Tomorrow provides us with another price catalyst.

One that’s greasing up the wheels for the next push higher.

You might remember last month when we explained how the options expiration date at the end of March was going to be a bullish event. Here’s the Chart of the Week back on March 22nd if you missed it.

After the expiration event where billions of options contracts ended, price crept up over 25% in the ensuing weeks.

This time it’s likely to unfold in a similar manner. The only difference is this month’s expiration dovetails into the Grayscale Effect “Do or Die” timeframe.

If the Grayscale Effects holds, then the two are pairing up to be quite powerful in the market.

Since we recently hit on the Grayscale Effect and how the next couple of months might create incredibly buying pressure if it holds, let’s look at the end of month options expiration.

What’s important to know is expiration dates for options can be broken down into quarterly, monthly, weekly, and daily. And it’s in that order that interest and volume tend to unfold. Meaning the quarterly options have a lot more activity than daily options.

Friday is a monthly option.

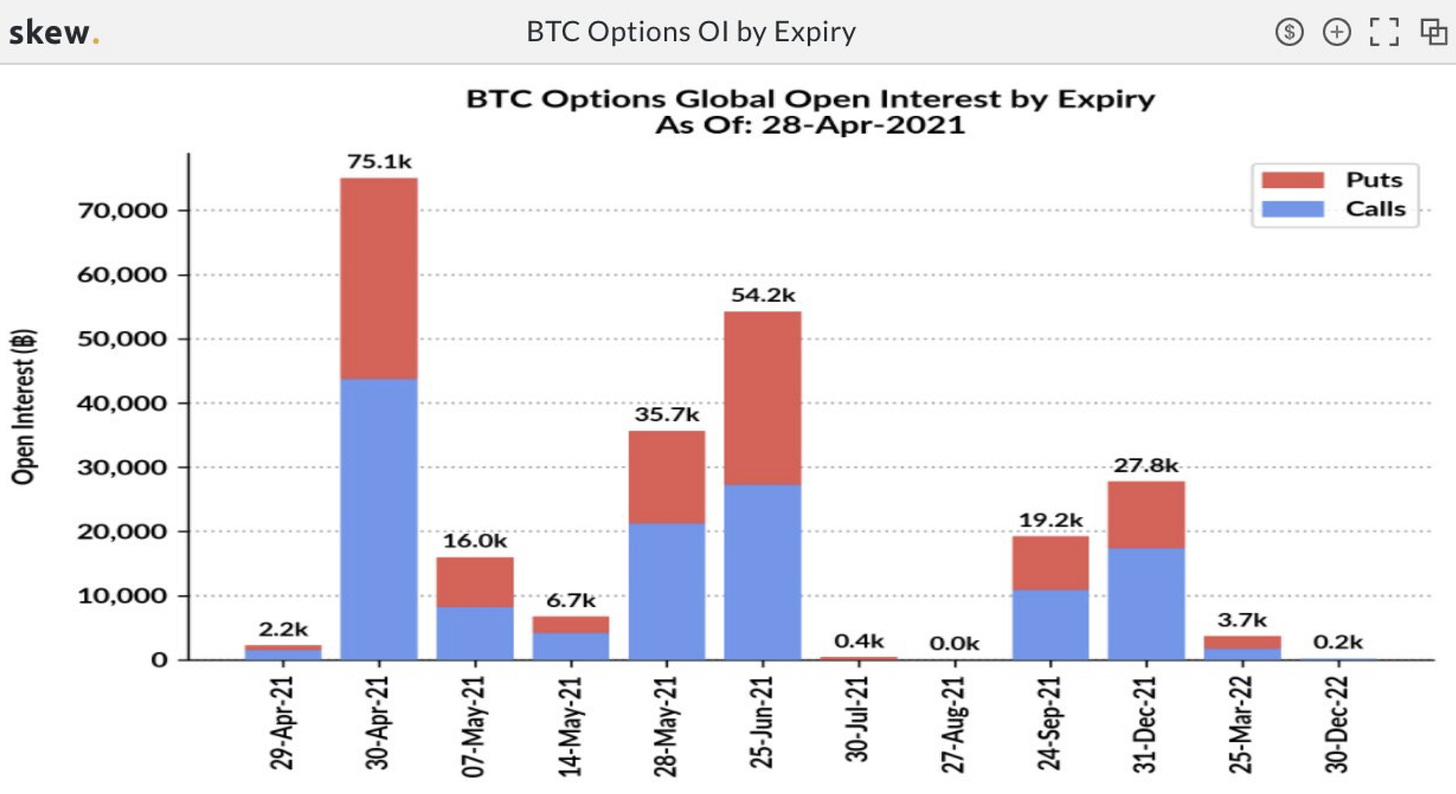

Currently about 75,100 of open contracts are set to expire.

This comes to nearly $4 billion.

Last month, which was a quarterly, saw about $5 billion roll off.

While the amount is not as high, it’s still significant.

Now, one of the reasons why the options market post expiration impacts price is how capital moves after the expiration.

Once the expiration date passes, two things tend to happen.

The first, new positions are opened up thanks to capital being unlocked for future use.

Second, old positions are closed.

I’m not sure about what will happen after tomorrow in terms of the first one…

But with the second one… Market makers are unrolling their hedged positions in the futures market.

You can see this by looking at Deribit’s open interest in the futures market. It takes a noticeable drop on monthly expiration dates. I highlighted last month so you can see the drop.

This drop may suggest short positions were being closed around that time.

In terms of this time around…

I don’t currently have the data for how gamma looked in prior expirations, but the current state of gamma is significantly negative right now.

Recall, negative gamma is like kinetic energy. As price moves, market makers hedge in the same direction. This creates more volatility. And it’s the position we’re in today.

The fact we’re in a highly volatile moment regarding options means the ‘unwinding’ of these futures could also be volatile.

So one thing I’ll be watching for is the open interest in the futures market for Deribit. I want to see how significant the drop off is and how price is impacted when this takes place

The overall volume will likely be small, but its impact might ripple through the market in the next couple days.

Be sure to watch the change as well.

In terms of things might look after expiration, price increased 17% on average from the day prior to the monthly expiration to four days after.

If this trend continues… and it’s strong enough to where we overcome the on-chain resistance at $55-57k we discussed yesterday…

Then we will be heading into next week just as the potential Grayscale Effect tranche that could really set the market on fire begins.

Pairing this up with the lack of BTC and ETH on exchanges, the heating up of institutional demand, inflationary forces, and other bullish reasons…

We get the potential for spontaneous market synchronization… for weeks.

Exciting times.

You Pulse on Crypto,

B

P.S. - Benjamin is still fighting. Fever is still high. He’s now eleven days into having a high fever, pray his fever breaks soon.

Great analysis as always. Hope to hear good news on Benjamin over the next few days.

Great analysis and wishing Benjamin well. I hope he flips resistance into support soon, and starts to trend up!

Also glad to see the correction from “Exiting” to “Exciting” LOL. Nearly fell out of my chair. I started re-reading the email but then decide to see if it was corrected on Substack. Phew!