Almost a Bad Decision

Notes from The Lab: MVRV and Time Horizons

“JJ.…JJ Henderson?” the woman called out into the lobby.

With shaky knees and sweaty palms, I collected myself as I stood… Took a big gulp and walked over to the receptionist.

“The Bens are ready to see you now” she said “please proceed down the hall and into the conference room. It’s the last door on your right.”

In I walked, resume in hand…

After walking through the doorway, taking a seat… the nerves somehow just vanished as both asked how I was. I guess I was caught off guard with how human they both were.

And as I casually took my seat, a subtle smile crept across my face.

The talk felt short… And whether it was my taste in music, interest in cryptocurrency, what they referred to as my wikipedia like catalog of cleaning products, or my ability to know the correct amount of cleaning solution / ratio of rubbing alcohol, vinegar, dish detergent, and water based upon the number of steps I took from the front door to their office… Which was 24 steps (making the hallway approx. 75 feet by 10 feet, so I needed about 3/4th a gallon of solution).

Whatever the reason, they offered the janitorial night post on the spot.

Mr. Lilly and Mr. Benjamin even jokingly mentioned to one another - I don’t think they were serious but just having fun - I’d be in analyst training by the end of the year.

HA, I wish!

Well, this week marked my 6-month anniversary of accepting the job offer on the spot.

And as I look back on that day, it definitely seems short… But more importantly, I realize the progress I’ve made. Not just as a janitor, but as an aspiring cryptocurrency analyst. (Hmm maybe The Bens were on to something…)

When I stepped in for that interview I could barely understand what a limit order was, and here I am trying to dissect Gamma in the options market!

As I came home all sentimental about the 6-month anniversary this Friday, I decided to celebrate the occasion. While it might seem ridiculous to some… Orthis and I shared an ice cream cake and watched his favorite movie together, Ferris Bueller’s Day Off!

As we settled in on my suede couch, the opening line dropped…

“Life moves pretty fast, if you don’t stop to look around once in a while - you could miss it.”

Talk about a ton of bricks to the gut. I was literally just getting all sentimental beforehand.

The Tao of Ferris Bueller… If only I could ever be that cool.

As the movie went on and Bueller made his friend’s 961 Ferrari 250 GT California airborne… that opening line surfaced to my mind again.

Not only is my time at Jarvis flying by, but also the cryptocurrency markets in general. Two months ago people were giving up on crypto as the Luna ecosystem faltered. And now today people are getting excited about some big Ethereum upgrade… Or event as some have mentioned?

And when we zoom out, five years ago Bitcoin was around $500. The pace of change makes anybody in the space sometimes miss the forest from the trees.

Armed with that perspective in mind I left Orthis on the couch to pull up a chart I saw earlier this week.

This chart I’m referring to is called MVRV. It just hit its lowest level since 2015… And as I try to see the big picture and longer time horizons, I thought this would be something worth sharing.

Hi everyone, my name is JJ - the night shift janitor here at Jarvis Labs.

Once I started working here I noticed the professors of Jarvis Labs frequently leaving up charts, reports, and even equations on the whiteboard once they finally left in the middle of the night. The stuff seemed pretty important, so I started interpreting these things for myself.

It wasn’t long before I realized it was like trading cheat codes. And lucky for you, my friend is sick of hearing me talk about it.

Every week I will try to share the coolest and most exciting thing I find laying around the halls of Jarvis Labs. I hope you like it because if I get 1,000 followers on Twitter (@JLabsJanitor) my friend will buy me a pizza.

So be sure to click the subscribe button below to get a weekly “Notes from The Lab” sent to your email.

OK, back to that MVRV chart…

Disinterest Visualized

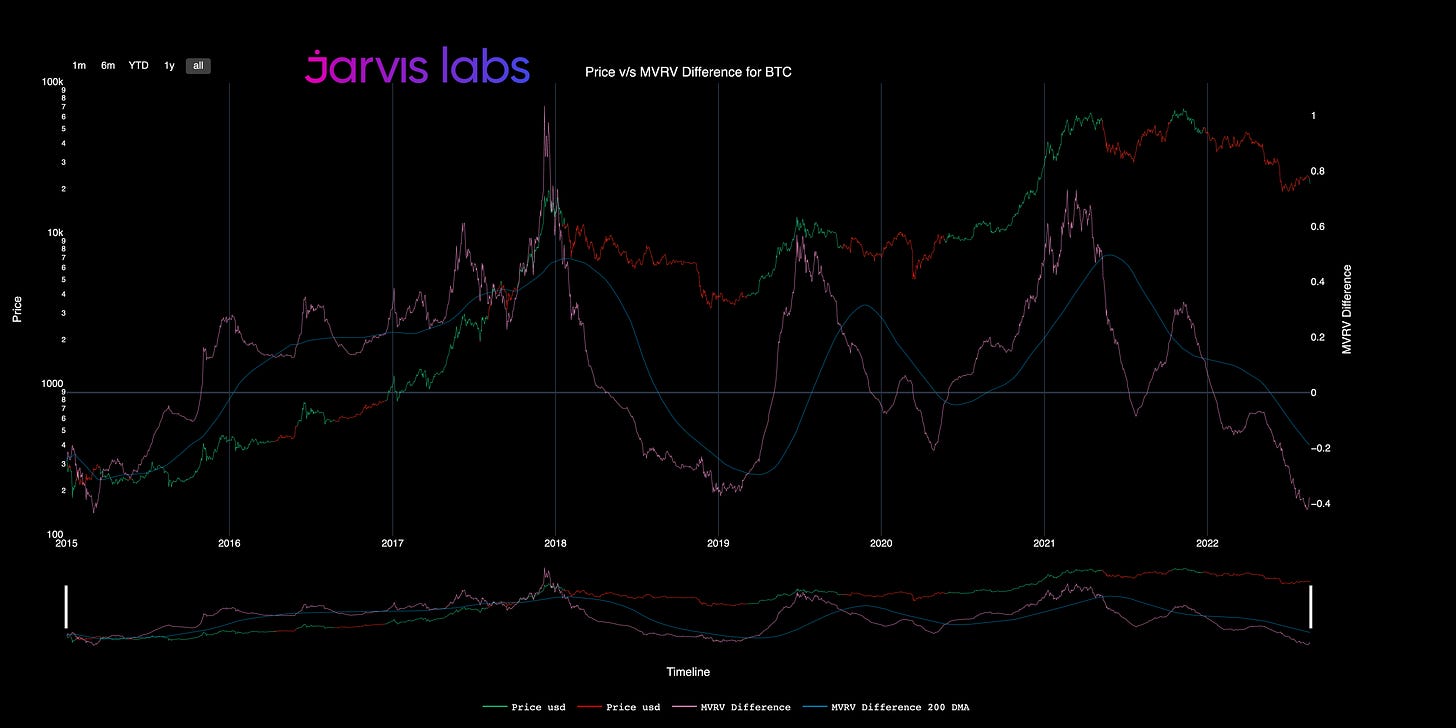

Before getting into what it is, take a look of the raw chart:

It is MVRV, a ratio of an asset's market capitalization versus its realized capitalization. It’s basically the amount people paid for the asset or tokens versus how much those items cost today.

This would be like everybody in my neighborhood who bought a house when the street got built. All ten of us bought for around $150,000 at the time. This made our neighborhood have a realized value of $1.5 million.

Frankie down the street recently sold his home for $250,000… This gave our street a market capitalization or value of $2.5 million.

What is interesting is that two people recently sold their homes for $250,000, so the new neighbors also have a realized value of $250,000… While the rest of us still had a realized value of $150,000.

We can use that same little process to do it with Bitcoin, which is what that chart above is sort of about… It takes those two valuations and compares them to one another.

So for Bitcoin, if somebody purchased their BTC at the all-time high, their realized value is $69,000.

At time of writing today, BTC’s price is $21,000. So the MVRV of that bitcoin is 0.30.

All the chart above does is take that valuation method and applies it to all bitcoin. Then it compares the value in a way that amplifies the reading. It is still a bit above my head, but that’s what I got out of what another analyst told me.

Going back to my neighborhood…

If sometime in the future everybody left the street and sold at $250,000, the MVRV would be back at 1, just like it was when the street first came about.

BUT if half the neighborhood instead sold at less than the neighbors bought at… The MVRV would dip again. So it acts as a way to see how much of a value current prices are relative to the price everybody else paid for it.

The chart above does this type of analysis, but with a slight twist that makes the value go negative and move a bit more higher and lower.

So to sum it up… The higher the MVRV is, the more in profit current household or token holders are realizing. The lower below “1”, the more of a loss they are realizing.

Pretty cool. And if we look at historical readings, we can see it is pretty handy.

The Historical View

The 2 highest MVRV readings for example have come in December 2017, when BTC charged from under 1k to nearly 20k within 12 months, and in the spring of 2021 when BTC broke above 62k for the first time.

I went ahead and made some boxes and arrows so you could follow along in the chart below.

By contrast, when the MVRV ‘difference’ (again, get too hung up on what this difference means, again, it just exaggerates things more to produce a signal is what I was told) has a low reading - as we see in the end of the first red box below - this is the bottom of the market.

The 3 lowest MVRV difference readings have come:

March 2015, when BTC was trading under $250.

February 2019, when BTC reached its a bottom around ~$3,500.

And this week when it fell below .42.

This means that on average, people are transacting their Bitcoins at a major loss.

What is interesting is this low in MVRV happens when price is low!

And today, the reading is extremely low, which I highlighted in the green box below with a red arrow.

Where it gets even more interesting is I decided to see how long these downtrends in MVRV difference went on for because right now it’s 9 months long - time flies.

The other three red boxes from left to right are five, eight, and 14 months in duration. Which puts the current trend as near the top of this list.

Did I Buy BTC?

So after getting all excited about the reading and how long the reading was trending… I was eager to cash in my old Marvel comic books and buy Bitcoin!

But I realized this only told me the price is good value relative to everybody else. It doesn’t tell me this is the bottom… And I’d hate to trade-in my old Marvel comic book to feel like it was a bad decision.

If anything I realized putting a little bit into Bitcoin each week is actually a much better idea. Price can go lower and I will still be just as happy as I am right now.

The reason being, after some more time passes I will be like I am in my current house, but for BTC. I’ll have a low realized value compared to the market.

And during that time I won’t fret so much…

Remembering the sage like wisdom of Ferris… Stop and look around at the bigger picture, rather than just focusing on the anxieties of the moment.

What do you guys think? Am I looking at MVRV the right way? Should I be selling my Marvel comic book?

Is it weird Orthis likes strawberry ice cream…

Leave a comment or tag me on Twitter @JLabsJanitor to let me know!

Your friend,

JJ

Nice, good indicator, informative.

Thanks, JJ.