Gensler Suing Chuck E. Cheese

Plus: Arbitrum’s Hangover and Sovereign Shitcoins

If there’s a story you’d like us to cover in the Blend, leave a message in the comments or email us at askus@jarvis-labs.xyz

The confusion is on full display.

Gary Gensler’s testimony before the House Financial Services Committee became a focal point for the blockchain industry last week. The video showing the back-and-forth between Gensler and the committee chair, Rep. Patrick McHenry, was plastered all over crypto-centric social media in the days that followed.

Video here: https://twitter.com/unusual_whales/status/1650198097258250241?s=20

The quick exchange between the two concerned whether Gensler views Ethereum (ETH) as a security. After not getting a straight answer from Gensler, a frustrated McHenry went ahead and mentioned to the room that he told Gensler ahead of time this exact question is one he should be ready to answer.

It was a call-out in the early minutes of the hearing.

The spectacle made it clear that (predominantly) Republicans are pushing back on Gensler’s policies of late. And he won’t be able to continue down his current path without encountering resistance.

It was a signal that Gensler’s influence and “power” were overextended on the RSI indicator.

Now, I’ll get into this hearing a bit more in just a moment, but I’d like to mention the other two topics we will hit on today.

One of them is Arbitrum’s recent hangover from the airdrop. It is beginning to show up in the data. And when we compare it to Ethereum, we see an interesting relationship to price.

The other has to do with global reserve currencies. What prompted this was a quote by Brazilian President Lula saying he wants to exchange goods using their sovereign currency, the Brazilian real.

I’ll go ahead and bring up Chuck E. Cheese tokens for this one. Not because Gensler’s warpath will have him calling them securities, but more from a value accrual perspective.

OK, let’s get ready for today’s blend… but first, a quick word from our sponsor.

For those who have been looking for a new exchange, consider checking out ByBit.

They operate in 160 countries. They have more than 270 assets trading on spot and over 200 perpetual and quarterly futures contracts. They even offer options contracts and NFT trading.

Simply put, ByBit has a lot to offer any trader. And right now, they are offering a $10 welcome bonus if you open a new account and complete some introductory tasks. They also have additional ways for you to earn.

If you are looking for a new platform to trade on, consider ByBit today by clicking here. Also, if you simply want to support Espresso and the Jarvis Labs team, consider giving a click.

Gensler’s Crypto Strategy Is Showing Some Cracks

Gensler was visibly shaking when trying to skirt around the question of whether ETH is a security.

I don’t blame him. In all actuality, even without facing a question with as much contention and shitstorm potential around it as ETH’s legal status, I’d still be a nervous wreck. Those hearings make their subjects feel like Congress is getting ready to squish you like gum on a sidewalk.

On the other hand, Gensler made the bed that he is now lying in…

To get to what I mean, I’d like to lean on what Jason Gottlieb from the snazzy New York law firm Morrison Cohen hit on during his discussion with Laura Shin from the Unchained podcast.

To summarize, Gensler is hurting retail. We’ve seen it several times now. The SEC chief might randomly decide on a mild Wednesday afternoon to get up off his rocker and declare something is a security. Then go back to his rocker in silence where nobody will be able to talk to him.

His actions can lead to serious aftereffects. A token’s price gets crushed, or users rip their money out of an exchange in fear. Meanwhile, he’s taking meetings with the face of crypto fraud, SBF.

As Gottlieb points out, Gensler’s reputation in crypto is starting to look more like he’s out to hurt retail. And if he says ETH is a security, this “Gensler hurts crypto” narrative will be written in stone.

Price would take a major hit since that means all tokens are likely securities as well, and a true shitstorm would be on hand. Gensler would look very irresponsible.

The other fact Gottlieb hit on was that ETH is more than five years old. This gives it another layer of armor to defend itself from such remarks thanks to the statute of limitations.

These two takes from the lawyer are great.

But what I’d also add in here is that many major companies are investing substantial resources into Ethereum. This is no longer a startup made from developers surfing couches.

We have industry titans like JPMorgan who are heavily involved in the network through their association with Consensus, Infura, and permissioned ethereum fork, Quorum. Societe General made waves last week with its work. Fidelity, BNY Mellon, Citadel, and others have developed infrastructure around it.

And while many will rightfully be upset that Ethereum will lose some of its permissionless ethos, it looks positioned to be used by Wall Street in some capacity.

Which also makes the question of calling ETH a security a giant red button to Gensler. He wants to say it is. But if he does, there will be massive pressure around him that will likely make the walls cave in. A flood of lobbyists, Congressional representatives, lawsuits claiming negligence, and even his former employer, Goldman Sachs (a backer of Circle), will be knocking on his door demanding answers.

It’s a fight he wants to have, but won’t.

Which is why we see him taking jabs at projects like OMG, DASH, and ALGO – projects that are decentralized and similar to ETH. It’s a roundabout way to scratch that itch of his…

And going after this itch works in Gensler’s favor, since these projects don’t have a central entity to defend them. If a group did make an appearance, it would imply there is a central authority responsible for the project’s success, making the securities claim for Gensler stronger.

Damned if you do, damned if you don’t.

It’s confusion to the max. But luckily, we seem to now have members of Congress starting to get vocal about stopping Gensler’s warpath.

Again, I don’t expect this peppering to slow down until FedNow is out with some semblance of success. In the interim, what we should be taking note of is if the regulators go too far. That might erode public trust, hurting FedNow’s chances before it starts.

Is Arbitrum Turning Into San Francisco

I’ve thrown some hate over a recent airdrop.

It stems from the sadness that this protocol might emulate San Francisco in due time. A once vibrant city that is now falling victim to unproductive activity after 21% of citizens fled in the 18 months that followed the 2020 lockdowns.

Many defend the city and say it’s back, and others continually criticize it. I’m not taking any sides here, just pointing out what I see from the comfort of my armchair. Such as this photo courtesy of the California Globe showing Tide detergent pods locked up at a Target.

But the reason I bring this analogy up is Arbitrum (ARB).

Protocols like Arbitrum are like cities. In periods of growth, you see many businesses opening up. In contractions, businesses slow down and even die.

For instance, right now we’re in the latter cycle. In the United States, monetary conditions are historically tight, reducing new business ventures. It’s why even the Federal Reserve is expecting a recession later this year.

It’s a lag effect. And when it comes to Arbitrum, we are seeing this happen in the aftereffects of its airdrop via the amount of verified contracts being deployed. That’s what the chart is below. It essentially tells us the amount of new code getting pushed on top of Arbitrum.

The area to focus on is the activity picking up in Q4 2022. Then, soon after it went parabolic in Q1 due to the airdrop. Arbitrum became a booming metropolis.

Businesses were opening their doors, ready to serve customers. When the customers arrived, transactions went sky-high. Textbook growth.

But since the airdrop, we see the amount of new smart contracts trending lower from about 300 per day to sub 100 on some days.. New businesses are not racing to open their doors as they were prior to the drop. We can view this as a bit of a hangover.

It’s a trend we want to keep an eye on as price seems to have some relation here. And it’s also a pattern I’ve seen before.

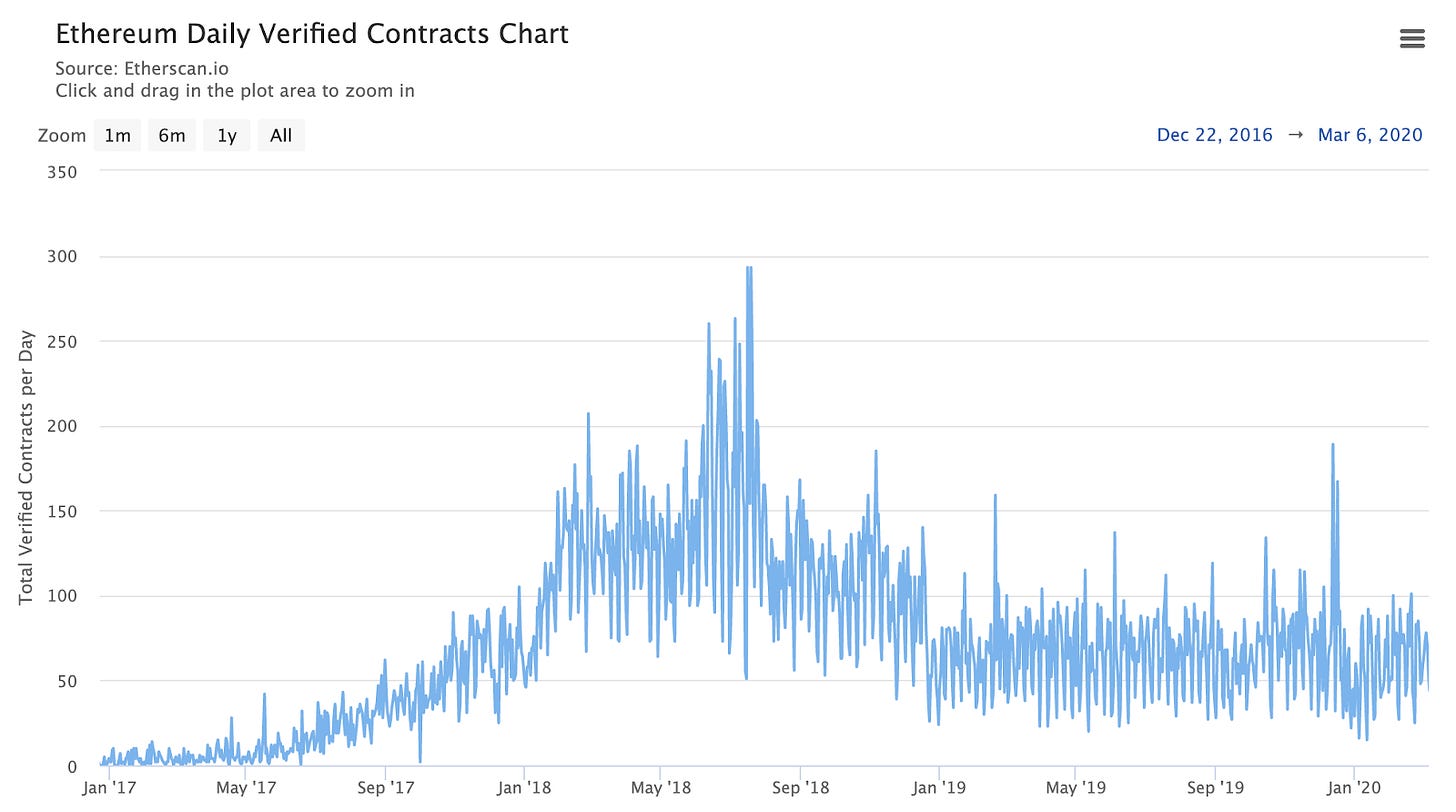

The chart above reminds me of Ethereum in 2018, when contracts being created jumped off the floor. Then, from February to May 2018, there was a consolidation before another jump took place, as you can see below.

Then, it was a slow trend to about 50 on the average. Many remember price went from $1,400 down to two digits during this time.

I’m not saying ARB will follow the same path here as the macro conditions in crypto are a bit different. If Bitcoin keeps rising, then its tide will lift all boats.

Instead, the way we can view this is if this trend continues downward, there might not be much juice left to squeeze if the L2 narrative comes around again in a few months.

In fact, what is equally questionable here is that transactions are still rising on Arbitrum. But it’s important to remember farming activities are now taking place throughout.

Regardless, last cycle, we saw transaction activity peak on Ethereum in May 2021 while contract creations peaked months.

There seems to be a soft lag effect there, which our team is starting to dive into to better understand when the lag happens and when it doesn’t.

For now, when it comes to L2s, moving forward I’d be looking for which ecosystem is realizing a trend higher on contracts created. Got one you’ve found? Drop a note in the feedback, and we can dive into it together.

Neither China nor Chuck E. Cheese Is Replacing the Dollar

If you have kids, you probably know this story.

Your friend invites you to his kid’s birthday party at Chuck E. Cheese. At the end of the day, you check your pocket. You have about a dozen Chuck E. Cheese tokens.

Do you hold them? Or do you give them away to somebody for free?

My guess: the latter.

The reasoning is simple. The token is not worth holding on to outside the building’s four walls.

You can’t get food with it at your local pizzeria. No chance you can grab an espresso down the street. And good luck depositing it into your bank.

There is zero chance to export those tokens outside the Chuck E. Cheese borders.

Apparently, they don’t have Chuck E. Cheeses in Brazil. Because this analogy seems to fly right over the head of Brazilian President Luiz Inácio Lula da Silva (Lula for short).

Recently, President Lula was quoted in the Financial Times saying, “Why can’t we do trade based on our own currencies?” It’s really a two-part answer here.

The first is you need to be a big spender. Second, you can’t be a shitcoin.

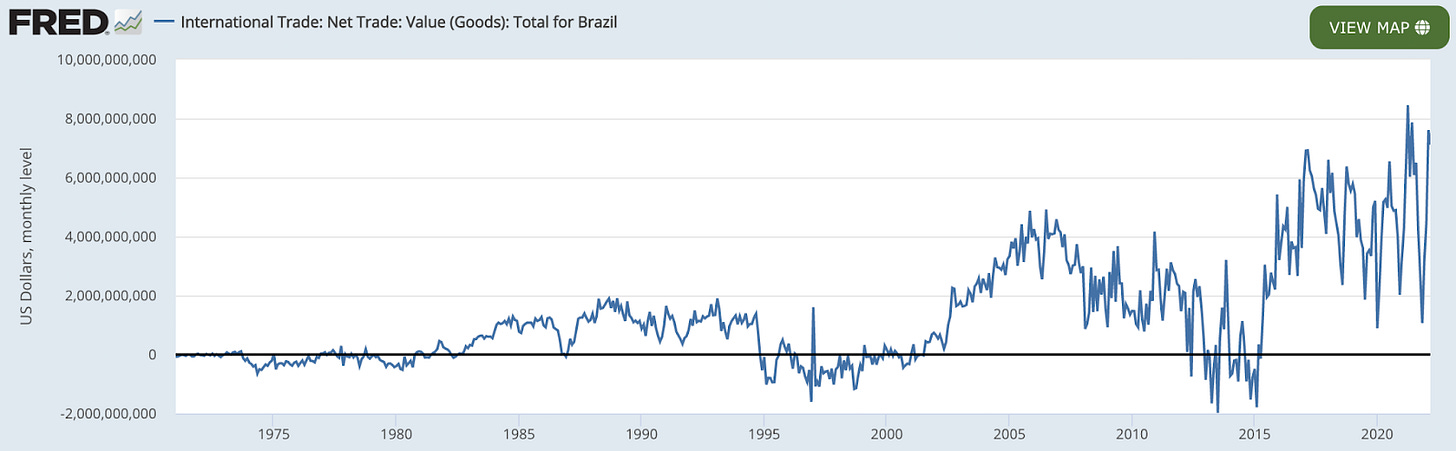

Hitting on the first answer… Brazil needs to buy more stuff. Right now, it likes to export a lot of its goods, but not import much. It’s why its trade balance (the value of its exports versus its imports) is constantly very positive, as seen below.

The idea here is once you begin buying lots of stuff, others tend to hold your currency more. This means you can pay for things in that currency or accept payment in it.

But to accommodate such a request, there need to be good financial instruments available to swap the currency, banks need to accept it, and most importantly, there needs to be a level of trust that the buyer – Lula here – won’t just nuke their currency with triple-digit inflation.

Otherwise, those selling to Brazil will swap every bill moving offshore with a hard asset like gold or some other currency… Meaning the Brazilian real would be constantly unloaded. Or said differently, constant sell pressure. Which is why being a massive buyer of goods comes with its own unique set of responsibilities.

This is what the United States bears with its policy. And you can see how it’s exporting its dollars offshore with its trade balance. In doing so, it needs other countries to have confidence it won’t just nuke its dollar with inflation.

Which is why Lula was just saying things to win points at home.

But what about China? We’ve heard similar mentions that it wants to dethrone the U.S. dollar. Are the fears there real?

To answer that question, let’s first check out China’s trade activity over the years.

Based on this chart, it will be difficult to move the renminbi outside of its borders.

But if the trend over the last year continues, maybe we’ll have to discuss it again.

Reason being, the country is making curious moves with its financial infrastructure. In 2014, it set up renminbi clearing banks in London and Toronto, followed by locations in New York and Tokyo in 2016 and 2018, respectively. And in 2015, China set up its own version of the SWIFT payment system.

This implies the financial infrastructure is being laid out.

Now, the real question is, is China willing to loosen its grip on price controls?

The answer will likely show up in the net trade chart above. If China decides to run trade as a deficit, then it would suggest it is willing to make a move.

But that’s clearly not happening yet. So for now, we can likely ignore a lot of the talk associated with the renminbi replacing the dollar on the global stage.

And for a bit of a tangent… For the token nerds like myself… These real-world dynamics can help us to better understand cryptocurrencies.

For example, if a project sets up a swap market for its currency and also has a 50% token supply growth rate over the next year, what do you think will happen as you distribute that token over time?

Users will exit the currency and opt for a superior currency. It’s called Gresham’s law, and it happens on the global stage as well as micro-token economies.

I’m sure if we looked at ARB tokens getting dropped, it would showcase this law fairly well… Ha, had to get that in there before I signed off for the day.

As always, hope you enjoyed today’s insights.

Your Pulse on Crypto,

Ben Lilly

This newsletter is sponsored by Bybit. Be sure to try out the exchange here, and take advantage of all they have to offer today.

Great as always. Many thanks mate