Arweave’s Crucial Mistake – And How Ethereum Avoided It

The Blend: This Group Doesn’t Share Your Recent Optimism About the Market; CEXes Are Addressing Their Big Problem

Be warned: This issue of The Blend is rather heavy on the reality check.

I apologize in advance for the lack of vibes that will emanate from the lines that follow. But sometimes we just need to hear it straight.

That way, we aren’t relying on hopium to get us through the next year. And instead, that project you are chipping away at will be ready at the right time.

Alright, let’s dive in.

This Market Is for Speculators, Not Builders

This first topic goes out to the builders…

In the first quarter of this year, I told my business partner Benjamin here at the Lab that July and August will be brutal for builders.

This was on the heels of a strong rally off lows as we entered 2023. The price movement gave crypto natives hope for an industry that seemed to be hanging onto a fraying rope while dangling over an abyss.

But amid such renewed optimism, I remembered that prior bear markets involved more than a year of innovating while being trapped in a tiny corner of irrelevancy.

Many of you will quickly point to BlackRock, Fidelity, Citadel, new legislation, and other positive catalysts bubbling up as reasons to get excited. I’m guilty of this as well… but then I remind myself that a builder's world is much different than a speculator’s.

For starters, pushing a product out into a market where new users are not pouring in makes things feel like a grind. It requires listening to users more closely and making upgrades without expecting anybody to notice.

Cue up the crickets for that special announcement post you have coming down the pipe.

Then you have VCs. Often we forget the money they are spreading out into the market is not theirs. Which means if outside interest levels are low, they are not raising as much for their fund. In turn, capital dries up.

And here we are, witnessing all of these things firsthand. It’s now July, eight months since the cucumber-eating swindler (SBF) forced the market to bottom out. And in that time, newcomers are nowhere to be seen.

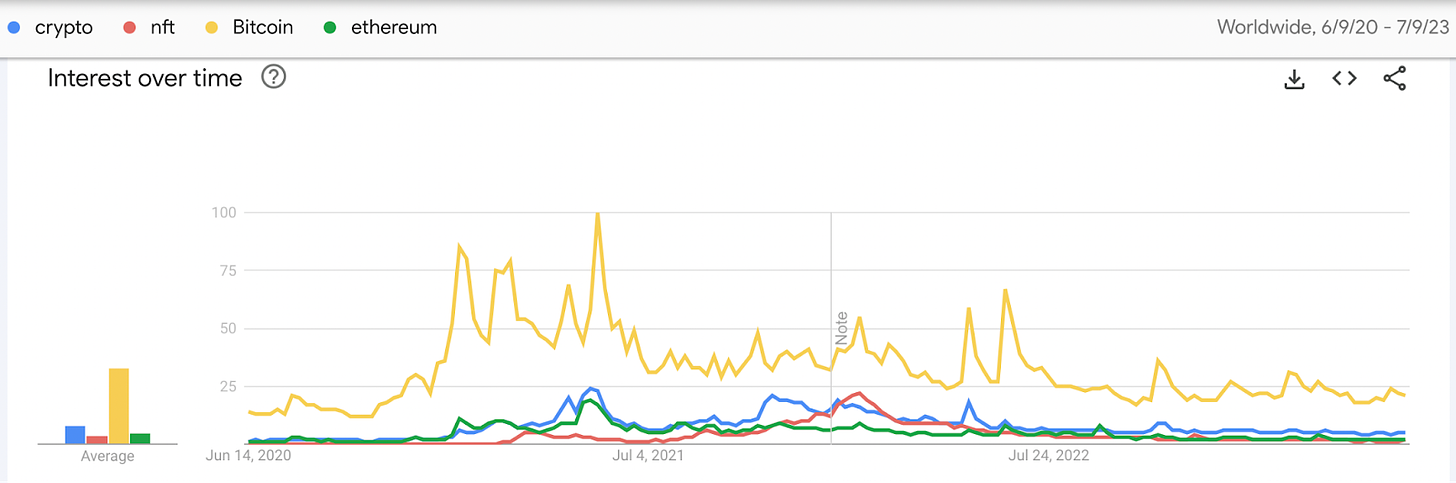

Here is a Google Trends page showing search popularity for Bitcoin, Ethereum, crypto, and NFTs. It’s just now returning to mid-2020 levels… pre-bull run.

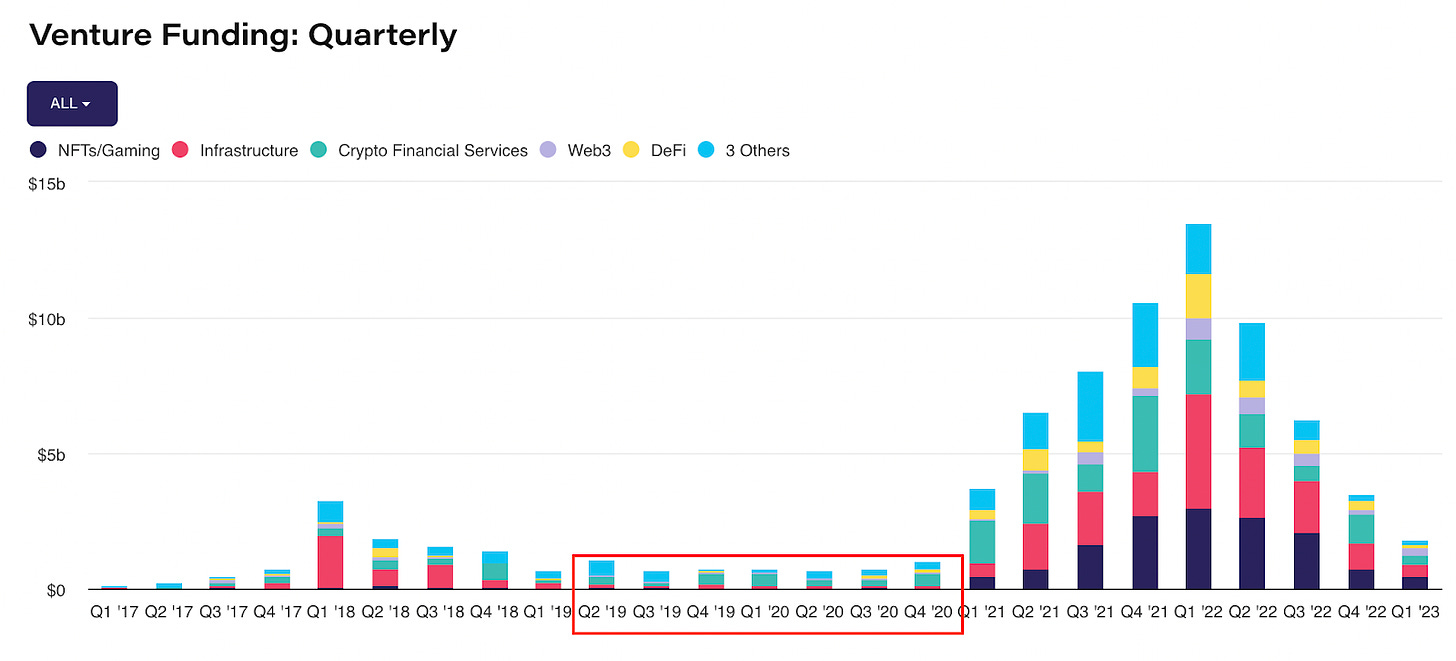

To translate this interest over time into dollars, let’s look at private funding deals in crypto courtesy of The Block.

In the chart below, we can see how reactionary capital is. In April 2019, Bitcoin rallied out of its bear market lows. It went from about $3,500 to nearly $14,000 in a few months. The market felt alive again.

But in the bar chart below, you can see capital flows didn’t budge until after Bitcoin made new highs in December 2020.

Right now, if the current pace of funding for 2023 continues, it will equate to a 64% downtick in private funding deals from 2022… And that’s a big “if.”

Plus, if we use Bitcoin’s halving as a gauge for when we hit new all-time highs, that probably wouldn’t happen until Q4 2024.

Depressing as hell, ain’t it? That’s another year of building amid a market as dry as the Sahara.

This is the unfortunate reality of the market we sit in. There needs to be market euphoria unfolding for the capital to flow back in as it was prior.

And as a note to the builders… Many of us know that the hot potato of capital sits in the AI world.

If you are not AI-themed, you will have trouble raising capital. Consider this an invitation to figure out a way to integrate AI into your product. But don’t just duct tape it on. The effort needs to be genuine.

This should help your project fit the narratives that flighty capital currently seeks.

For all the crypto natives that joke about these pivots, it’s easy to hate. But it’s harder to build. Let’s consider what VCs need to do to satiate client demand for AI exposure. People want AI. They don’t want crypto right now.

Hopefully, this gives a few builders the confidence they need to make the hard decisions and ignore the keyboard warriors. Let’s build smarter.

Arweave’s Crucial Mistake – And How Ethereum Avoided It

Arweave (AR), a decentralized solution for permanent data storage, is a shining example of a successful web3 building block.

It’s raised decent capital, its usage has grown even in the bear market, it has a vibrant ecosystem of builders, and many protocols are integrating its solution into theirs. It’s met just about every definition of success in crypto.

Except this one.

Since September 2021, AR’s price went from over $70 to about $6 in less than 10 months.

What gives? Sure, it could just be the bear market. But there’s more to this story, as I’ll show you.

To start, a large number of AR tokens were unlocked right as price took off. That new token supply creates major downward pressure on price, especially when it’s at parabolic extremes, once demand lets up.

Here’s a circulating supply chart showing AR tokens getting unlocked just as price ripped higher.

Understanding that more supply results in lower prices should be almost second nature at this point for crypto natives.

But the second part I want to bring up is that advances in technology are deflationary.

Imagine that cars became twice as fuel-efficient overnight. Demand for oil would crater, prices would realize a shock, and inflation readings would look favorable for the first time in years. That’s how evolving tech is a deflationary force.

And when this force is neglected in crypto, it does serious damage to price.

Around September 2021, Arweave announced its much-anticipated layer-two solution, Bundlr. This allowed for easier storage, lower costs, and improved workflows.

Naturally, usage of the protocol exploded higher until recently.

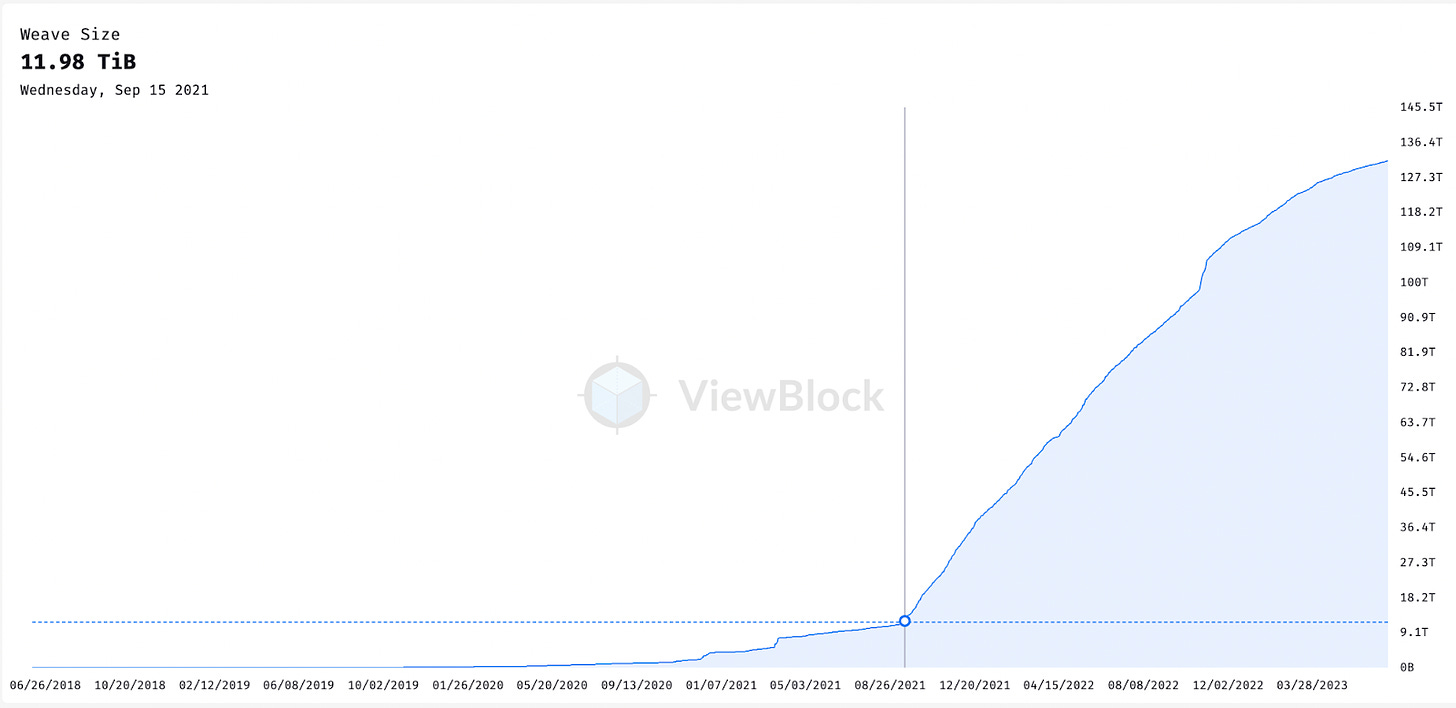

Below is a chart of weave size on Arweave that shows the total amount of data stored in its network. It’s up 12x since September 2021.

Layer-two solutions are great news events. They show a project is improving its technology, users pay less for the protocol, and now the protocol can handle more usage in general. Win-win… At least in a non-crypto token world.

But when it comes to token economics, it’s all about supply and demand. If the cost to use the protocol just dropped, what happens to the price of the token?

Users spend AR to pay for permanent storage on Arweave. Meaning more usage, more demand for AR.

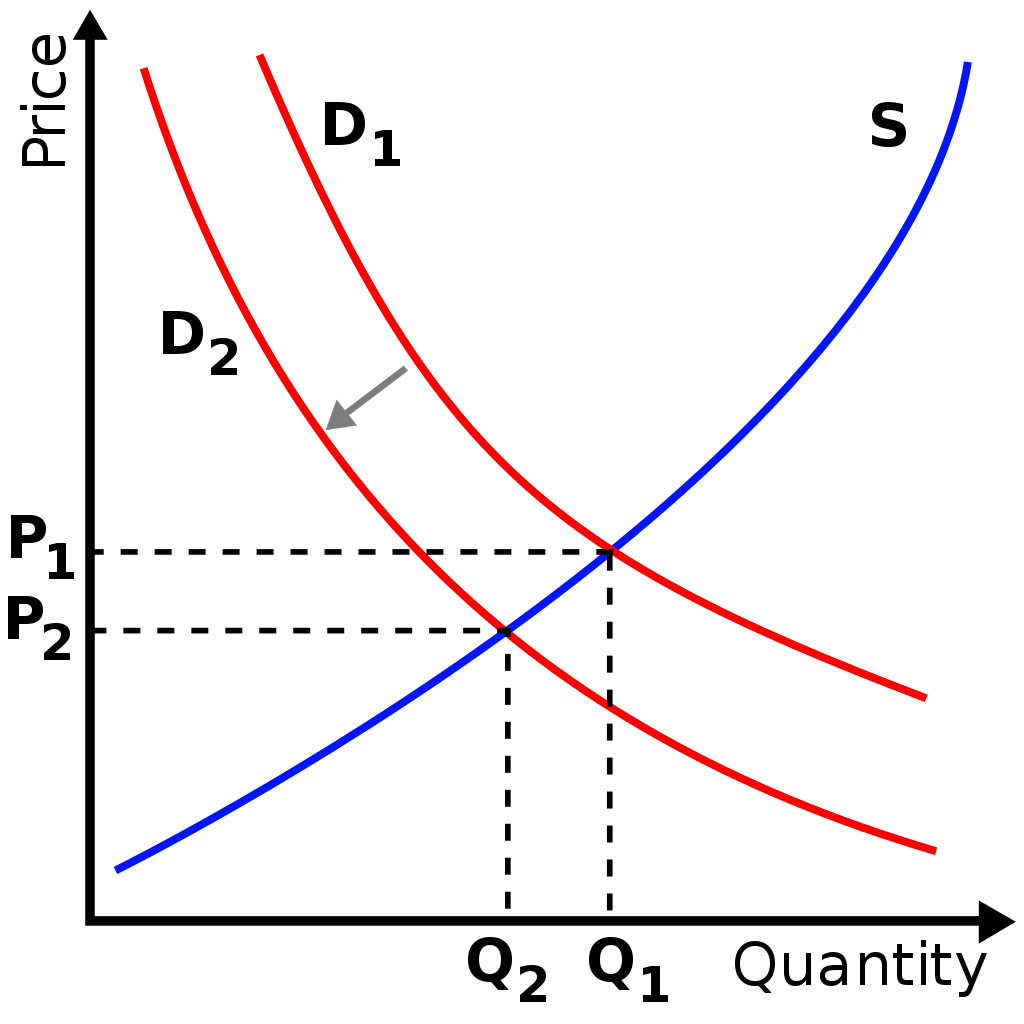

But with Bundlr’s launch, now users don’t need as many tokens to store data. So that reduces demand. Here’s a very boring chart to explain this.

Because of this drop in demand, fewer tokens (Q2) are in demand, which results in a lower price level (P2).

But let’s not forget that supply also moved at this time. This would shift the “S” supply curve to the right. And in turn, we would have an even lower price level on this overly simplified diagram.

This speaks to a common occurrence in crypto. Protocols improve on fees to increase usage, but neglect the deflationary force it places on the token.

So what’s the alternative? Ethereum I believe has given this considerable thought. It went ahead with EIP-1559 to reduce supply of ETH tokens ahead of one of its most deflationary events to date – the ETH Merge.

This event improved layer-two solutions like Arbitrum and Optimism, so now the network can handle more transactions at lower costs than before. And thanks to the burn mechanism, the network was more apt to handle such a transition.

I hope to see more protocols consider these deflationary pressures in the future. For now, let this sort of price action with Arweave serve as a moment of learning.

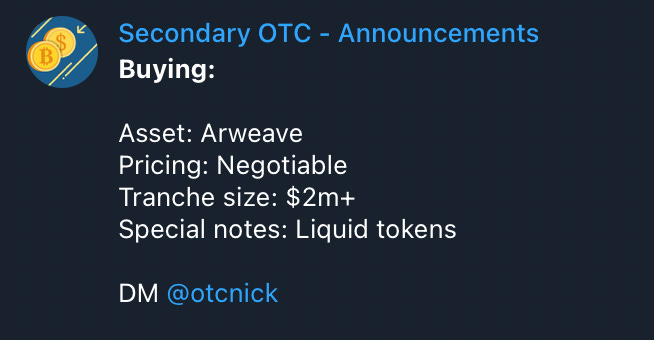

After all, when we are in the depths of a bear market that is difficult for builders, better monetary policy can mean unloading native tokens in the open market. Which helps fund future development. That’s what I’m assuming is taking place below in a message dated June 28, 2023.

This is the true cost of poor design…

CEXes Are Listening

If you asked me in December 2022 if centralized exchanges (CEXes) would have a place in crypto, I would have said no with 80–90% certainty.

It was hard to get the transparency users wanted with centralized exchanges. On the heels of BlockFi, Celsius, Voyager, FTX, and others, it was assumed every exchange had some degree of unethical practices taking place.

Auditors were not trustworthy, there were no disclosure requirements, and exchanges could easily shuffle funds around wallets for “security reasons.”

Distrust was and still is at an extreme. The SEC’s lawsuits against Binance and Coinbase have put this topic back on center stage.

But if you ask me today if CEXes will have a place in crypto, I say yes.

A few months ago, I learned about an exchange called Coincall that’s looking to simplify derivatives and options trading.

It’s also leveraging third-party custody solutions to address the glaring trust concerns in the market.

Now, I want to be open here and mention that if you saw our messages on Twitter and Telegram mentioning Coincall, those were sponsored. But the message here in Espresso is not sponsored.

In saying that, we have known about the development of Coincall for the better part of this year. We also know there is a big opportunity for growth in the options market. And even more growth for whatever exchange builds solutions that lean less on users' blind trust.

The reason why we care is straightforward here: Jarvis Labs builds autonomous trading software solutions. Much of our work depends on centralized exchanges. This means we are always looking at what is coming to market and comparing existing solutions. Our business depends on it.

It also means if traders like a specific exchange, then we need to consider integrating it into our software. Coincall is one we fully expect our customers to request in the coming months.

Now, we think this is because its team is open to solutions that bring transparency to the end user. We’ve approached them with a few solutions ourselves, and their eagerness for building toward openness was apparent right away.

The way their current solution works is they literally have no wallets. The assets you deposit are held by Cobo or Copper, both top custody solution providers.

And if you are still wary, you can deposit your funds directly to the third party using existing tools like ClearLoop from Copper. This means you are not sending your tokens to Coincall, and you don’t have to waste time waiting for it to disclose its wallets or attestations.

And while crypto natives, including myself, prefer things onchain… The reality here is we are still years away from the technology being able to compete with centralized solutions. Which is why the realist in me is expecting onchain solutions to blend with offchain execution in due time. It’s the best of both worlds.

Coincall’s team expects to make more custody solutions available in time and possibly innovate on this side even more in the future.

In saying all that, if you want to give Coincall a test, and you are an avid reader of Espresso, I ask that you use this referral link (please note that Coincall is unavailable in certain jurisdictions, including the U.S.).

We don’t require payment for you to read our hard work and analysis. But we’re looking to grow the team that delivers you Espresso several times per week. Using referral links like the one above, if it suits your trading needs, pushes us closer to that goal. And we are exploring more opportunities like this for the future.

That said, we will always perform due diligence before sharing a link to a service here in Espresso. We’ll be open about any writeups or links that are sponsored. And even if they are, we won’t let them affect our editorial independence.

Anyways, hopefully the improving trend of transparency in CEXes added a bit of positivity to an issue that’s heavy on hard truths.

Enjoy your week and talk soon.

Your Pulse on Crypto,

Ben Lilly

FYI: "Here is a Google Analytics page showing [....]" should be read instead: "Here is a Google Trends page showing [...]".

Google Analytics is tracking code you insert in a website, Google Trends is what people are searching for on the web.

I've not read the whole article yet, but so far it's good stuff as usual.