“See the Wiz Kid”.

I was anxious to learn more after reading the Token Design team’s first essay earlier this week on Axie Infinity. And I was hoping to pick the brain of anybody part of the section of The Lab which went up several months ago.

When asking Mr. Lilly who to talk to, that was his reply. He was referring to the new guy, Kodi.

Kodi got his nickname because in his first week at The Lab he mastered some software program that typically takes months to learn. Mr. Lilly said he’s never seen anything like it.

The program does this agent based modeling and simulation. It'’s one of several forms of analysis the team uses to run advanced simulations and stress test token economies.

“You got to meet this guy, JJ, you’d love the way his brain works. He is even into quirky music, just like you.” said Ben.

“I’ll set up a meeting for you two this week. Note, he might be at the tail end of his break. While meeting with him be sure to ask him about his Sly & The Family Stone record collection. You two will hit it off on that. He might even show you a few of his dance moves… just promise not to laugh. He tries hard, so let’s be supportive.”

Tuesday I arrived to The Lab with my Trapper Keeper stocked full of fresh paper prepared to notate my meeting with the boy wonder.

What happened next however, I was not expecting.

I opened the door to the token design department and there was Kodi, performing what appeared to be some sort of interpretative dance ritual while watching Yo! MTV Raps.

I wasn’t sure what to do, so remembering Mr. Lilly’s request to be supportive, I sat quietly and applauded between songs while waiting for him to finish.

After about ten minutes, the show was over.

He wiped the sweat from his brow, grabbed a nice cold water, and we finally got to talking all things token design.

The conversation blew my double lined socks off.

My initial questions I had ready were about Play-to-Earn and GameFi. But he instead opened my eyes to the bigger picture that this is financial experimentation in real-time.

Steve Jobs

“JJ, have you ever heard of Steve Jobs?” Kodi then asked.

“Of course I have? He created the Macintosh computer.” I answered, though a bit confused by this seemingly off topic question from token design.

“That was actually his partner, Steve Wozniak, Jobs was more of the front man… but you’re thinking of the right guy, he was a true luminary.” Kodi continued,

“I saw this great clip of him explaining how if you want to build a successful product, user experience is more important than technological superiority.

Because if the average person can’t understand your product or why they should use it, then it will never gain traction. This may seem simple, but it’s something builders often overlook.

The project in crypto that best exemplifies this is Cosmos. Since its creation, the technology was top notch. But their team were not big on marketing and community building on the user side. This led to technologically inferior chains gaining more users than them.

But the real secret… In The Lab we call it wealth creation or users above the network’s poverty line…

I like to call it NgU technology.” Kodi said.

“NgU technology?” I asked.

“NgU stands for Number Go Up, the most precious tech in existence.

You see, it’s every (or almost every) project’s aim to build something useful or make the world a better place.

But to get the project off the ground requires a dedicated and loyal community. This is not easy to build.

There is one shortcut though. And that’s rewarding early adopters with realized gains from the token. This turns users into evangelists.

And that’s why NgU is what every protocol and token alchemist is trying to find the magic formula for.” he replied.

“Too much of NgU has created an industry littered of projects that flew too close to the sun like Icarus, and plummeted.

But what is so interesting right now is Cosmos, the project often passed over for inferior blockchains, is getting ready to try its hand at NgU. I’ve only started to monitor it, but so far it looks to be a great financial and ecosystem experiment happening live, want me to explain?” Kodi asked.

“Absolutely.” I replied, unleashing my Trapper Keeper.

Cosmos Adopting NgU

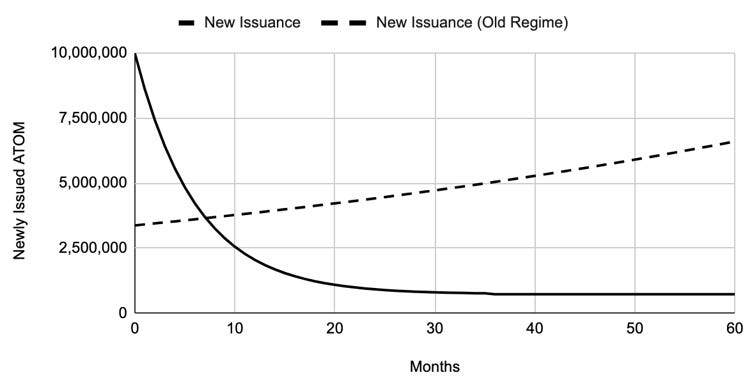

Kodi proceeded to show me this chart below which illustrates the proposed change to ATOM ( Cosmos Network’s native token) supply schedule, as outlined in the Atom 2.0 whitepaper.

“In an effort to increase the amount of ATOM staked on the network, Cosmos is looks to drop its new supply issuance (inflation rate) from nearly 3 million new tokens created per month to just 300k.

This reduction in issuance helps stakers avoid getting diluted with new supply. It also incentivizes holders to hold onto tokens due to their scarcity.

But where NgU gets incorporated is with how they look to influence the demand side.

They aim to accomplish this is by instituting what’s known as “liquid staking”.

Currently staking on Cosmos requires users to deposit their Atom tokens. This makes them illiquid. And also to unlock them requires a certain period of time to pass.

But with liquid staking, users can eat their cake and have it too.

Liquid staking lets users receive yield and receive a $stATOM for every Atom token they stake. This $stATOM derivative token can be used to do all the same things Atom can do, like trade and mint stablecoins.

So rather than just earning simple yield returns, stakers now receive APY and a free token with day 1 liquidity + utility.

Not a bad deal. Right? Right?

The Cosmos team believes this solves the users dilemma of picking staking vs having liquidity. Their belief is that this will create an influx of new stakers to their network, resulting in fortified security and most importantly, Number Go Up.

An interesting development.

Right now, it is clear everybody coming out of the recent Cosmos conference is very excited about this. And they should. It is one of the biggest changes to their token’s economics to date.

But as we’ve seen time and again in crypto, what often seem like brilliant ideas in theory have resulted in some disastrous real outcomes after unforeseen variables are introduced.

It’s what Mr. Lilly calls ‘the best laid plans of mice and men’.

But here’s the thing. Look at that chart above.

The first seven or eight months actually create a flood of supply to the Cosmos network. Meaning the amount of supply that would exist two years from now might not be that much different than what the original economics were.

Not to mention, the ecosystem is allowing for liquid staking. This makes illiquid supply more liquid. Which is more of a silent, and sudden uptick of supply in circulation.

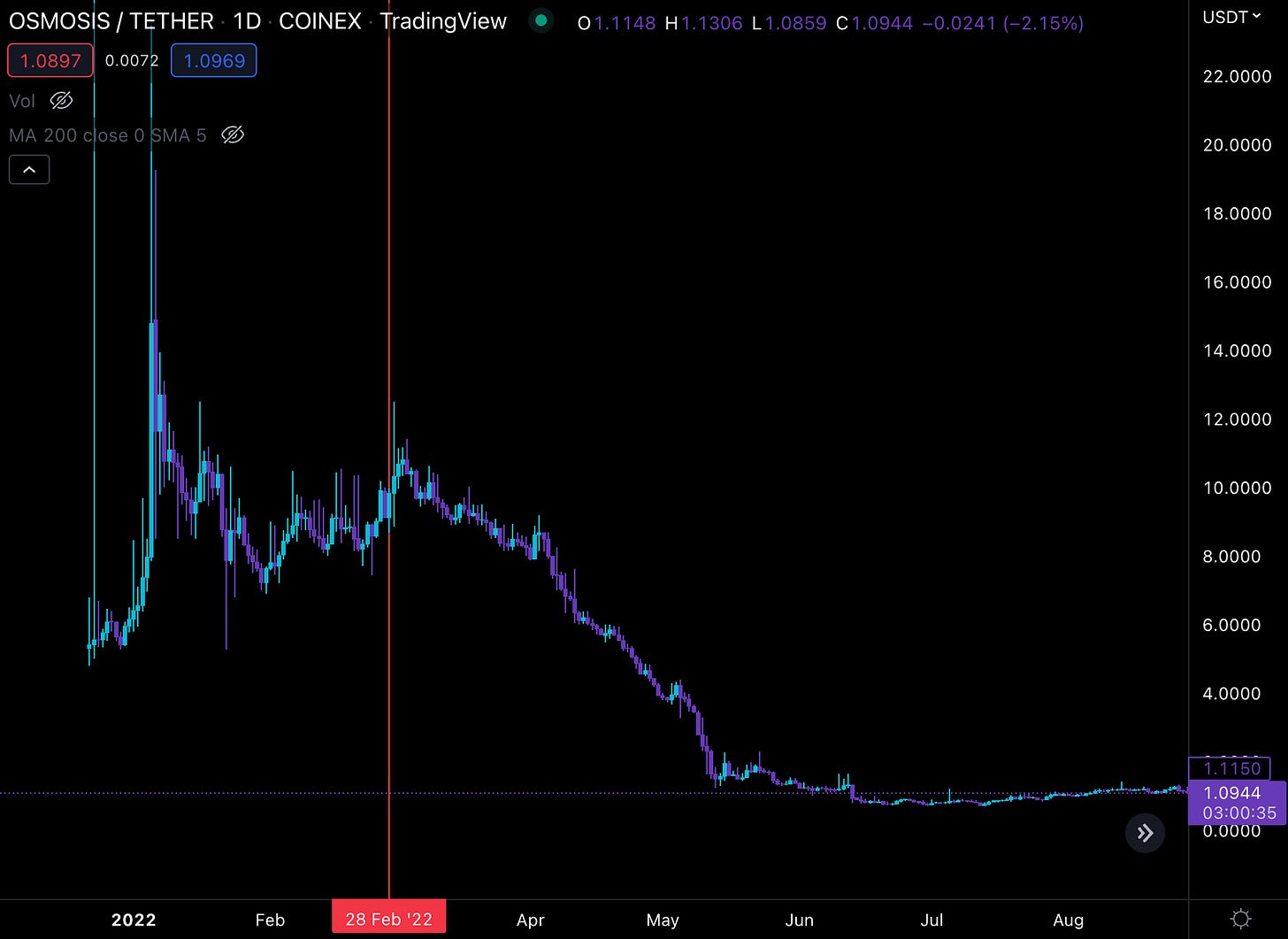

Osmosis did something similar when it introduced superfluid staking. One OSMO token could essentially double staked. Meaning if users wanted to take part in multiple pools, they did not need to purchase new tokens.

While different, it is a lesson to keep in mind. It’s also important to keep in mind the entire market turned very bearish at the same time. This makes an OSMO chart not a great indicator of how that tech upgrade influenced price… To do determine that requires running various simulation software.

(Below is a chart I grabbed from The Lab)

What is clear is this dual use case is still a rather new manner of using tokens, so the book is far from written on it. For Cosmos, what our team is most keen on actually what I’ll hit on next.

The first is how users create credit in the system with this stATOM token.

If users begin to stake ATOM, and then borrow against the derivative form, this can create the desired traits for demand… While also expanding the Cosmos economy in one move. It’s what happened in DeFi Summer in 2019 when ETH holders began to buy up ETH to then borrow against it.

In borrowing against ETH, credit growth happened… Acting as a tide that lifted all boats.

This is likely an extreme example.

The second form is when other Cosmos ecosystem chains borrow ATOM stakers to secure their own blockchain - something that is helpful for new projects. This provides ATOM holders with yield from other chains that might represent high upside returns without much risk.

What is clear is we don’t know what will happen. This move is sure to spark something that nobody is quite anticipating, one that falls outside the economics of inflation, issuance, and percent staking… And one more in line with what happens in real world economies as they expand.

If they have success, expect this NgU or wealth creation model to be one that many projects follow in the next run. It’s financial experimentation in real time!”

Kodi mentioned he and the team are keeping an eye on how this unfolds by monitoring their in-house onchain metrics designed by the ChainPulse team.

Whether or not this is Cosmos’ Apple moment is one we are eager to find out. What is clear is this is something the team at Jarvis Labs seems to be excited about.

What do you guys think?

Leave a comment here, or message me on Twitter @JLabsJanitor

Your friend,

JJ

So many smart minds jumping into cosmos. Luna minds have seemed to roamed to it. I think it does something similar next bull