The last nail in Arbitrum’s death bed will be driven in on March 23.

Will ARB be laying in it by the end of the year?

That was the question at The Lab when Arbitrum announced its token drop. We then took a look into the economic design of the ARB token, and thought it might be an opportunity to discuss token economics a bit. And even discuss how to trade such a token with an understanding of its economics.

Reason being, is it seems there is a bit of a misunderstanding when it comes to token design.

Specifically, just because you have a project that lacks any demand drivers, price does not always go straight down.

This is market dynamics, and it’s influenced by the personas being attracted to your token.

Which is to say you need to separate the two - design and market dynamics.

The way we tend to do so is with something we call personas. Personas are a way of bucketing individuals into groups like traders, gamers, enjoyers, utility users, hodlers, etc.

And when it comes to these personas, certain design traits appeal to certain personas more than others. This helps us better understand a token’s market dynamics.

For Arbitrum, its token will be nearly all price speculation personas from this point forward.

To better understand why, we went ahead and modeled out the ARB token in a simulation software called Machinations. We use the software to help clients visualize their ideas and, most importantly, better understand any weaknesses that exist in their design.

It can normally take a week to build out a standard model… This one took the team about 30 minutes to build it and run it due to its simplicity.

It’s important to note, this simulation focuses on design to better understand any glaring weaknesses. In doing so, we can better understand what personas will be attracted to this token - speculator, farmer, hodler, etc. This step helps us iterate a model, but as you’ll see from the team, it’s not necessary here.

I’ll hand things over to our design expert, Rishi, for the next two minutes. He stopped by the XChanging Good (XC) studio and recorded an explainer on ARB’s economy design. He did this to showcase what this supply/demand setup does to price, ignoring speculators. This should help frame things for the point I’ll get to in just a bit.

Hopefully, you enjoyed that video format, as we are creating a series to be released in the weeks to come using this style. (Feedback always welcomed here! Also, no need to follow me on YouTube, we will use a different account to release content through.)

OK, so based on the lack of demand, there is little reason to hold the token. This creates a setup where people will rush to the exits and unload the token… Inviting the speculators to try and corner supply as well as time the market. Which is when trade market dynamics enter the picture. (Speculators is the only persona that really matters here, which is why we don’t need to model it any further.)

Now, if you are a project that wants to give the token more shelf life, how do you create demand after the realization your token lacks basic demand drivers?

The 2021-2022 playbook was artificial staking mechanisms (cough cough: APE) to prevent the mass exodus. Or the creation of yield farming programs so users hold the token as an entry ticket to earn more tokens.

For traders, these artificial demand drivers enable market dynamics to more easily play out. To better understand what we mean, let’s go back to a project similar to Arbitrum.

The Historical Rhyme

That banner above look familiar?

Well, the OP token has a similar design as ARB. It’s merely a governance token. And any holder will suffer from severe cases of chronic dilution in the months following any purchase or reward.

Many analysts in the community will focus on supply figures, inflation in the years to come, what entities will hold what percentage of tokens…

But at the end of the day, it doesn’t matter when the design lacks demand. It’s all about speculative market dynamics attached to the artificial demand. To this, I refer to traders cornering supply, front running announcements, and creating distribution patterns on charts to unload supply.

To better understand, let’s look at the price action of OP.

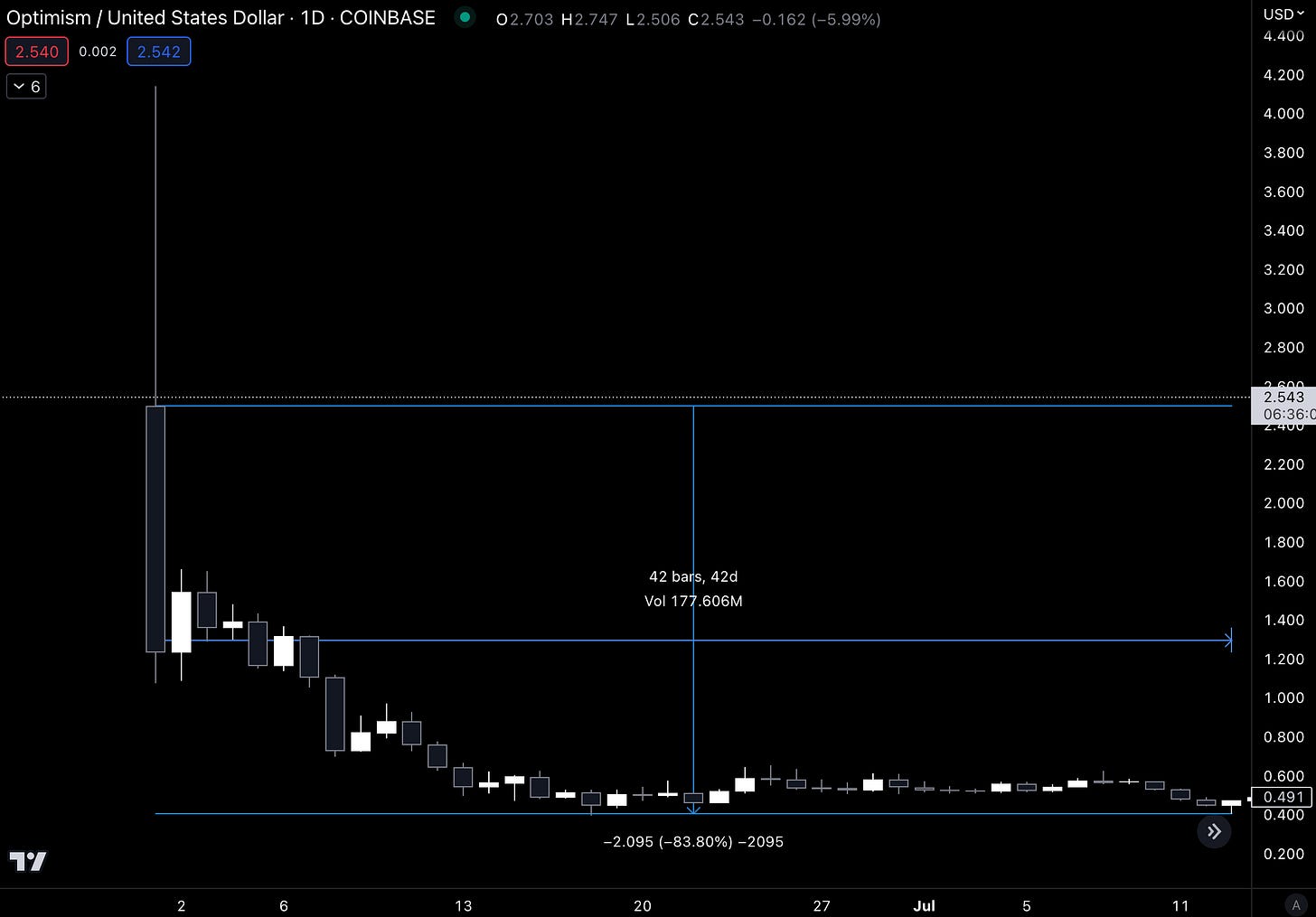

If you remember, OP was launched at the end of May 2022.

In the initial days, users flocked to the exits. Priced responded… The token was down 84% in 42 days. That’s exactly the dynamic you saw Rishi model earlier for Arbitrum.

The main difference between ARB and OP at the moment, is users could farm OP (second persona). So there was an incentive for traders to accumulate in this range as they looked to gain market share of OP tokens.

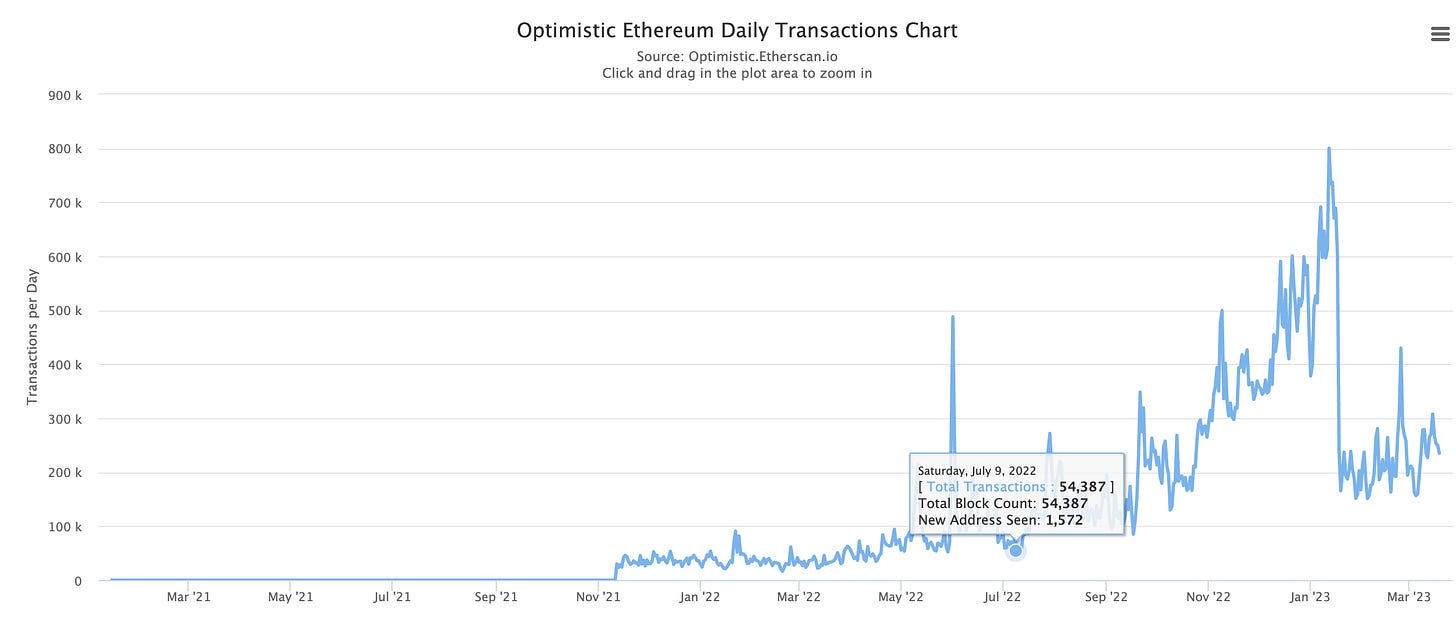

We then saw a spike in activity unfold with the start of the second airdrop of OP tokens.

The second airdrop rewarded transaction activity and also those who delegated their OP token. The details are seen below. Meaning farming season was in full effect.

There was also a date set for the airdrop. All the ingredients for successful farming operations to unfold.

Farming started en masse shortly after that July. The airdrop was scheduled for February 9. So to unload supply before the massive dilution event meant selling before that date.

Well, here is the date that farming got turned off… January 19.

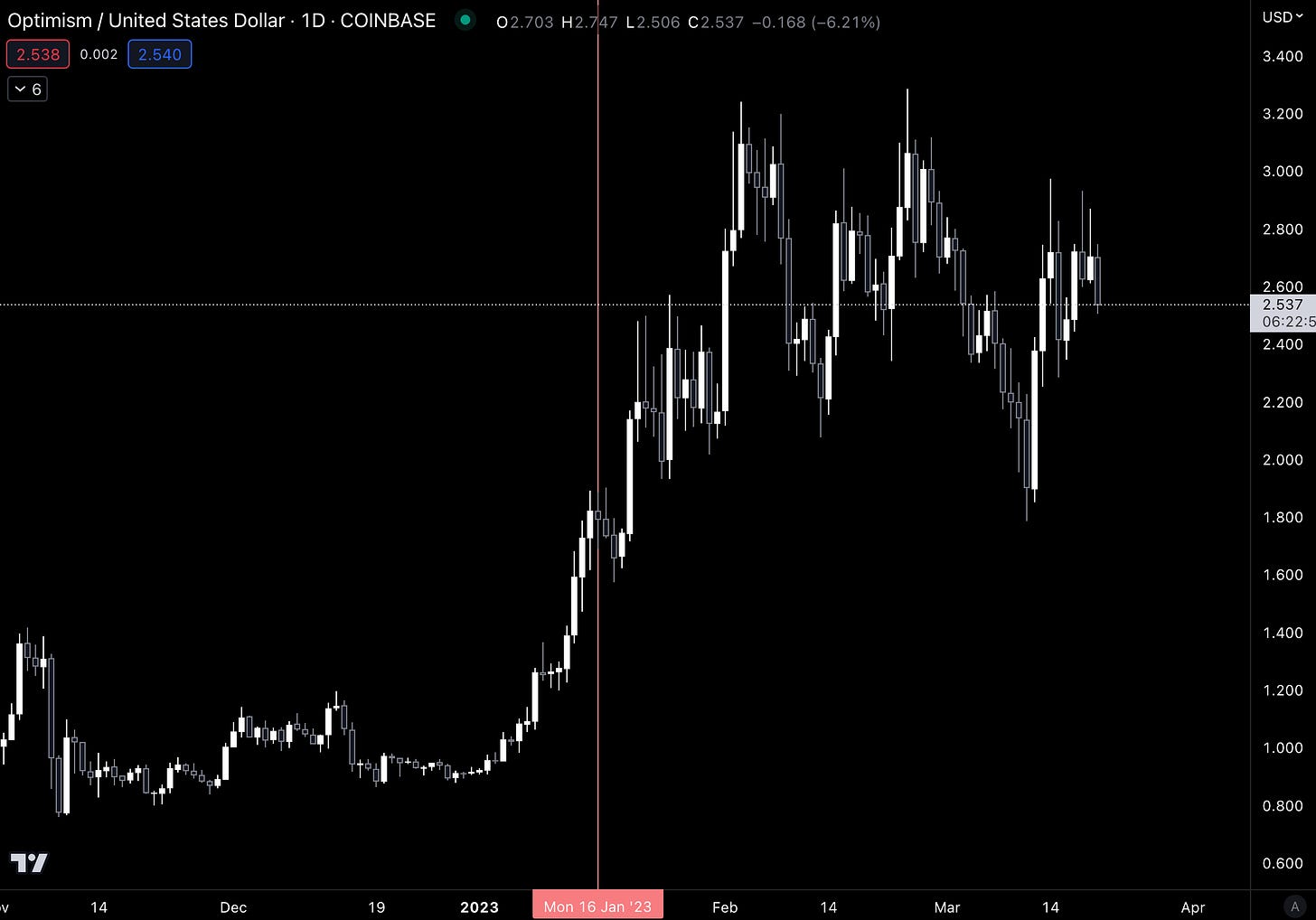

Let’s now check out the price action to better understand the market dynamics unfolding via speculators and farmers.

Price began to rip the week before farming was shut off. Hello speculator persona.

The crescendo and massive distribution pattern that unfolded as the airdrop hit is seen above. Price whipped around from $3.28 down to $1.80, a trader field day.

And while that was all in the past, we can still ask: Will OP’s price stay above this $2.20 floor in the coming days? To better address this question, we should ask ourselves if the main drivers of market dynamics - the speculative and farming personas - are still there?

Looking at Arbitrum’s activity, it seems when Optimism’s transaction activity died, they headed over to Arbitrum. Check the chart below, and you can see the spike that took place just after this January date.

This means moving forward, we can use the price action of OP as a nice model for ARB. Especially in the event they create farming incentives, second airdrops, and other methods to lure in these similar personas.

With the knowledge of their token design, you can better understand what makes ARB tick - market dynamics.

More immediately, you can use information like this to consider tokens without real demand drives as good hedges. To be specific, we can think of these tokens as possible hedges to their L1 - ETH.

Hopefully, that clears up some thoughts on Arbitrum. It should also showcase why a project wants good design… To attract different personas that will not flee your economy when the music stops once the token drops.

If a project wants sustainability and a token, it needs to really focus on demand drivers. Otherwise, the token launch will do more harm than good for the project.

As far as L2s looking to win the market by unloading a token, I would not consider Optimism or Arbitrum as likely winners unless they change their economic designs.

In fact, we already see the activity is headed to other L2s that have yet to launch a token.

Here are bridge users and inflows moving to StarkNet in a stampede in the past few days.

ZKSync saw similar activity over the last few days.

These ecosystems have a real opportunity to create a sticky user base if the design is done better than OP and ARB.

At the same time, with no real great designs yet, I don’t think it’s too late for OP and ARB. Nobody is running away with the L2 game. They can still successfully conduct an overhaul to win market share.

Which is to say, the coffins might be made, but don’t consider them six feet under yet.

Your Pulse on Crypto,

Ben Lilly

P.S. - We do token design consulting. If you have a project you want to launch or overhaul, consider giving us a try. We are preferred partners of machinations and have one of the largest databases of data to drive our decisions. You can learn more here: https://tokendesign.jarvis-labs.xyz/

Do you think this event will affect the whole ecosystem TVL?

I think something similar also happened to OP

Fantastic and thoughtful insight into the upcoming ARB airdrop and design mechanics. I predict a race for the door as well when the tokens hit wallets. Gonna be an epic slide downward. But over time, I think OP and ARB will find their rightful place in the crypto ecosystem.