Complicit in Catastrophe

Notes From the Lab: How U.S. Regulators Enabled SBF's Multibillion-Dollar Fraud

Horror vacui.

Or as my mentor, Mr. Ben Lilly, likes to say, “Nature abhors a vacuum.”

The philosopher Aristotle stated this theory of physics in the 4th century BCE. It means that in nature, there can be no such thing as an absence of power. If the void is not filled by conventional means, then it will be filled by unconventional means.

You can think of it like the law of supply and demand. Where there is power for the taking (supply), demand will rise to meet it until equilibrium is reached.

When we look at examples of failed states and toppled governments in human history, we see that this dynamic rings true. The absence of a formal hierarchy doesn’t remove the human demand for power structures. It only shifts the balance of power from one group of people to another.

Since crypto’s first derivatives exchange, BitMEX, launched in 2016, we’ve had front-row seats to watch this dynamic unfold in real time.

All crypto derivatives exchanges are headquartered in what are known as “offshore” locations, small island nations that have little to no financial regulations — in other words, a vacuum. For example, FTX was headquartered in The Bahamas, separate from its smaller U.S. exchange.

This arrangement allows the exchanges to engage in predatory business practices they wouldn’t be able to get away with in developed nations. Practices such as counter-trading clients, force-liquidating their positions, rehypothecating their funds, and in the case of FTX, outright stealing billions of dollars’ worth of customer deposits.

Offshore trading is a Mad Max world where the inmates run the asylum.

So why would anyone dare to enter this snake pit?

It is not by choice, but rather out of necessity. There are no U.S.-based, FDIC-insured, audited, and well-regulated crypto derivative exchanges because U.S. regulators have arbitrarily declared them illegal. U.S. law threatens considerable jail time and hefty fines for any good actors who come in and provide crypto investors with a quality alternative to offshore fraud.

But as we know, nature abhors a vacuum.

Declaring something illegal doesn’t prevent bad people from doing it. It only stops good people from providing the public with better alternatives. It hinders the free market’s ability to make bad businesses unprofitable and gives cover to criminals.

Bureaucrats don’t prevent fraud enterprises like FTX from spawning. Instead, they enable them.

Let me show you exactly how…

Taking Shelter in a Burning Building

There are over 46 million Americans who reported owning Bitcoin in 2021. If we add in Ethereum and altcoins, the total number of U.S. citizens who own crypto is likely well over 50 million at present.

Of those 50 million Americans, it’s safe to assume that at minimum, 500,000, or 1%, of them actively invest in crypto for a living. This is likely no different than those who feed their families by investing in stocks.

When one invests professionally, they need access to derivative instruments to manage risk, hedge, and protect their investments. For some reason, U.S. regulators have decided that derivatives should be illegal for crypto, but of course, not for stocks and commodities.

Rules for thee, not for me.

Due to these punitive laws, professionals have had no choice but to become virtual offshore refugees in order to earn a living. It’s a process which involves paying $50,000 or more to register entities in island nations, and doing business with broods of vipers, like kingsnake SBF, rather than regulated and insured counterparties.

And speaking of slithery ol’ SBF, do you know the primary reason why he was able to lure in so many depositors to his Ponzi scheme?

Was it the pro sports sponsorships and Super Bowl commercials? No.

Was it his long list of celebrity investors and corporate endorsers? Getting closer.

Was it the cult of personality mainstream media created of him? Almost there.

What enabled SBF’s fraud the most was his large political donations and his close proximity to key U.S. regulators.

Between SBF and his co-CEO Ryan Salame, over $65 million flowed out of FTX and into the pockets of bipartisan political candidates in 2020 and 2022. Oddly, they were not required to submit their company’s balance sheet or undergo a basic audit to make these large donations.

Instead, SBF gained access to powerful public servants such as CFTC commissioner Caroline Pham, SEC Chair Gary Gensler, Federal Reserve Chair Jerome Powell, and Maxine Waters, who chairs the House Committee on Financial Services. And there were plenty of others.

This lack of due diligence among regulators allowed SBF to exploit the public’s trust in high offices. His regular meetings with them gave his operation the appearance of legitimacy and added to the illusion that he was one of the good guys.

Because of this, the assumption within the industry was that if regulators were going to offer citizens no other choice other than to do business offshore, FTX was the safest bet for solvency.

Rigging the Game

So what is the end result of all this?

First, the obvious: SBF and company are still enjoying life, free as birds, after stealing billions.

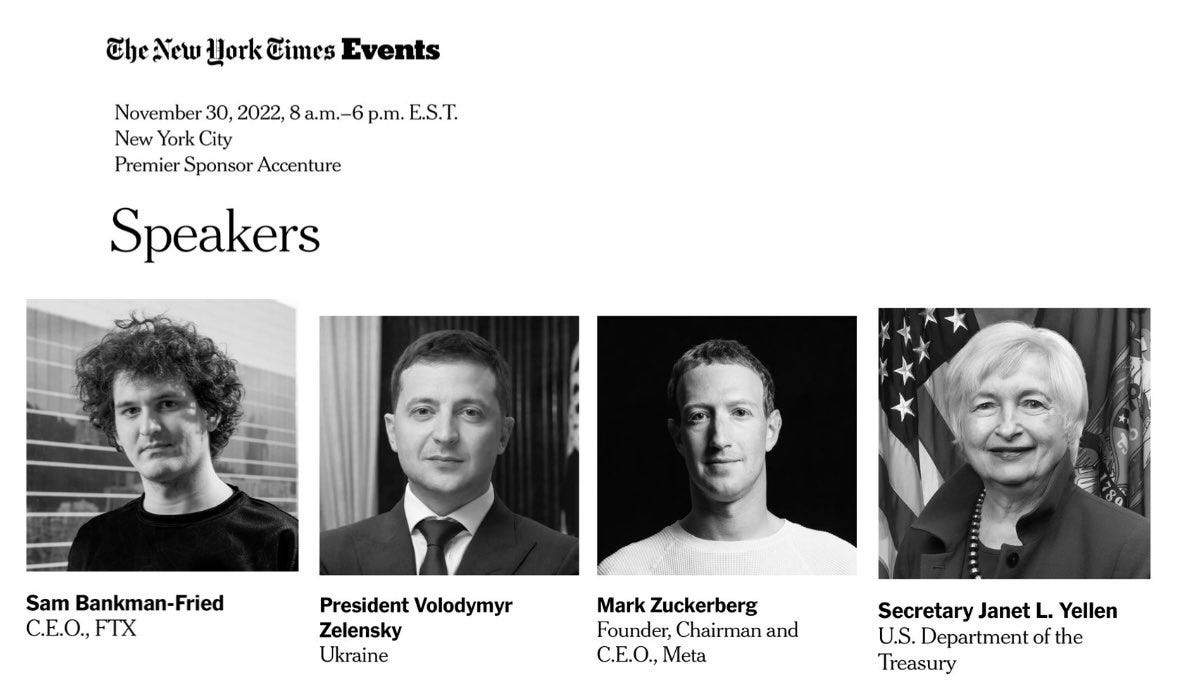

In fact, just yesterday Sam confirmed that this upcoming Wednesday, November 30th, he will still be delivering a keynote speech at The New York Times’ DealBook Summit:

Stranger than fiction.

Second, the disastrous: Regulators and the corporate press will use FTX’s fraud as an excuse to say, “See, I told you crypto was risky,” rather than recognizing their own role in the heist.

What’s worse, their crackdowns will do nothing to stop billions of dollars from continuing to flow *out of* the U.S. financial system and directly into the coffers of the unregulated underworld. Rather, it will only make the crime vacuum larger.

Not to mention the countless jobs and would-be tax revenue their policies will drive further offshore.

Did you know that last year, Binance alone exchanged over $7.7 trillion in trade volume?

If we account for the dozens of other offshore exchanges, this total likely eclipses $10 trillion annually. It’s hard to overstate the amount of jobs and tax revenue that would be generated if regulators allowed this money to flow into U.S. markets.

Last I heard, the U.S. had nearly $32 trillion in debt, crumbling infrastructure, and was fast-approaching a deep recession…it's not like we couldn't use the cash.

If regulators did something as simple as make a list of rules for domestic exchanges to follow, an entire economy and tens of thousands of new jobs would be created overnight. Most, if not all, seedy offshore exchanges would see their revenues instantly drop by 50% or more, and American ingenuity would lead crypto innovation into the future.

The refusal of regulators to see the obvious here makes me wonder where their allegiances lie. Is it with their employers (us, the taxpayers)? Or is it with the only people who benefit from their policies, offshore exchange owners, who just so happen to be large political lobbyists?

After all, it wouldn’t be the first time FTX has had umpires on the payroll…

But what do I know? I’m just a janitor on the internet.

Your friend,

JJ – @JLabsJanitor

This was an excellent article.