Powell’s Soft Landing Can’t Avoid the Turbulence Ahead

Macro Update: SVB, Inflation, and the Fed's Risky Flight Plan

“OK, which runway would you like at Teterboro [Airport]?”

“We can’t do it. We’re gonna be in the Hudson.”

On the afternoon of January 15, 2009, Manhattanites were treated to a frightening spectacle.

US Airways 1549, a flight scheduled for Charlotte, North Carolina, had struck a flock of geese right after taking off from LaGuardia Airport in New York.

Both of the plane’s engines shut down. The pilot, Chesley “Sully” Sullenberger, asked to make an emergency landing back at LaGuardia, but then he realized it was too far. He then asked to land at nearby Teterboro Airport in New Jersey.

But it turned out that even Teterboro was too far.

So Sully decided to land the plane in the Hudson River.

Landing in the Hudson was a brave but risky decision.

The rest is history.

Flight 1549 successfully landed and floated on the Hudson River. Miraculously, the plane stayed intact and there were no fatalities (although there were a couple serious injuries).

Captain Sully managed to salvage a potential disaster and turn it into a fairy tale ending. Federal Reserve Chairman Jerome Powell wants to be like Sully.

Captain Powell wants to combat inflation by raising interest rates and tightening the money supply while avoiding sending the economy into a tailspin. In other words, he wants to be able to land the jumbo jet of the U.S. economy safely without any casualties or irreparable damage to the plane.

This is the fabled “soft landing.”

Will he succeed?

Strap yourself in and let’s go over the Federal Reserve’s (FED) plan for a soft landing.

The Flight Plan

The FED Chairman is in a bind.

Even though Powell has not confirmed it, the worst-kept secret in the market is that he is looking for a soft landing for the troubled economy.

And to achieve that, it requires a balancing act to avoid triggering a financial crisis.

First, the FED has to reduce consumer spending in order to bring inflation to a manageable level. It does this via hiking interest rates.

With the cost of borrowing money now more expensive and yields more attractive, people begin to cut back their spending.

Second, the FED needs to shrink the money supply via quantitative tightening (QT). This will drain liquidity from the market and also cause interest rates to rise.

Both these methods will weaken the stock and housing markets. With asset prices lower, spending will slow down. This in turn translates to weaker demand for goods and services.

The wanton thinking here is to lower inflation via demand reduction, with the two-pronged approach of raising interest rates and reducing the FED’s balance sheet via QT.

In this ideal scenario, the inflation rate drops, and interest rates go up. When both meet halfway, inflation will be under control.

However, the FED doesn’t want to raise the funding rate sky-high to like it did back in the late 1970s and early ’80s. The FED fund rate went up to 15.8% back in 1981 (compared to 4.75% today). This would crash the economy and make the U.S. government’s massive debt even more costly.

But there’s already signs of turbulence ahead…

Turbulence #1: What Recession?

For quite a while now, almost every restaurant in the city from the posh establishment to the local family eatery is fully booked weeks in advance if not months. The bars are always packed. The shopping malls are always crowded with shoppers walking around with shopping bags.

I certainly cannot tell that a recession seems imminent, or that people are tightening their belts. Then, the recent Consumer Price Index (CPI) reading for January 2023 provided the proof in the pudding.

CPI went up last month to 6.4%, coming in hotter than what the public and the FED expected.

This certainly does not bode well for Chairman Powell and his fellow FED bank governors. They are looking for consumer spending to fall so inflationary pressure can disappear.

But households are still wealthy. And they’re standing in the way of the FED’s grand plan.

Below are three charts that all point to the fact that the household balance sheet in the U.S. is still quite strong.

The first chart is the value of total financial assets held by households and nonprofit organizations. This does not include equity in real estate holdings or the value of durable goods.

The latest data shows that the value of household financial assets was still increasing at the end of 2022.

But given the downturn in real estate value, the actual net worth of households must be trending down now.

Surprisingly, the answer is no.

In defiance of all the headlines of real estate market downturns, owners’ equity in real estate is actually plateauing as of the end of 2022.

This did not really do much to affect the trajectory of total household net worth, as seen below.

The total net worth is calculated by subtracting the total liabilities (including all debts) of a household from its total assets, including cash, investments, and real estate holdings.

So, it is not surprising that, just like the total financial assets chart, household net worth was actually increasing at the end of 2022.

Despite all the aggressive rate hikes and QT for the FED, consumers and the market kept shaking it off and continuing to spend.

But it’s not just the affluent population that is giving the FED a headache. The less affluent are also causing problems for the FED.

Turbulence #2: Buy Now, Pay…Never?

While a strong household balance sheet is propping up inflation and preventing it from falling, burgeoning consumer debt is creating a different headache for the FED.

As inflation permeates every facet of daily life, more and more people are resorting to using credit cards, revolving debt vehicles, buy-now-pay-later (BNPL) platforms, and payday advance services to make ends meet.

In fact, total consumer debt in the U.S. hit an all-time high of $16.9 trillion as of the end of 2022. It is up year-over-year (YoY) by $1.3 trillion and shows no sign of slowing down.

Not to be outdone, U.S. credit card debt also hit an all-time high (contributing to that $16.9 trillion total debt). It reached $930.6 billion at the end of 2022, a YoY jump of more than 18.5%.

The average balance on credit cards rose to $5,805 in 2022, which is the highest since 2019. While this might seem to be a trivial figure, with rising interest rates, it becomes much more difficult to pay off this debt.

And as the FED raises its interest rate, the delinquency rate on all types of loans is starting to tick up.

Credit card delinquencies have reached 4%. Car loan delinquencies are now at 2.2%. The percentage of mortgage loans that have been delinquent for 90 days or more recently hit 0.57%.

These stats are low compared to historical figures. But these numbers are lagging indicators. The true effects won't be felt until months afterwards.

We can expect these numbers to hike up in the next 12-18 months.

As the FED raises the funding rate to fight inflation, it makes financing more difficult for average citizens to meet their debt obligations while trying to manage high costs stemming from inflation.

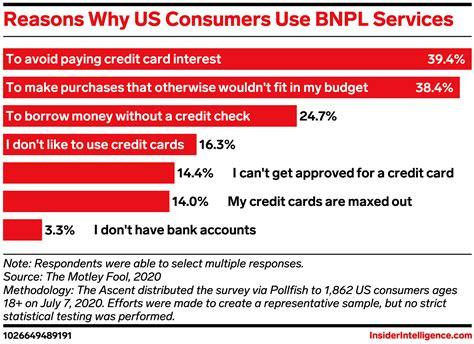

Hence, we are seeing an increase in the demand and popularity of BNPL platforms.

The higher the FED pushes the rate, the more consumer debts will grow. It will be more and more difficult for individuals and households to pay their debts.

If we start to see significant job cuts, the issue exacerbates. Banks and other financial institutions will be on the hook for these assets and will have to write them off. A crisis of this kind will certainly make it difficult for the FED to achieve a soft landing.

More importantly, raising interest rates too aggressively brings on another type of turbulence.

Turbulence #3: Could Another SVB Happen?

Namely, the turbulence we just witnessed with Silicon Valley Bank (SVB).

As you know, SVB was a niche bank that served venture capital (VC) funds and start-ups in Silicon Valley. After fears of insolvency led to a bank run, the FDIC took over SVB to ensure it could pay back its depositors.

The chaos and panic created by the media, along with the lack of diversity in its customers, might’ve been the last straw to break the back of SVB. The pandemonium created by social media generated massive hysteria among SVB’s depositors to rush to get their money out.

But what laid the groundwork for this collapse was the FED’s interest rate hiking.

As interest rates rose, the value of SVB’s fixed-income portfolio took a hit, because its loans – mostly older Treasurys and mortgage-backed securities – were paying lower rates. As SVB tried to plug this hole, word got out, and that led to the bank run that finished it off.

This type of scenario will certainly pose an interest rate risk to other banks – especially because banks can’t hedge this risk once their securities are marked to be held-to-maturity (HTM).

That said, after the Great Financial Crisis in 2008-2009, reforms made the banking industry quite robust and equipped it with ample liquidity. Although SVB is a cause of concern, we will reserve our judgment on whether it’s a sign of things to come. The banking industry is in much better shape to handle these conditions compared to 2008.

Should the SVB insolvency disappoint the FED pivot zealots, there is another cause of concern with aggressive rate hikes: The corporate credit market.

We will provide a comprehensive update on this market and its risks in the next few weeks.

Preparing to Land

The interest rate decision from the FED tomorrow will be a key moment.

A pivotal (no pun intended) moment.

It will be the true test of mettle for Jerome Powell. It will test the will and the dedication of the grandest of all the central banks in the world. And it will answer the question: How determined is the FED in this inflation crusade?

Should the FED pause the rate hike, expect the market to erupt in cheers with all risk-on asset values shooting up like a volcano.

If the FED continues to hike interest rates, then it’s a message to the market: Don’t fight us. We’re serious about fighting inflation come hell or high water.

As Captain Powell drops the landing gear and prepares to guide the U.S. economy to the runway, which one will it be?

A soft landing, or a hard landing?

Even before the Silicon Valley Bank crisis, the odds of a soft landing did not look too promising. Now, they look worse, and the FED’s job just got incrementally more difficult.

Be prepared to grab the life vest.

Yours truly,

TD