How Arbitrum Can Turn Its Token Around

Single Origin: ARB Needs to Take Some Cues From ETH

Back in March, I said the following:

The last nail in Arbitrum’s deathbed will be driven in on March 23. Will ARB be laying in it by the end of the year?

Arbitrum, if you’re unaware, is a layer-2 protocol designed to help scale Ethereum. And that “nail” I mentioned was referring to its upcoming airdrop of a native token called ARB.

I thought I’d check in on how ARB (blue) has been doing since. And, uh, well…it’s not looking great.

Sure, everything’s been suffering this year. But ARB especially has fallen on hard times.

Price hit an all-time low last Monday around $0.74. Whales and market makers have been dumping the token at a loss. A handful of them recently sold 21 million ARB for a loss of $8.15 million.

Even its main competitor, Optimism (OP), just overtook ARB in market cap last week.

To be clear, I’m not blaming ARB’s decline on the airdrop. When you deploy a new token into a bear market, you shouldn’t expect it to magically go up.

And price isn’t everything. It’s also important to see what the health of the network is as a whole.

But this airdrop did put the pressure on for the ecosystem to find ways to innovate and attract demand if it wants to survive and be around for when the bull returns. And ARB is still struggling to do that.

Luckily, the team at Jarvis Labs has a few ideas.

But first, let’s explain why Arbitrum isn’t quite out of the game yet.

Is Arbitrum Still a Contender for the L2 Crown?

Arbitrum has come a long way since it first launched in August 2021.

For a few months, it barely had anything going on. Most of the DeFi projects from Ethereum had chosen to launch on Optimism instead.

But as months passed by, developers started to switch to Arbitrum.

As a result, the Total Value Locked (TVL) on Arbitrum went from zero at launch in August 2021 to $2.5 billion in November 2021, the crypto market’s last peak. That’s pretty remarkable growth in just three months.

Currently, Arbitrum has $1.7 billion in TVL (first chart below). Compare that to Optimism’s $650 million (second chart below).

Further, it has 450 protocols, more than double Optimism’s count of 190.

But what’s important to keep in mind is not just the amount of TVL Arbitrum has built, but also how diverse it is. Diversity in TVL is important for an ecosystem’s health so that it’s not reliant on a handful of protocols that could threaten the project if they go bust.

And Arbitrum has 27 projects with a TVL of over $10 million. While it’s a bit concentrated with 25 percent of total TVL in the decentralized perpetual exchange GMX, that’s still a very diverse ecosystem.

And across all these protocols, Arbitrum has about $1.5 billion in stables sitting on its platform. That’s more than the $500 million that Optimism has, and it’s about the same amount as Solana, one of the most popular layer-1s used for stablecoin payments.

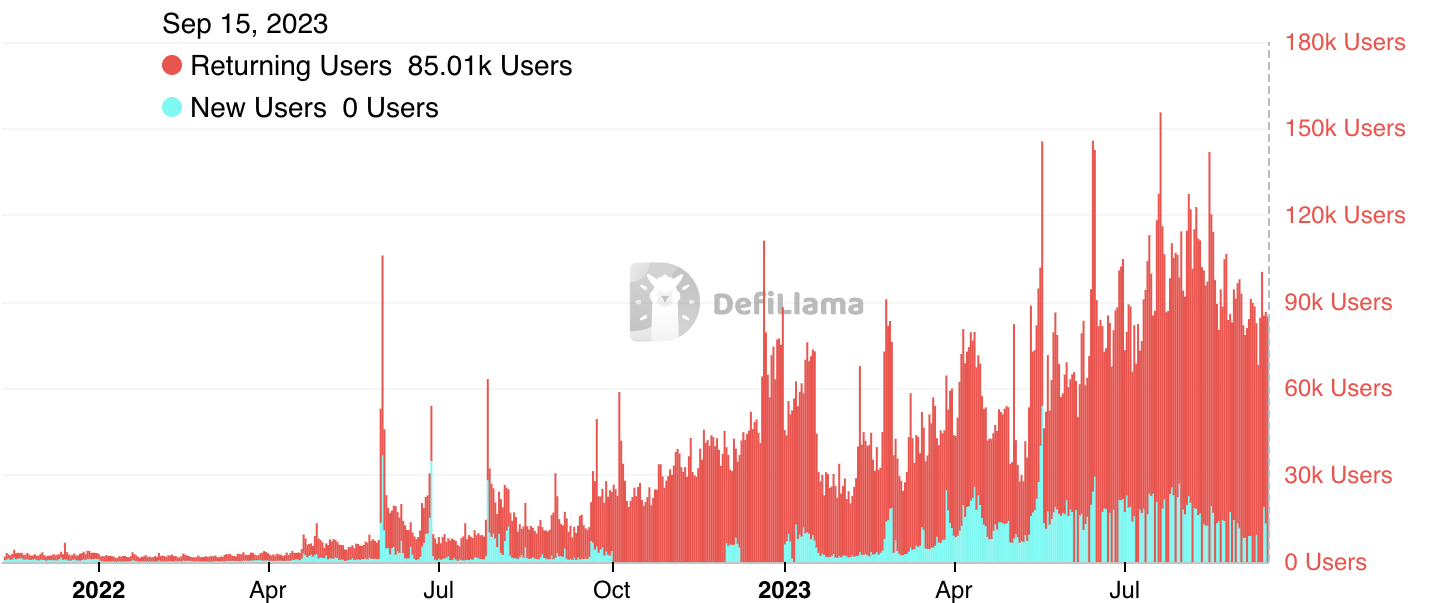

Also, Arbitrum’s number of users is slightly above Optimism. Arbitrum has just over 107,000 users, while Optimism has about 85,000.

So with all this activity going on, even in a bear market, what can Arbitrum do to make itself a force to be reckoned with in the next cycle?

It’s All About Usage

To explain this next part, we need to look at how ETH itself functions.

ETH has a lot of use cases. You can use the token to pay to create a smart contract or pay transaction fees. You can also use it as collateral for borrowing or to earn staking rewards, among other things.

These use cases don’t just make it more versatile for the tokenholders. They give the token a higher “elasticity.” If you’ve been following me in Espresso the past few weeks, I showed in a recent Blend how a higher elasticity can help tokens absorb selling without impacting price much.

So ETH has a high elasticity due to its use cases that extend beyond just a way to send payment. This includes creating a smart contract and paying for computation, as well as acting as a storage of value, collateral, or yield instrument, among other higher levels of use.

Now, what can you do with the ARB token?

Take your time...I’ll wait.

…Think of anything?

That’s the problem. You don’t even need ARB to pay for a transaction on the network.

The token needs to have some level of usage, even if it’s basic. And once it has that, it can start to unlock higher levels of usage similar to what we see with ETH.

The benefit of this is that it makes TVL very sticky. All that liquidity can then act as a sinkhole which better absorbs changes in supply.

Right now, ARB doesn't have that. If there was a big unlock coming or one of the protocols on the network wanted to sell the tokens it acquired from the airdrop, the ecosystem wouldn’t be able to absorb it.

Bottom line is I would like to see greater usage of the ARB token outside of just being sold into the market. Right now, if I had to give ARB’s economics a grade, it would receive an F.

Luckily, Arbitrum can improve this.

Remember that Arbitrum is a rollup. It computes transactions outside the main Ethereum chain, then once it verifies them, it batches them together (“rolls them up”) and sends them back to mainnet. It’s a cheaper and quicker process than verifying each transaction on Ethereum.

To enable this, the chain employs sequencer nodes to order transactions and send them back to mainnet once verified.

The good news is, there are plans being made to decentralize this process by requiring sequencers to stake ARB tokens. These sequencers can earn fees from verifying transactions and helping the network run, similar to proof-of-stake networks. And it provides a potential use case for ARB.

Looking Ahead

Arbitrum’s airdrop didn’t doom it to become extinct this cycle. It has been steadily attracting projects that can help it make a run once the wider market sentiment shifts.

But if it wants to stay competitive, it needs to start thinking about how to align incentives with its token.

Below is a chart showing that there’s over 1 million ETH (~$1.6 billion) locked on Arbitrum. While it’s been trending down recently, it’s still higher than at any time in 2022.

That’s really good to see. It shows the potential Arbitrum has to be a key app within the Ethereum ecosystem.

But sooner rather than later, we want to see a chart like this for the native ARB token. And that will only come when the team designs better usage for the token.

That will go a long way toward making it an attractive asset once people start venturing down the risk curve out of just Ethereum.

Your Pulse on Crypto,

Ben Lilly

P.S. The team and I discussed this same topic in much more depth on last week’s episode of the Alpha Bites podcast. You can listen to the full episode on YouTube, Apple Podcasts, or Spotify.

Qui. Aide

But that's the thing with all L2s - activity spikes because people are farming in anticipation of airdrop (that's why "users" metric is misleading, one person/farmer on average has about 10 wallets) and then it dies down and better product wins. Let's be honest, most protocols don't need token but it's the only way for VCs to cash out.

Airdrops / gov tokens are just a meme meant to be dumped on the first candle. You know it, I know, everybody should know it. Don't marry your bags. Do you remember hype around HNY in Q4 2020? Look where it is now. That's how it ends.

Also, fragmented liquidity is just bad for the whole ecosystem.