Halving and Options

Options Update: 30 Mar 2024

Options lit a match and dropped it on the market.

And it's burning.

The premium on options contracts that is.

Premium is the cost that an options contract commands due to implied volatility. And in Bitcoin's push to new all-time high above $74,000 two weeks ago, this premium price got very high.

You can see that in the chart below which measures implied volatility (IV) for each expiry at certain date. The dark blue line is March 11 while the light blue line is March 28.

Note just how much the front part of the curve has dropped since then.

That's the burn.

We highlighted this changing tide last week as we saw the market took advantage of that premium. It shifted from rewarding volatility buyers to burning them.

Here was the open interest by expiry chart for March 22nd, where we saw all these call contracts expiring worthless as BTC corrected back towards the low-$60,000 region.

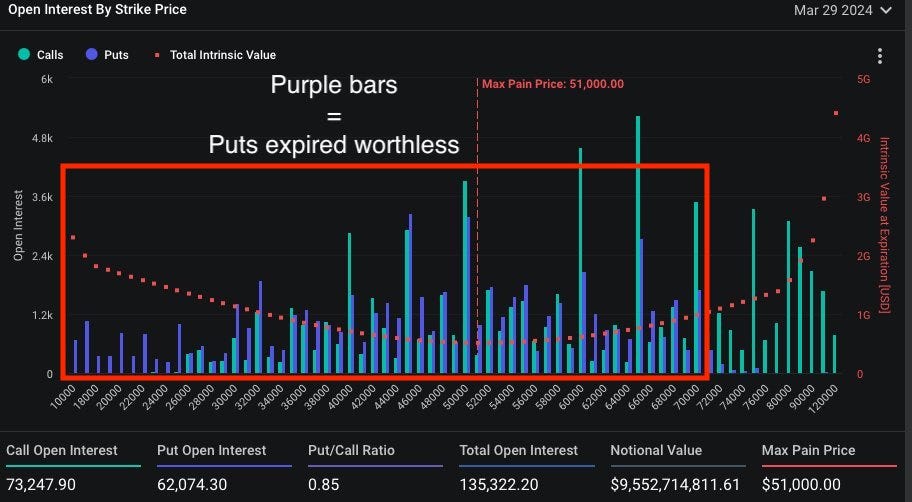

Fast forward to this week and nearly every put contract (purple bars) is expiring worthless as we see highlighted by the red box below.

The house wins again.

This past week it was setting up to be a situation where the market would experience the most pain with a choppy price action to the downside into the monthly close. But we didn't get that. That's likely due to sentiment shifted leading to an excessive amounts of short dated puts entering into position.

This reactionary move creates a unique market dynamic.

That's because markets, especially options markets, are complex adaptive. Which means as new positions enter, especially those that are short-dated, it forces market makers to trade against them as they hedge their new positions.

And when too many people are betting in the same direction as we saw happen over the prior weeks, it creates the perfect opportunity for the pendulum to swing back and bleed premium out of the overcrowded trade.

So what does this mean moving forward...

Breaking Range

Since Bitcoin reached its new all-time high in early March, implied volatility levels have also peaked.

We can see this with the blue line below which is an index on IV pricing for options.

This implies that as long as Bitcoin continues to trade within its current price range of $62,000 - $74,000, the range where it established elevated March IV levels, options contract premium pricing should continue to fall.

To break this trend, we need to see a price breakout in either direction. This would cause IV levels to spike along with it.

And with this, many might feel like there is indecision. But that's not the case. The current set-up creates opportunities for options traders currently sidelined to express views on the market as we enter into Q2.

If one is expecting the market to continue to chop back and forth in the current range, selling covered calls against spot BTC holdings or outright selling call spreads can be a lucrative strategy as calls are still trading at a steep premium.

BTC calls with strikes above the all-time high level at $75,000 expiring the end of April for example are currently trading for around $4,500 each at present. That’s a breakeven price of $79,500, meaning in order to lose money - if selling these calls - Bitcoin would need to be above $79,500 by the end of next month.

As we see in the order books below even the April $90,000 calls are carrying a $1,100+ premium at present which appears to be some signs of pre-halving FOMO.

Selling those calls while accumulating spot or longer dated call positions beyond the $80,000 mark that don’t expire until June or later in 2024 wouldn’t be a bad way to hedge yourself if you expect upside later this year, but are unsure of what to expect into and immediately after the halving.

If the halving then plays out in a similar fashion to the ETF launch, with sell-the-news price action playing out, selling these premiums now will drastically reduce your net cost basis.

Additionally, out-of-the-money put contracts continue to trade at low premiums for those in need of a hedge, or a way to express a bearish bias in April.

If we take a look at puts expiring at the end of April with strikes at $62,000 (bottom of current price range) and below, we see downside insurance can be bought fairly cheap, relative to the move Bitcoin could make if April paints a red monthly candle .

Should price fall to the low-to-mid $50,000 level in April, the pricing in these contracts could quickly multiply as those currently holding their Bitcoin unhedged would find themselves rapidly seeking insurance.

It would be like market makers rushing to you begging to buy your put positions.

Hopefully this provides you with some ideas on how to potentially structure your Bitcoin option trades into the halving as I’m sure the price action ahead will have plenty of twists and turns in store for us.

Until next week, trade safe and beware of the burn.

Watching the tape,

J.J.

Very helpful. Thanks, J.J.

Great perspective as always JJ. Many thanks.

Don