How Options Fueled Bitcoin's Rally

Options Market Update: 1 MAR 2024

The whisper is now a roar.

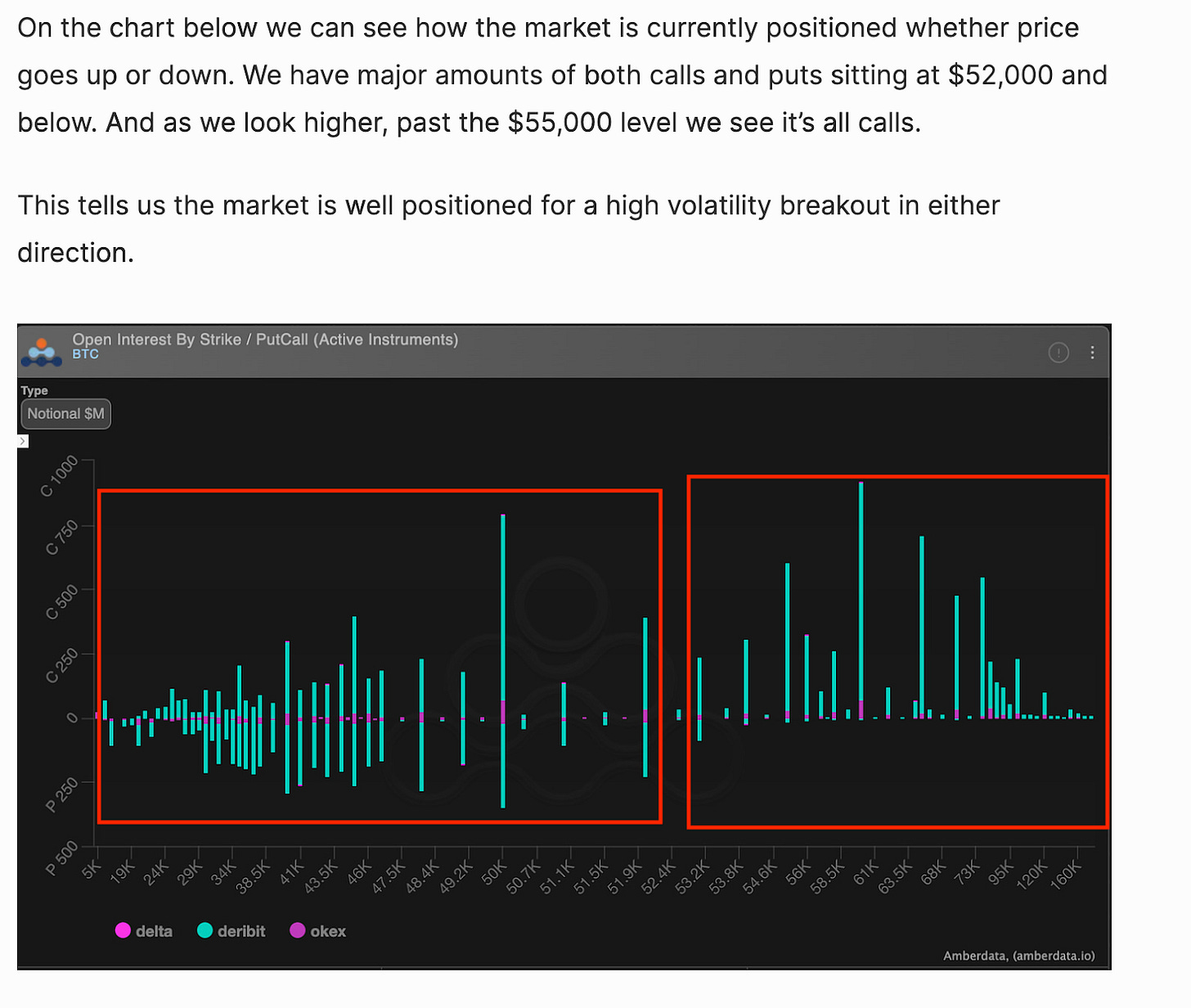

Last week we mentioned the market was bracing itself for a high volatility break-out of the $50,000-$53,000 with huge amounts of open put interest below $50,000 and open call interest above $55,000 as we saw on the net positioning chart below from last week.

Here’s a snippet from last week’s update for those that missed it:

When Monday came around, this powder keg of positioning found its spark as billions of dollars of inflows poured into spot Bitcoin ETFs.

If you tuned into Tuesday morning’s episode of The Trading Pit, you heard Ben Lilly and I break down in detail how this unfolded.

To sum it up briefly, as price accelerated past the crucial $52,000 mark, the race was on for options dealers. These were the same market makers who sold the previously out-of-the-money calls. This price move forced them to begin hedging their short (short also means sold contract) call positions against the price of Bitcoin like a person on fire seeking a body of water… All because price went parabolic.

As Kelly Greer of Galaxy HQ pointed out, this meant that for every 1% Bitcoin made to the upside, dealers were being forced to buy an additional $17,000,000 worth of BTC in order to remain delta-neutral.

That’s like somebody using a fulcrum to lift a bulldozer with only a finger.

Add to that equation the persistent spot buying from ETF inflows and shorts getting liquidated, and this created the perfect storm for the high velocity move which culminated in BTC crossing $60,000 for the first time since 2021.

This, not unlike what happened on the break above $30,000 this past October, was yet another example of options market reflexivity.

It’s still a misunderstood area of the market since most crypto traders rarely venture outside of perpetual futures and spot markets. But dealers being on the wrong side of “gamma” is often the primary driver of Bitcoin’s largest single day moves.

If we look into the effect dealer’s being off-sides on those calls has had on the options market we now see the current term structure chart versus an older one.

Term structure charts give us a glimpse at how much pricing for options is being impacted by implied volatility. And comparing two different structures to one another helps us identify trends.

The notable change we see is that dealers may have learned their lesson in regards to selling volatility at too low a price.

If we compare the current structure of IV to what we saw in early February (dark blue line) we see the slope from early February is being priced away. We mentioned this presented opportunity only two weeks ago, it has since been pounced on.

This adjustment has led to higher IV across the board today.

What this sharp mark-up in IV also signals is the market preparing itself for greater volatility throughout 2024. Otherwise, we would see a lot more selling to bring this value lower. For those wanting to learn more nuance on this topic, we put together an educational series on how to effectively trade Bitcoin options in 2024 since it this sort of move on term structures happens in the current stage of Bitcoin’s cycle

Hopefully you’ve been following along.

But with that said, now may be the time to exercise caution on your long volatility positions into the end of Q1, and avoid call-option FOMO if you don’t already have a position, as this recent spike in premiums will be difficult to sustain throughout March.

If you missed this move, remember the options market moves fast, and the worst thing you can do after missing out on a move like we just experienced is chase it. This can result in paying high premiums for contracts that depreciate at a very high rate.

There will inevitably be better opportunities throughout this year to capture volatility when premiums are lower.

Low risk, high reward volatility set-ups like the ones we saw last week happen quite frequently in options, so don’t let the fear of missing out rush you into being someone else’s exit liquidity when premiums are trading at such a steep near term premium.

When such a set-up arises again we’ll be sure to let you know, but for now trade safe and remember that volatility can take away gains just as fast as it presents them.

Until next time….

Watching the tape,

J.J.