Crypto Shopping List Part 2

If $30k breaks....

Well the cat is out of the bag.

Pablo is here. And the amount he is moving is no insignificant sum.

He began moving coins last weekend. Earlier this week he started to make deposits into various exchanges. Which means Pablo is locked and loaded.

What’s important to remember is Pablo tends to not only attack support, but also tends to coincide with macro news events. Many times these events result in DXY (US dollar) pumping.

So if we see bitcoin take a nose dive while DXY goes on a bit of a breakout higher, then we can say with some confidence that Pablo’s move is over.

Otherwise we can only guess as to whether his selling has started, is continuing, or is over. That’s because once coins enter exchanges it becomes a bit of a black box.

This is the point at which onchain analysis gets put on the book shelf and replaced for tracking order book flows.

Now, outside of the Pablo “freak out” transaction that every subscriber of Espresso is probably well aware of now, is the continued bearish transactions that are ongoing.

While not overly bearish to the point where large downside moves can happen outside of Pablo, its simultaneously not threatening a potential big pump in the market.

And the pump that we did see about 24 hours ago was more along the lines of too many shorts piling in too late. When this happens market movers can push price into those freshly entered short positions and liquidate them for easy profit.

For big wallet traders its easy capital. And for anybody looking to understand how market makers hunt pools of liquidity like we saw yesterday, take a look at this older essay title “In Search of Pools”.

So the scene is pretty much set… We have bearish transactions hinting at a low chance at a pump… Pablo is out there in the wild… and late short positions got wiped out from the mini pump yesterday. And we’re now testing the low of $31.5k that was formed yesterday.

If it fails to hold, then things begin to get very interesting heading into the weekend.

One area of the market to take note of - if bitcoin’s price ends up slicing through $30k - is the altcoin market.

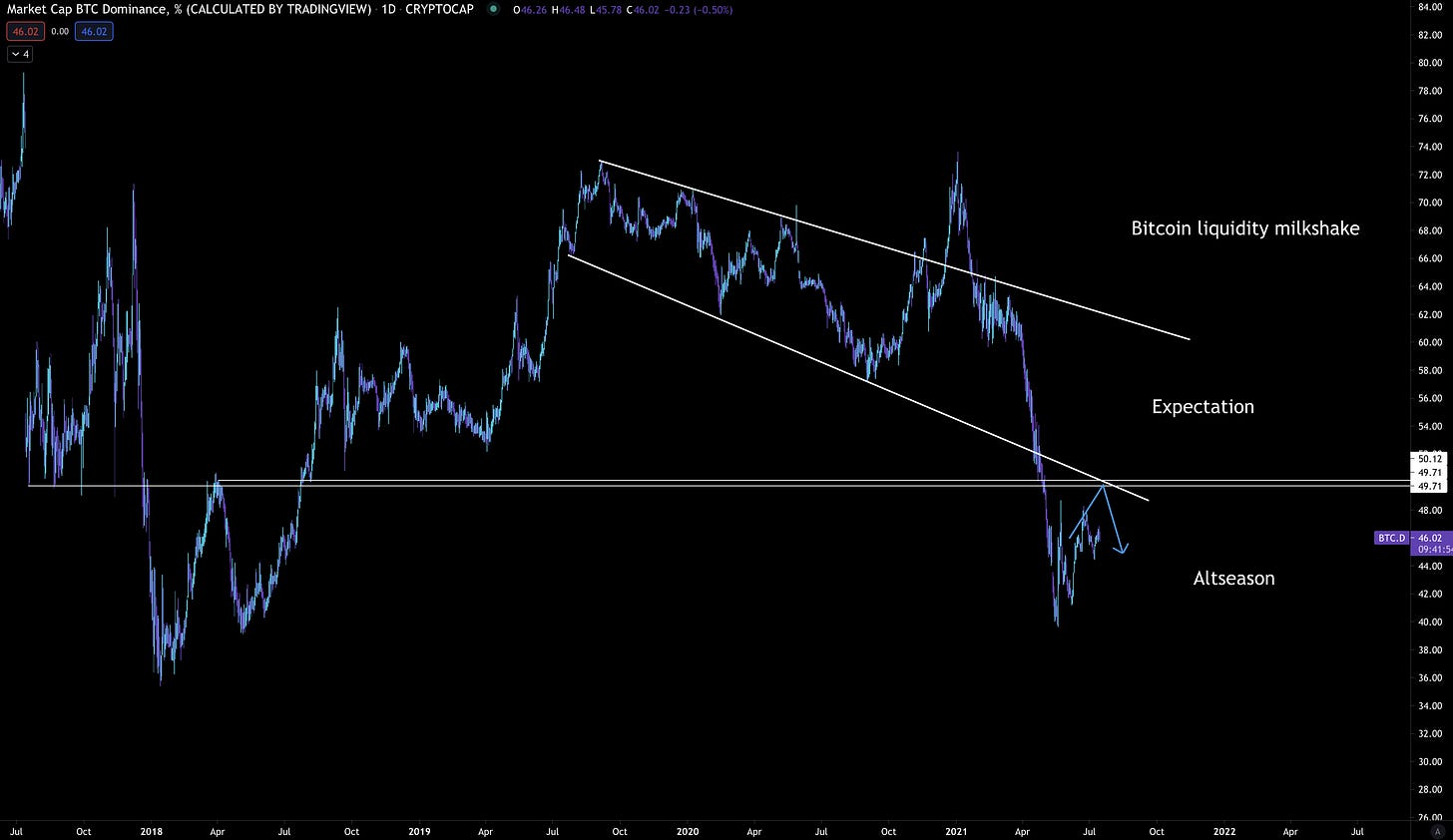

Earlier this week I posted a chart on Twitter regarding bitcoin’s dominance as a percentage of the total crypto market and how we might get a retest of its prior break of the cone pattern as well as the prior support near 50%.

You can see it below. The blue arrow is the potential scenario I’m currently describing.

If bitcoin ends up breaking through $30k then this retest might unfold. And if bitcoin’s dominance rises… Well… Altcoins will take another blow to the knee caps.

For those on the sidelines, this is a great opportunity to load up some bags for what might be a great blowoff top coming late this year.

Which means… Drumroll please.

It is time to make a shopping list. Last time we did this was on May 11th.

Important to note on the previous shopping list the market has not come back yet. So from that May 11 list, shorting the over priced coins was extremely beneficial (ie -EOS and RLC) as they experienced up to 80% drawdowns.

On the other hand, the underpriced coins never had a chance to perform. And with any bag I personally load up on, I’m more of a believer in larger cap coins with promising items on the roadmap. That’s likely because I’m more conservative than most.

And when it comes to roadmap items you will need to DYOR as it currently falls outside the scope of Espresso and Jarvis Labs (for now).

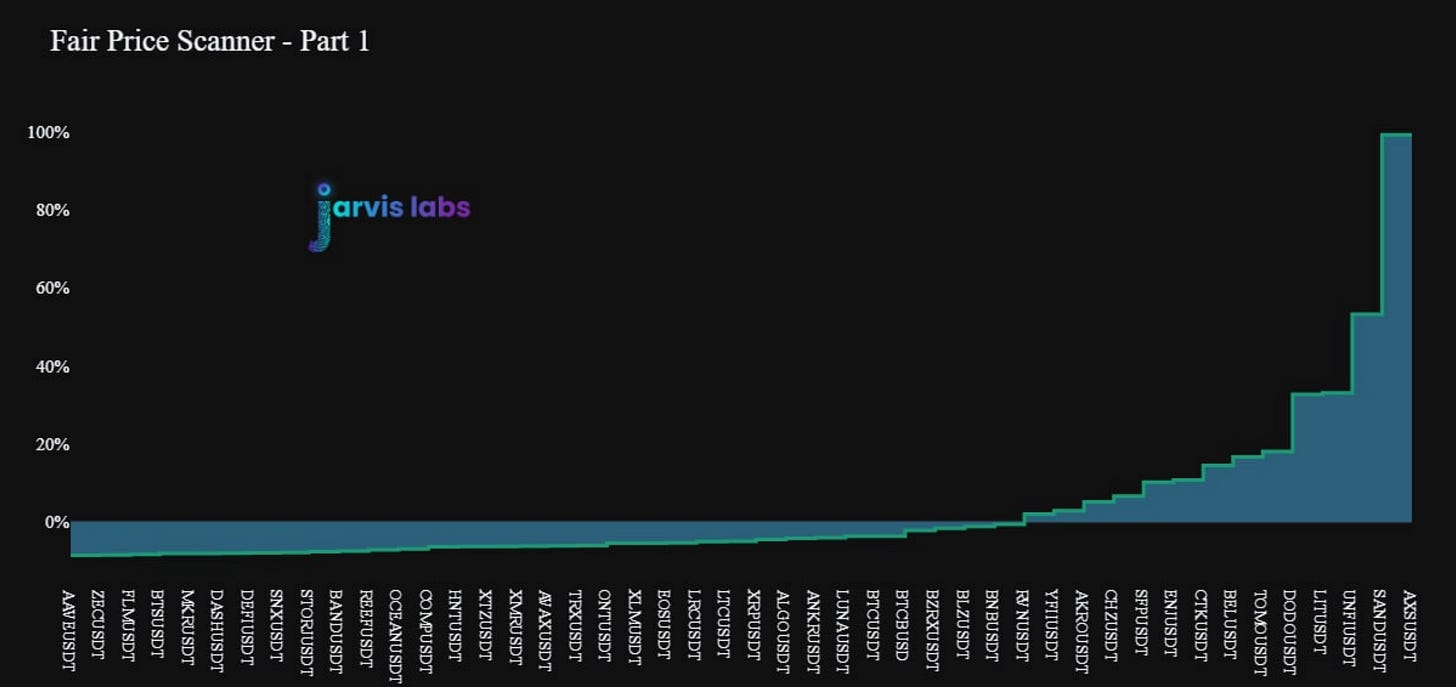

So here’s the fair price scanner list. Remember, the higher the percentage is, then the more expensive the coins is.

Also, no need to FOMO your account into coins during a dip. Always best to keep dry powder on hand for lower lows as nobody can say with absolute clarity what the bottom will be and how long this period of low activity will persist for.

And as for the second chart, the lower the reading, the “cheaper” the coin is.

The way we calculate fair prices is by using market mover data of accumulated prices, combine data about the volume at which the asset was accumulated at, and generate a weighted average price.

If the price of the asset is much higher than what this variable comes out to be, it’s viewed as ‘overbought’… Meaning its a riskier asset to trade.

This also means if the reading is very negative, this indicates the asset is trading at a discount to whale accumulated prices. Which alludes to strong “buy the dip” opportunity ahead of an alt-season.

Pretty handing metric to have on hand when it comes to on-chain data. This is filtered for who moves the market… You won’t find it anywhere else.

And that’s it from me today. We are insanely busy behind the scenes still. In staying true to our pursuit of high caliber products we actually completely trashed the website a developer had built is in order to remake it from the foundation up. Which is why you haven’t seen anything from us come out on that front.

So until we get through the rush to the finish line we are experiencing right now, Espresso will be rather unpredictable and random in terms of its timing.

Hope to get back to a more daily cadence soon.

Until next time…

Your Pulse on Crypto,

Ben Lilly

so happy I found out about your letter sir, always a pleasure to read your opinions. Your copy style is outstanding and pov 100% on point! Big up and many thanks Ben!

My most enjoyable part of daily crypto routine is reading your articles and posts !!!! Thank you!