I re-wrote my intro for this issue four times.

One was a typical and rather cliche personal story where I learned a valuable life lesson. Another about how tokens are evolving to true money within their respective economies. And another on how 3% each month makes you an all-star in crypto.

Needless to say, I deleted them all. I’m not sure how to frame the topic to help make it more digestable to readers, and as I sit here and wear out my delete key, the topic keeps evolving.

So instead of trying to be elegant about it all, I’m going to just fumble around and try to unpack what is still a rather opaque market, one that is becoming one of the biggest catalyst for Ethereum in 2024 outside of a potential ETH ETF approval. In getting this essay and these thoughts out, I hope to follow up on the topic as it evolves.

And to also show new opportunities as they arise.

To introduce it, let me quickly just say, the bond market and money market in traditional finance is $57 Trillion in size. That figure is only for the U.S.

Globally this figure swells up way past $100 Trillion.

But if we stick to the U.S. for a moment, this becomes impressive in size when we consider the total money supply as measured by M2 is just north of $20 Trillion.

I use these figures to hit on how massive rate markets are to an economy.

And the flow of this money matters.

Rates rise from the Federal Reserve, the borrowing for corporations rise in turn. As this movement happens and a large enough spread shows up in a corner of the market as we saw recently with overnight borrowing, billions upon billions race to close the spread.

Money markets, rates, and yields in many way resemble water. Just like gravity will find any leaks or cracks, and flows to the shallowest points… Money in this market will flow to the best risk-adjusted opportunity.

And with a protocol starting to garner outsized interest, I see the yield and money market about to further Ethereum’s inelastic attribute even further - some prefer the phrase “supply shock” here, but that is more about a sudden change in supply. I’m referring here to a slow and constant shift to the characteristic of a supply.

I’m an economist, this is how I talk. This is who I am…

This inelastic attribute happens where the overall percent of a token’s total supply changes its usage from lower form (sitting in a wallet) to a higher form (locked in a smart contract earning interest) increases.

For regular readers of Espresso, this would be the ratio of M2 : M0 increasing.

For the Tradfis out there, this would be lots of checking account money flowing into long duration instruments, which reduces the velocity of money.

This dynamic will send the value of ETH much higher when demand kicks in.

But for today, I’d like to hit on what is causing this shift in supply.

So to give a little structure for today’s write up, I’ll first go over why I’m long ETH yield. Then how I expressed this trade. That’s the first section.

In the second section I’ll get into a new rate market that is bubbling up. One that will enable more nuanced expression of this trade from part one, and how it is likely to evolve in the years to come in to resemble what we see with the traditional bond market / Moody’s rating system.

I’ll also show you where to find 38.38% yield on your ETH if you stick around.

You game?

Then carry on.

Part One: Longing ETH Yield

I believe the yield earned by each unit of ETH staked to Ethereum will grow in the coming two years.

To breakdown how I formed this prediction, let’s figure out how yield is determined.

The first factor is how many validators exist on the network. We can think of this like “how big is the pie”. Meaning how many validators must split network rewards and additional fees earned with the rest of the validators on the network.

As more validators come online, the yield - all else equal - goes down. Here are the number of validators over time.

Rising, fast. I don’t even see a slowdown in sight.

Now, how big of a factor is this?

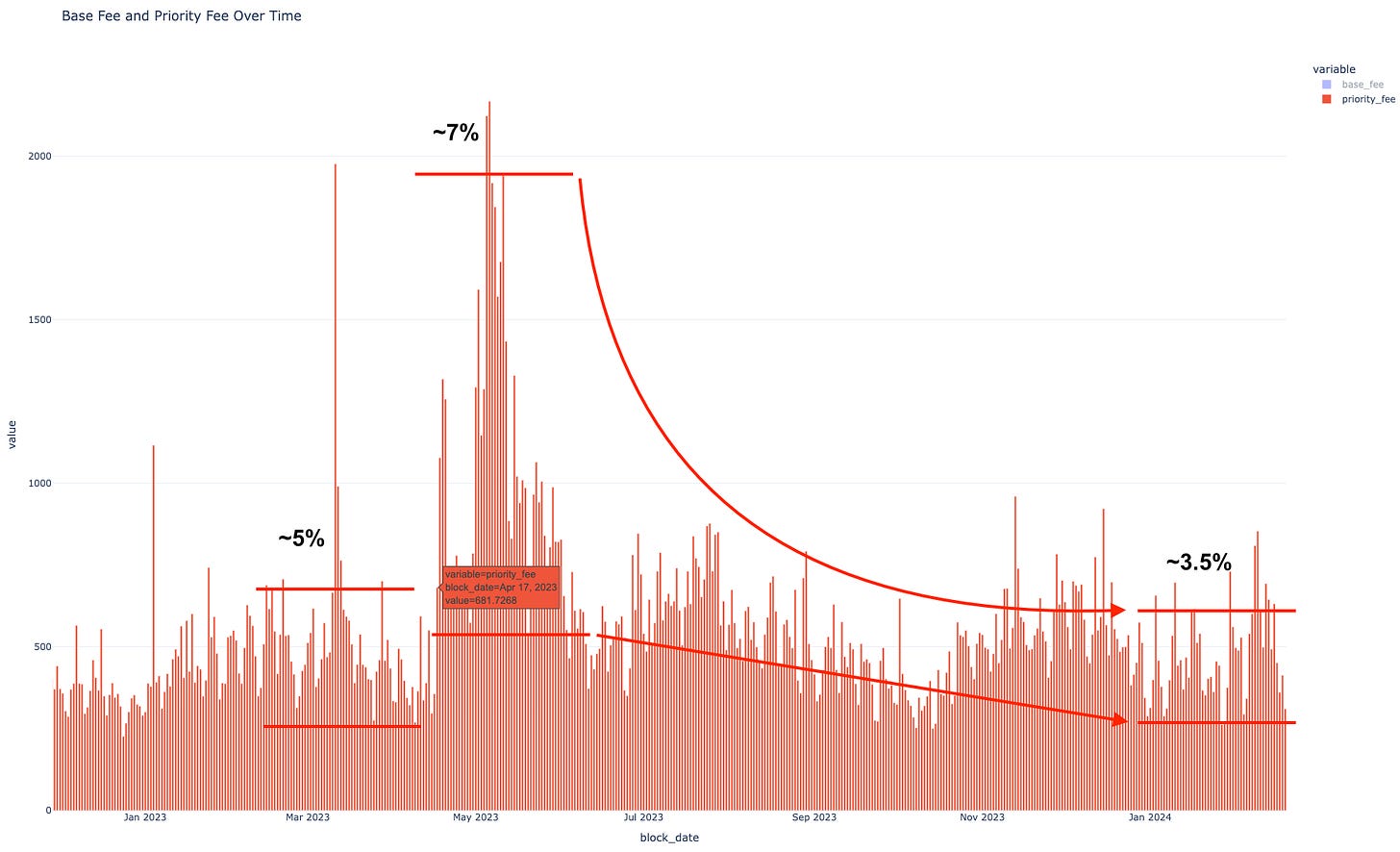

In April 2022, just before the biggest uptick in validators happened, stETH was yielding around 5%. You can see that in the chart below - it’s where you see the comment box on the chart. (I apologize about the size of the text here, it’s mostly for internal use, but we plan to make this more public facing soon.)

Now, much of the variability in around this time was due to strong price action and Ethereum’s Shanghai upgrade. It’s in part why yields jumped to >7% in the weeks that followed.

But since then, yields have dropped to mid 3%. This is the yield we see with more than twice the amount of validators on the network.

Now, to figure out how much of this uptick in validators and lack of drop in yield was picked up by fees, we can check out gas fees on Ethereum. This is the other factor to yields.

To see that, we ignored base fee as that gets burned, and instead focused on priority fees.

You can see the April spike below where yield surged to more than 7%. During that month there was about 2x more priority fees coming through the network than what we see now.

Assuming we return to a fee hike like we saw in April 2023, then yields will not reach 7% due to the major uptick in validators.

But asking if we can return to April 2023 standards is not what we should be looking at. If anything we need to see what was happening during the last cycle. To get a taste, the left portion of this chart below is September 2021, the tail end of the bull run. Fees were about 3x larger than what we see today.

Now we’re getting somewhere.

To get even further, below is the average gas price in gwei. Since yield is paid in native units, it makes more sense to price it in native unites.

In the chart below, we see that September 2021 fees were even less than what the network realized a year prior ,and for the first half of 2021.

In as basic language as possible, this gives me an expectation that yields above 4% are highly attainable when token prices are en route to test all-time highs.

You can go ahead and plug in various fundamental reasons such as upcoming upgrade, new research on the L1 solving more complicated problems on behalf of L2s, RWAs, NFTs, or whatever fits your narrative. But I won’t. I’m a simple man that looks at historicals and believe that odds are such that this event repeats itself.

OK, so hopefully I’ve convinced some of you that yields will rise. I’m not saying 10-20% in our future, but more like 8% as a realistic expectation due to more validators online, and fees being 3-4x higher than what we see today.

Great, so should somebody lock up their ETH for single digit yield? If you’re conservative, that’s a good method.

But if we want to speculate on the change in yield, then we can be express this viewpoint. Luckily, we can use Pendle.finance to do it.

Before I get into how somebody can express this trade on Pendle, I would like to showcase this chart below. It’s the yield market trading on Pendle.

It’s another internal chart where we need to update the font to be larger for public viewing… Nonetheless, it showcases the yield of the various intruments that exist on Pendle. It’s like viewing the yield over time for a 2-year Treasury in a way.

I also took away a few instruments because there was some noise on some of the maturity dates, but the red box below is what we should focus on (something I mentioned two weeks ago here). Yields were rising on 2024 and 2027 contracts. And it’s not just a quick hit thing, it’s a multi-month trend now.

In the past week, we’ve seen 2024 maturities begin to close in on 5%. I say all of this to hint that the market is starting to expect more activity coming to the Ethereum network.

Higher yields are starting to get priced in.

But what is interesting is the market is ignoring the 2025 maturity. This is odd since it resembles more potential opportunity to a trader.

To explain what I’m referring to, we need to better understand just how Pendle enables the market to go long or short the yield on stETH.

How It Works

It’s easiest if we simplify things and assume that stETH will yield 4% over the next year.

This means that 1.0 unit of stETH will equal 1.04 stETH after 365 days.

Now, if I were to sell the yield of my stETH to somebody, I’d accept an amount near 0.04. In doing so, I would lock up my stETH for one year, and the person would receive that yield until our agreement reaches maturity.

Fair, right?

Well, there’s an issue there. What if I want out while the other person wants to continue to earn their yield?

The exercise works great when it’s two parties that are committed to the agreement. But issues arise when the desire for liquidity shows up. This is why the design around Pendle’s platform enables a secondary market to exist.

If we take our same example from earlier where 1.0 stETH matures to 1.04 stETH, we can make an instrument that is fully backed from day one, and revolves around that assumption of 4% yield.

The secret revolves around discounting stETH so that it matures to 1.0 at the end of one year. This means if somebody hold 0.96151 worth of stETH, at the end of one year it will accumulate stETH so that it equals 1.0 stETH. Meaning it earned a 4% yield.

That’s what Pendle’s PT token is. You can think of this as the principle that pays yield. And for somebody wanting 1 stETH at the end of one year, the individual can pay 0.96151 stETH to purchase 1 unit of PT stETH.

On the flipside, there is the yield component. This is the YT token on Pendle.

That’s the secret to this instrument. Pendle breaks up a yielding token into two components. The principle (PT) and the yield (YT).

The YT token for this 1.0 stETH represent the amount of yield the 1.0 stETH earns over the next year. Right now, the yield is about 0.04 stETH.

But that’s the fun here… Yields in this type of bond, change. It’s also the speculative part of yield markets.

I know that’s confusing, so let me try to explain it one more time here…

The buyer of YT stETH is purchasing the yield attached to that 1.0 stETH token upfront, thinking it will earn at least 4% over the next year. But if yields rise, they receive that higher amount daily.

Which means if stETH begins to yield 8% the day after purchase of the YT stETH token, then over the course of one year they receive 0.08 stETH in yield. That’s how somebody can go long yields. And in this example, they earned a double on their capital.

But that’s just the yields.

…Only half the fun.

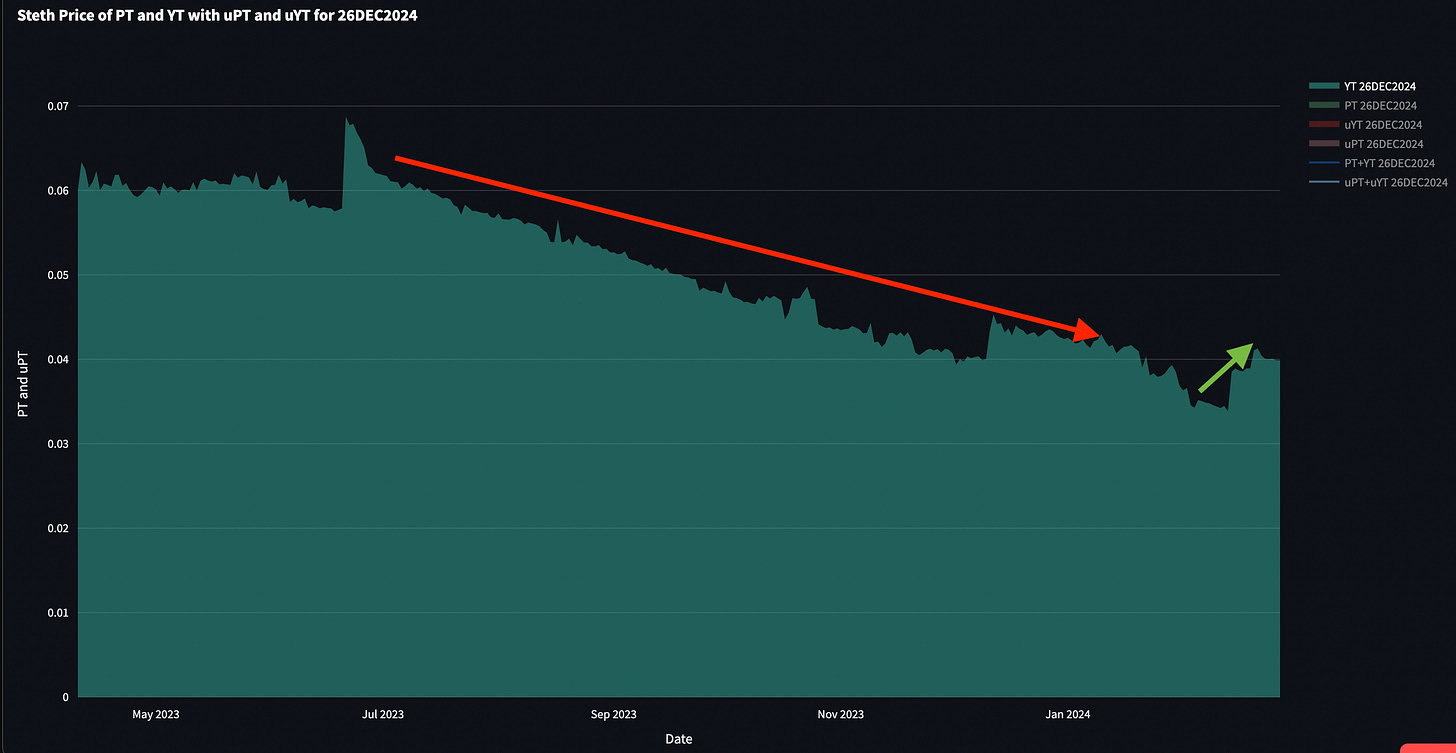

In the chart below, you can see the YT token for the 2024 stETH instrument trends lower. That’s because the YT holder is earning the interest daily on the locked stETH. As each day passes and the holder earns interest, the value of the token falls - all else equal.

This is why the token matures at a value of zero - all the interest is paid, no more left.

But notice that green arrow and spike in price. This is the market changing the expectation of that yield. The price here jumped from 0.0338 stETH to 0.0412 stETH in a few days, or 22%.

Meanwhile, that YT position was earning yields as price was rising as shown by that green arrow.

It’s like the value of a rental property rising in value while you earn cash flow. It’s a beautiful thing.

And this is where these markets get fun. Because if the market begins to get very excited about Ethereum yields, the YT token can jump in value quickly.

But here’s the thing… The 2024 contract, which is rising the most of late, is short on time. The variability in the YT price will not be as extreme as it nears its end date. Remember, the token matures to zero. So a token with a bit more time on it creates greater potential volatility in price.

And the way the 2025 token is priced, it’s an opportunity that looks underpriced in the market right now.

You can likely guess what instrument I’m involved in (YT stETH 2025).

This market is very interesting to me as I spend my days watching yields and rate markets. Even when it comes to Ethereum, we have our own yield curve and various rate markets to help us see when things might prohibit growth.

We also watch them to see if perhaps a bigger trend is causing billions of dollars to slosh around.

And that’s what I want to get into today for the second part... Where we see billions of dollars worth of ETH starting to slosh around.

Part Two: The Newest Rate Market

If you haven’t heard of EigenLayer, then you shouldn’t be reading this essay.

I half joke here. Only half…

Reason being is on the one hand, Espresso is intended for traders that lean crypto native. And if you’re crypto native, then chances are you’ve heard about EigenLayer (EL) points. On the other hand, the half that is joking, I welcome all new up and coming crypto enjoyers. I just doubt we have many since Espresso is not a newcomers first destination.

Getting to EL… the market wants their points. To get them, you need to be able to gain exposure to staking ETH through one of the liquid restaking providers like Ether.fi. They go ahead and liquid stake your tokens, and then look to restake with EL.

This means when you allocate ETH to ether.fi, you gain exposure to earning EL points.

So in a way, staked ETH that earns a yield using Ether.fi is earning two yields right now…

There’s the Ethereum network rewards like we saw with stETH. Let’s round up and call it 4% for now. And then there’s the EL points. So for every 1.0 ETH or eETH as it’s called on Ether.fi, there are two yields.

Just how much is the EL points yield?

That’s where the market comes in, and it’s how Pendle has found a great opportunity with liquid restaking tokens (LRTs) such as those with Puffer, Swell, Ether.fi, Kelp DAO, and Renzo.

These protocols are offering EL points in exchange for your ETH tokens. And they are also, via Pendle, creating a massive market for yield traders to make the most of this EL point opportunity. Let me explain.

38.38% APY is what exists for traders willing to accept a fixed yield on ETH. Pretty nice.

I’ve told a few people who I know are active in the yield markets about this opportunity, the first response I got was that it was way too risky. Not the question people should be asking - where is the yield coming from.

Asking the latter helps a yield trader know that this is justifiable.

It’s an incredible opportunity, and to explain it, let’s lean on our earlier example of 4% return on stETH. In this conservative example, we only needed to deal with 0.04 worth of stETH coming to the YT holder (yield token)… This is the trader that’s buying YT at 0.04 stETH for the chance to earn that yield back over the next year - and some.

The main difference in this example with EL involved is the points. Meaning the YT holder gets the 0.04 ETH plus some EL points. Remember, that yield is coming from that 1.0 initial ETH capital being used by Ether.fi.

So how much are those EL points worth?

Well, what’s important to note here is that all these LRT opportunities are also stuffing their own points into this amalgamation of yield. So Ether.fi, Kelp, etc are also offering points. It’s a true Oprah Winfrey distribution moment for mystery value points.

Now, the market is pricing in all these points at 38.38% for Ether.fi’s April 24, 2024 maturity. That’s less than two months from when I’m writing this section.

The easy way to figure this out for the fixed yield side is to look at the current price of 1.0 PT eETH token. Remember, this will equal 1.0 eETH (similar to stETH) when it expires in less than 60 days.

The price is 0.95.

If you purchased 100 PT eETH, it would cost you 95 eETH. And at the end of two months, you’ll have 100 eETH.

Nice 5 eETH return.

This suggests for every 1 eETH token, the market is valuing the points at 0.05 eETH across two months (that’s the approximate value of YT eETH tokens for this instrument).

But remember, it’s only two months. At 4% yield on liquid staked ETH tokens, this amounts to approximately 0.00625 eETH tokens. Not quite 0.05.

If we take the difference there, we get 0.0437 eETH, which represents the value of Ether.fi and EL points over the next two months.

ETH/USD is at $3,200 today, which means each YT eETH token is expecting to see $140 worth of cash flow over the next two months.

Whether or not this $140 seems to be worth it, I’ll be honest and say I don’t follow the EL points ecosystem enough to make that determination. What I see instead is something more substantial when we zoom out.

Lots of airdrop farmers are stuffing more than $1 billion into Pendle to get these points. Look at the chart below, that’s growth every protocol dreams of.

And where I see a frenzy like this, I’m glad to supply the garden hoes, seeds, and fertilizers to earn 0.05 eETH for each 1.0 eETH within 60 days. I’ll take that side just about any day.

Now, if you got to this point, bravo. That was a lot of percentages and likely complicated reading with multiple tokens representing various expressions of a trade.

But after you let it sink in for a few days, I want you to come back and read this next part. Because it speaks to where this market is going from that 10,000 foot view.

Everything is about to be broken up into multiple yields. LSTs, LRTs, LP positions are getting broken up… Shoot, I’m guessing the Pendle team will figure out a way to break up LP positions on Uniswap in time.

But what’s more, new apps that allow roll-up chains to be deployed in a few clicks will need LRTs from EL. They are renting security. And since protocols like Ether.fi can use EL to provide this security, it represents more yield opportunities for ETH tokens.

Pendle is likely just getting started here.

I genuinely believe rate markets are about to become one of the largest DeFi ecosystems in crypto. And if you’ve known me long enough, rates and yields are my jam.

I plan to keep coming back to topics like this.

So continue to follow along as we keep going further down this rabbit hole because Ethereum as an ecosystem is about to see its rate and money markets turn its native asset into the most sough after yield instrument in the world.

In fact, one of my predictions for 2024 is Ethereum will have its own credit rating system for this bond market. And junior/senior tranche products will spring up as roll-ups become much more popular in 2025.

Whether you like this restaking trend, doesn’t matter, it’s happening… So buckle up, we’re only getting started.

Your Pulse on Crypto Rates,

Ben Lilly