they didn't…

I don't think they were asleep at the wheel. Maybe they just trusted the Curve guys to not be malicious... I don't know if it's like, “Oh, yeah, we know this guy, like we might let him do this loan even though we probably shouldn't.” Gauntlet and Chaos Labs, which are two risk shops, recommended not to allow this and basically to put caps on the amount of CRV that Michael Egorov could borrow. And these DeFi protocols just didn't listen. So, now we're faced with this.

DeFi has taken its fair share of lumps in this bear market, and this one hurt more than most. But the industry will be fine. This is just part of the growing pains that are necessary to go through as we discover its true potential.

If you’re worried about this event’s impact on the market, I encourage you to zoom out and try to focus more on the long-term outlook going forward to get a better sense of where we’re at. And that’s why I wanted to bring in our reliable janitor, J.J., who’s been keeping a close eye on whale activity lately.

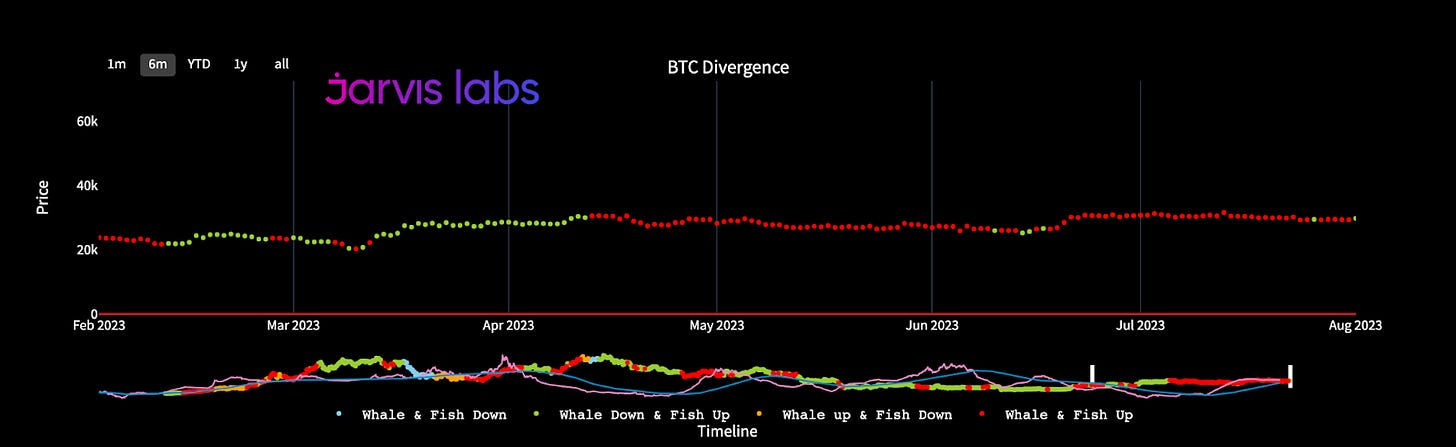

According to him, whales (wallets with over 10,000 BTC) have been accumulating Bitcoin since April, even buying above $30,000. You can see that in the chart below. For our purposes, focus on the red dots, which indicate whales buying.

With sentiment still low, it begs the question of what the smart money is anticipating. J.J. has an idea:

There's been very little spot volume in markets basically all year in Bitcoin, especially since March. So the fact that there's this much supply concentrated in whale hands means that the market is very easy for them to manipulate. And kind of the way I look at in my mind (maybe I'm a bit conspiratorial) is that they're waiting for one side of the market to get completely offside on perps and then just blow it out with their spot holdings.

So if you kind of keep pricing this boring range, and everybody steps in on purpose either long or short, [it’s] very easy to manipulate the price against them with their spot holdings. And you either sell into it or buy into it and cause a squeeze one way or the other, then you buy or sell the liquidation points.

And I think that's coming. Ben's been pointing to that spot CVD chart multiple times. So eventually, we will see that. And I expect that's when we'll see these holdings change one way or the other, once we get kind of a violent move in either direction there.

But DeFi wasn’t the only one that took some hits this week. We saw ratings agency Fitch downgraded U.S. credit from AAA to AA+.

This move came as a surprise to some, leading to speculation on how it could affect the economy. But as I told our Alpha Bites host Marconi on Wednesday, it actually might benefit the Federal Reserve in its quest to achieve a soft landing:

When it comes to that question on this downgrade, I think it actually works in terms of the yield curve in its favor. Because if [the government is] going to have to issue some debt, and they want to keep those yields relatively high, they need to attract some buyers. So rising yields will help normalize that yield curve even further. So while the headline news is pretty terrible in one sense, we should consider the fact that this might actually play out in their favor.

It’s good to remember this isn’t the first downgrade event. The U.S. has been able to “earn” its pristine collateral ranking back before. And while it’s not ideal considering high rates and debts, this is good for the yield curve… and maybe that’s it. (You can listen to the full episode on YouTube here, or on Apple Podcasts or Spotify.

The team and I also explored the BALD rug pull, the IRS’ ruling on staking income, and even, uh, what aliens have to do with crypto. And we introduced a new format that we think our listeners will appreciate – still waving my fist at the producers on this.)

While I was optimistic on what the downgrade means for the U.S….looking further into the future, I’m not as upbeat about the dollar’s chances.

And that’s because blockchain technology is opening up an opportunity to knock the dollar off its perch as the reserve currency.

I’m so consumed by this idea, that I used this week’s Blend in Espresso to break it down piece by piece. Essentially, Russia’s invasion of Ukraine has triggered what could be the next big monetary shift:

The severe sanctions levied against Russia denied it access to a significant portion of its foreign exchange reserves, including its supply of dollars. This incident set a precedent: If you go against U.S. policy, then your assets can be confiscated. It was a moment where a global hegemony abused its power to wage financial warfare.

That marked the pivot to v3 of Bretton Woods.

Countries now look at U.S. dollars in their bank accounts and see a new degree of risk attached to them.

...

This is why we now are beginning to see trade agreements where the U.S. dollar is no longer involved. It’s a shift that will take significant time to usher in, mostly because of the sluggish nature of government and old financial infrastructure.

But what looks to be most interesting here is the fact that the technological infrastructure for trade is about to get a massive upgrade….

That “upgrade” is coming because certain financial authorities are already using their own version of automated market makers (AMMs). You can read the full story right here.

As always, you can find links to all the content we published this week below – along with our Tweet of the Week.

That’s all from me this week. Enjoy the weekend.

Your Pulse on Crypto,

Ben Lilly

Can you restate “they're waiting for one side of the market to get completely offside on perps and then just blow it out with their spot holdings” for the non-finance person, please?